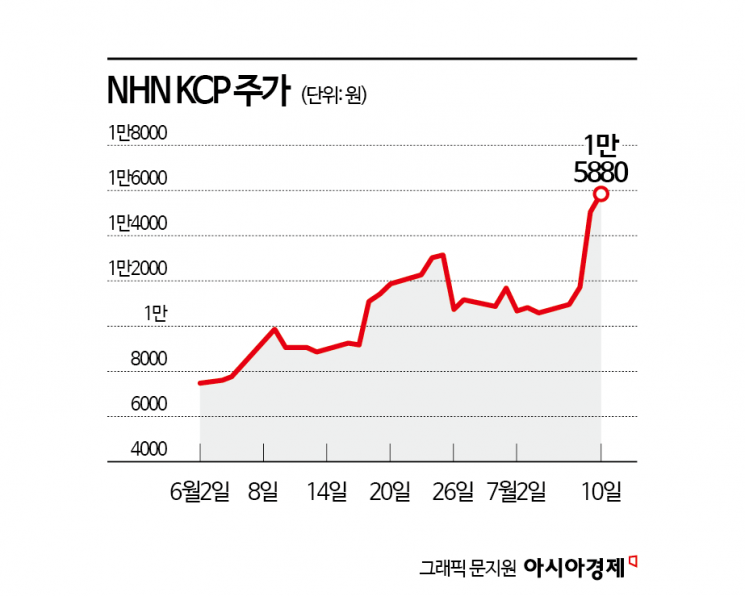

Stock Price Up 112% Since June 3 Presidential Election

NHN KCP Secures Advantage in Stablecoin Issuance and Distribution

No. 1 PG Company in Korea

NHN KCP's stock price, which had been stuck in a narrow range until early June this year, has surged sharply over the past month. The stock gained momentum as discussions on the introduction of stablecoins became more active following the inauguration of the new government.

According to the financial investment industry on July 11, NHN KCP's stock price rose by 111.5% compared to June 2. Its market capitalization increased to 638 billion won. During this period, individual investors recorded a net purchase of 20.5 billion won, which helped drive up the stock price. Foreign investors, on the other hand, recorded a net sale of 24.5 billion won, taking the opportunity of the stock rally to increase their cash holdings.

NHN KCP is the No. 1 electronic payment gateway (PG) company in Korea, providing both online and offline payment services. It offers services such as online shopping mall electronic payment gateway, value-added network, and payment terminals. As of the first quarter of this year, the breakdown of sales by segment was 87.5% from PG fees, 11.1% from VAN fees, and 0.6% from product sales.

The largest shareholder is NHN Payco, which holds a 42.3% stake. NHN Payco provides easy payment services and is also developing various customized payment solutions for businesses. It has a large number of domestic merchants, such as Coupang and Naver, as well as overseas merchants, including Apple, Amazon, and Tesla. As of March this year, NHN KCP maintained the top market share in PG transaction volume at 26.1%.

Choi Jaeho, a researcher at Hana Securities, said, "NHN KCP stands to benefit the most from developments related to stablecoins," adding, "The benefits are expected to be particularly strong in the issuance and distribution sectors of stablecoins." He continued, "NHN KCP completed trademark applications for the issuance of 11 types of stablecoins last month," and added, "Given its status as an electronic payment operator with hundreds of thousands of merchants, it is expected to take charge of direct distribution as well."

Choi also noted that, considering payment service providers pursuing stablecoin businesses have not yet issued coins, the leading payment service provider in terms of transaction volume and number of merchants is likely to benefit the most.

If NHN KCP utilizes stablecoins, it is expected not only to secure business leadership but also to generate additional interest income from managing coin reserves. Han Jeyoon, a researcher at KB Securities, analyzed, "Since PG companies recognize fees generated from card payments as revenue, their business environment is inevitably affected by card company policies," and added, "If a PG company issues stablecoins and promotes coin payments through its existing infrastructure, it can secure business leadership."

Han also stated, "NHN KCP is the No. 1 PG company in Korea, and its parent company operates an easy payment business," adding, "There can be synergy effects in both coin issuance and distribution." Entering the stablecoin business is highly likely to lead to a revaluation of the company's corporate value.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)