As Household Loan Regulations Tighten to Curb Housing Prices,

Banks Hit Hard... Turning to Corporate and SOHO Loans

Increasing Performance Weight and Preferential Rates... System Improvements Underway

Rising Delinquency Rates Remain a Challenge... Risk of Concentration Among Large Corporations

Banks, hit hard by the financial authorities' stringent household loan regulations aimed at curbing housing prices in the Seoul metropolitan area, are seeking new opportunities through corporate and SOHO (Small Office Home Office) loans. They are increasing the weight of corporate loans in performance evaluations and expanding preferential interest rates and special loan limits to ramp up their marketing efforts. However, experts point out that there are clear limits to expanding corporate lending, given the worsening domestic business environment and the resulting surge in delinquency rates. To prevent funds from being concentrated only in large, high-credit corporations, there are calls for government support, such as expanding guarantees for new businesses and reforming risk-weighted assets (RWA).

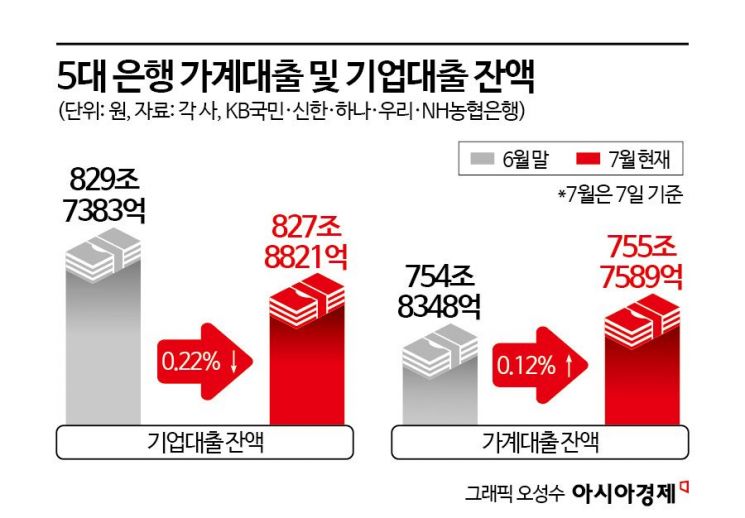

According to the financial sector on July 9, the outstanding balance of household loans at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Bank) stood at 755.7589 trillion won as of July 7, up 924.1 billion won (0.12%) from the end of last month (754.8348 trillion won). This translates to a daily average increase of 184.8 billion won on business days, which is almost half of last month's daily average of 355.45 billion won. With the full implementation of the June 27 regulation, which further restricts household loan limits and total volume, industry insiders expect the growth of household loans to shrink even further going forward.

As it has become increasingly difficult to defend their performance through household loans, banks are now collectively strengthening their focus on corporate and SOHO lending. KB Kookmin Bank and Shinhan Bank have raised the evaluation scores for corporate loans in this year's key performance indicators (KPI). This is essentially a signal to increase corporate lending, but unlike household loans, the outstanding balance of corporate loans has actually declined since June as banks move to manage total volume. The outstanding balance of corporate loans at the five major banks peaked at 838.1594 trillion won at the end of May but fell by about 8.4 trillion won by the end of last month. As of July 7, the balance had dropped to 827.8821 trillion won, a decrease of about 1.85 trillion won in just one week.

Marketing for corporate loans in the second half of the year has also kicked off in earnest. KB Kookmin Bank raised the preferential interest rate limit for small and medium-sized enterprises (SMEs) and small business owners from 8 trillion won to 9.5 trillion won, while Shinhan Bank set its limit at 12 trillion won. Hana Bank significantly increased the special loan limits for corporate and SOHO loans eligible for preferential rates and higher limits to 10 trillion won and 1.27 trillion won, respectively. Woori Bank launched the "Woori Growth Industry Export-Import Package" at the end of last month, which reduces foreign exchange fees for innovative growth companies and high-quality export-import firms.

There are also efforts to structurally improve the corporate finance system to expand lending. For example, Woori Bank launched "WonBiz e-MP" in mid-June, a system that links transaction information such as orders, contracts, and settlements between companies with financial services, enabling loans to be executed in one seamless process. Using this system, loans can be executed immediately upon order confirmation within the agreed amount, minimizing gaps in financing from order to delivery. Nonghyup Bank is preparing to launch "The Quicker," a platform that will allow corporations to complete the entire loan process non-face-to-face, from application to execution, in November.

However, there are also concerns about the limitations of expanding corporate lending. Demand for corporate loans has weakened due to the economic downturn, and it has become increasingly difficult to identify high-quality borrowers. According to the Financial Supervisory Service, the delinquency rate for corporate loans at domestic banks stood at 0.68% at the end of April, up 0.14 percentage points from the same month last year. Notably, the delinquency rate for large corporations rose by 0.02 percentage points, while that for SMEs increased by 0.17 percentage points (to about 0.83%), indicating that managing soundness has become more challenging for smaller firms.

An industry insider commented, "Corporate loans are a double-edged sword. If you recklessly increase lending and defaults occur, you become an immediate target." He added, "Because soundness management is required for value-up, it is difficult to extend loans to promising sectors or new businesses that cannot provide sufficient collateral, even if they are not immediately profitable." Another insider pointed out, "With the current system, competition is likely to intensify only among large, high-credit corporations. For corporate loans to reach new growth sectors, there needs to be increased guarantees for those industries and support such as lowering risk weights."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)