Financial Services Commission Announces "Action Plan to Eradicate Unfair Trading in the Capital Market"

Enhancing Market Surveillance with AI

Strengthening Disclosure of Major Shareholder Violators... "Raising Investor Awareness"

Financial authorities are strengthening their response system to unfair trading, such as stock price manipulation, by establishing a "Joint Response Team." The team will enable three institutions?the Financial Services Commission, the Financial Supervisory Service, and the Korea Exchange?to cooperate and respond swiftly to major unfair trading activities.

In addition, the authorities plan to enhance market surveillance functions by introducing artificial intelligence (AI), and to strengthen external disclosure of unfair trading offenders, aiming to eradicate stock price manipulation at its root.

On July 9, the Financial Services Commission, together with the Financial Supervisory Service and the Korea Exchange, announced the "Action Plan to Eradicate Unfair Trading in the Capital Market" at the Korea Exchange in Yeouido, Seoul.

The action plan to eradicate unfair trading is a follow-up measure to President Lee Jaemyung's policy on stock price manipulation. President Lee Jaemyung has repeatedly stated, since his presidential candidacy, that he would strictly respond to unfair trading, including stock price manipulation.

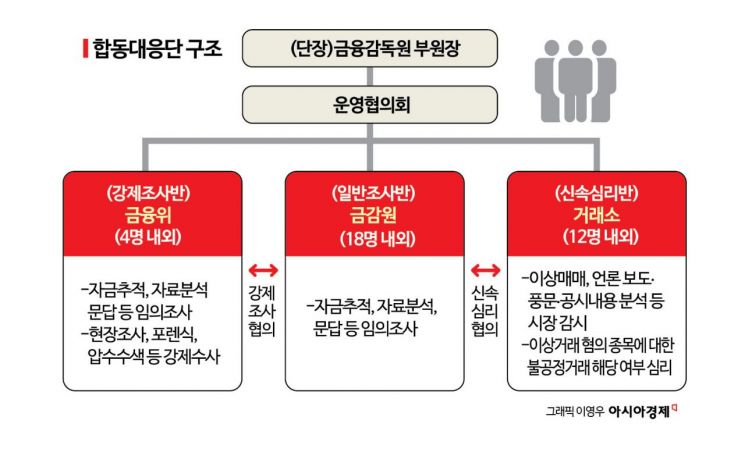

First, the financial authorities have decided to establish a Joint Response Team. The team will handle incidents involving key players, major shareholders and executives, and cases involving the misuse of social networking services (SNS) or false reports, in a swift manner.

The team will be set up within the Korea Exchange, and will be led by a deputy governor of the Financial Supervisory Service. The team will consist of approximately 35 members: 4 from the Financial Services Commission, 18 from the Financial Supervisory Service, and 12 from the Korea Exchange. The team will work at the Korea Exchange and operate as a collaborative system to process urgent cases quickly. This measure addresses the issue that differences in authority between institutions have caused delays in responding to incidents.

Lee Yoonsoo, Standing Commissioner of the Securities and Futures Commission at the Financial Services Commission, explained, "The team will be composed of personnel with sufficient expertise, selected from those actually responsible for market surveillance, review, and investigation at each participating institution." He added, "We also plan to expand staffing to prevent any gaps in the existing response systems of each institution, especially regarding important cases currently under investigation or review, due to the reassignment of personnel."

Depending on its performance, the Joint Response Team may become a permanent organization in the future. Commissioner Lee Yoonsoo emphasized, "For now, the relevant agencies will cooperate and operate the team as a kind of pilot test for about a year, after which we will evaluate its results and effectiveness."

The market surveillance system at the Korea Exchange will also be fundamentally restructured. The current "account-based" surveillance will be switched to a "person-based" system. The account-based system made it difficult to identify connections between the same individuals and resulted in an excessive number of surveillance targets. To address this, the authorities aim to combine account information with encrypted resident registration numbers, thereby shifting from an account-based to a person-based unfair trading surveillance system.

The financial authorities stated, "By converting the surveillance system to a person-based model, the number of targets for monitoring and analysis will decrease, greatly improving the efficiency of market surveillance." They also expected, "It will become much easier and faster to identify the same individuals, measure their market influence, and detect wash trades?tasks that were difficult under the previous account-based system."

Furthermore, the authorities plan to incorporate artificial intelligence (AI) technology to upgrade the market surveillance system. The current system, which has been in place for seven years, is deemed inadequate for quickly responding to and analyzing the increasingly sophisticated methods of stock price manipulation. Therefore, the authorities aim to use AI to analyze past decisions of the Market Surveillance Committee and to refine the indicators used to detect suspected unfair trading activities.

A representative from the Korea Exchange said, "At this stage, we plan to use AI primarily to quickly select stocks that require urgent review and investigation," adding, "In the future, we expect to use it as a tool for analyzing trading patterns."

At the same time, the authorities aim to implement a "one strike out" policy, removing those involved in unfair trading, such as stock price manipulation, through proactive administrative sanctions. Recently, the Securities and Futures Commission decided to refer Bang Si-hyuk, chairman and major shareholder of HYBE, to the prosecution on suspicion of fraudulent trading, and other major unfair trading cases involving major shareholders and executives continue to emerge.

Recently, the financial authorities have introduced new administrative sanctions, including payment suspension, fines, and restrictions on trading financial investment products or appointing executives. They intend to actively use these new measures to permanently remove unfair actors from the capital market. If illegal profits are found in a suspect's account, the authorities plan to freeze the funds promptly and impose fines of up to twice the amount of the illicit gains.

In addition, external disclosure of major unfair trading cases involving major shareholders and executives will be strengthened. Commissioner Lee stated, "Publicly disclosing the names of violators will have a significant impact," adding, "Such disclosure will create a heavy burden for those who attempt or consider stock price manipulation."

Furthermore, the criteria for delisting insolvent listed companies will be significantly tightened. Low-performing companies are more likely to become targets of stock price manipulation, and may resort to accounting fraud, embezzlement, or breach of trust to avoid delisting, making prompt removal necessary.

The requirements for market capitalization and sales will be raised. Companies will be delisted immediately if they receive an adverse audit opinion for two consecutive years. For KOSDAQ-listed companies, the delisting review process will be streamlined from a three-stage to a two-stage system, improving the efficiency of delisting procedures. The financial authorities expect that, once the criteria are strengthened, 8 to 9 percent of KOSPI-listed companies will ultimately be delisted.

Commissioner Lee Yoonsoo stated, "This action plan is a fundamental measure to establish the 'one strike out' principle for unfair trading. We will promptly implement actionable measures such as strengthening inter-agency cooperation and the swift removal of insolvent companies, and will accelerate necessary institutional improvements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)