Government Eyes Tax Reform to Achieve 'KOSPI 5000'

Second Quarter Results Expected to Surpass Market Expectations

With the passage of the Commercial Act amendment in the National Assembly, "separate taxation of dividend income" has emerged as a new issue in the securities industry. In particular, the banking sector?traditionally recognized for high dividend yields?is expected to exceed performance expectations for the second quarter of this year, leading experts to predict a favorable outlook.

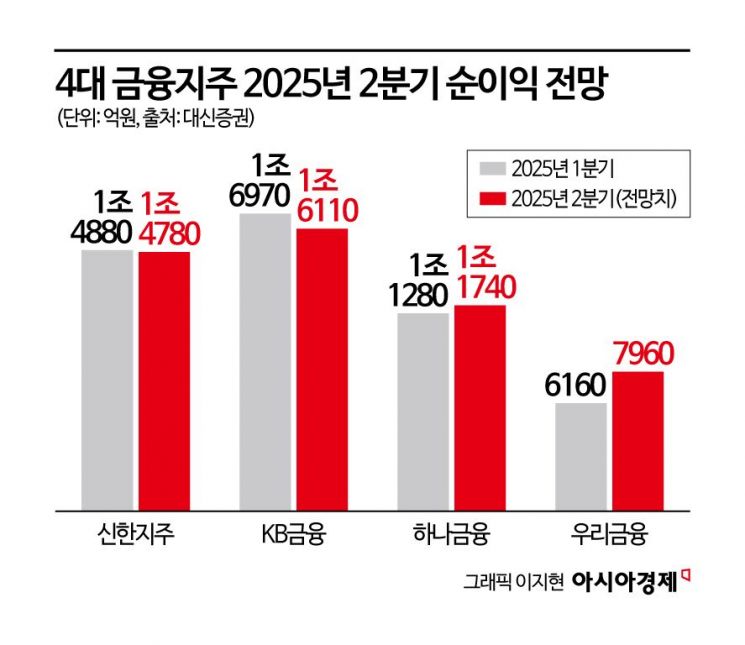

According to an analysis by Daishin Securities on July 8, the combined net profit of the four major domestic financial holding companies in the second quarter of this year is expected to reach approximately 5 trillion won, slightly surpassing market expectations. This improvement in performance is attributed to a combination of factors: banks' ability to defend margins, an increase in lending, robust non-interest income driven by falling interest rates and exchange rates, and a rise in stock indices.

For the second quarter of this year, the net interest margin (NIM) of the four major commercial banks is expected to decline by only an average of 2 basis points (1bp=0.01%), despite lower lending rates due to the base rate cut. This resilience is attributed to repricing of time deposits and a decline in bank bond rates. In addition, due to speculative demand following last month's real estate policy, the household loan growth rate surged by nearly 2%, and total won-denominated loans are expected to grow by an average of 1.5%. As a result, net interest income is projected to reach 11 trillion won, a slight increase of 0.1% compared to the previous quarter.

Non-interest income is also expected to reach a record high. The simultaneous decline in interest rates and exchange rates, along with rising stock indices, has improved gains on trading valuations, non-monetary foreign exchange gains, and securities commission income. Consequently, the combined non-interest income of the four major financial holding companies is estimated to reach 3.5 trillion won. In particular, due to the decline in exchange rates, Woori Financial Group and Hana Financial Group are each expected to secure additional foreign exchange gains of between 70 billion and 100 billion won.

However, the burden of credit loss expenses is expected to be unavoidable to some extent, due to rising delinquency rates on credit cards and among small and medium-sized enterprises led by self-employed individuals. Some financial holding companies are also expected to set aside additional provisions related to overseas commercial real estate, but the overall high collateral ratios are seen as limiting credit risk.

The most notable aspect is the growing expectation for dividend tax reform, including separate taxation of dividend income. On June 11, President Lee Jaemyung visited the Korea Exchange and stated that tax or institutional reforms to promote dividends are being prepared, citing as an example the amendment to the Income Tax Act proposed by Democratic Party lawmaker Lee Soyoung in April.

The core of the amendment is to apply a separate tax rate to dividend income from listed companies with a dividend payout ratio of 35% or higher, separating it from comprehensive income. Previously, the possibility of implementation was considered low due to concerns over tax revenue shortfalls. However, as concrete directions for reform have recently been discussed in the media, there is now a possibility that the measure will be included in the tax reform plan at the end of July.

Park Hyejin, a researcher at Daishin Securities, stated, "Achieving KOSPI 5000, as emphasized by the Lee Jaemyung administration, requires a revaluation of companies with low price-to-book ratios (PBR) through measures such as the Commercial Act amendment," and added, "Based on the increased likelihood of dividend tax reform, we are raising our target prices for bank stocks by an average of 19%."

In particular, Woori Financial Group is drawing attention in the market, as its expansion into the securities business and acquisition of insurance companies are progressing smoothly. There is an opinion that, toward the end of the year, the dividend appeal of Woori Financial Group will stand out even more compared to other financial holding companies.

Jung Junseop, a researcher at NH Investment & Securities, analyzed, "Unlike other companies that pay equal dividends in each quarter, Woori Financial Group allocates a larger portion of its dividends per share (DPS) in the fourth quarter, resulting in a higher expected year-end dividend yield." He added, "Furthermore, with the introduction of reduced dividends starting from the settlement dividend, individual investors will experience an even higher perceived dividend yield."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)