"Winner's Curse" Hits Jeongyukgak After Chorokmaeul Acquisition

Cash Crunch Forces Both Companies Into Court Receivership

Industry Expects Chorokmaeul Sell-Off Amid Ongoing Restructuring

Jeongyukgak, a fresh food shop, has fallen victim to the "winner's curse." After acquiring the organic supermarket Chorokmaeul, the company suffered from a cash crunch and has ultimately entered court receivership. Industry insiders expect that Jeongyukgak will likely sell off Chorokmaeul.

According to industry sources on July 7, Jeongyukgak and Chorokmaeul have been under court rehabilitation procedures since July 4. Currently, Jeongyukgak has temporarily suspended its distribution services for restructuring, while Chorokmaeul continues to operate its core business divisions, including offline stores, online mall, logistics center, and customer service center. The company explained that even over the past weekend, 100% of directly operated stores and more than 95% of franchise stores nationwide were operating as usual.

The court receivership for both companies comes three years after Jeongyukgak acquired Chorokmaeul. The financial burden and deteriorating profitability resulting from the acquisition of Chorokmaeul ultimately proved to be detrimental.

Jeongyukgak is a distribution platform specializing in livestock products, founded in February 2016 by CEO Kim Jaeyeon, a KAIST graduate. The company gained attention with its "super-fresh meat" sales strategy, distributing fresh livestock and seafood products such as pork within four days of slaughter and eggs on the day they are laid.

In particular, Jeongyukgak drew industry attention when it acquired Chorokmaeul from Daesang Holdings in 2022. The acquisition was notable because a startup, growing with funding from venture capital, stepped in to purchase Chorokmaeul, which was operated by the Daesang Group. At the time, major domestic distribution companies such as Kurly and Emart Everyday were also mentioned as potential buyers, making the result all the more unexpected.

An industry source explained, "At the time, Chorokmaeul was put up for sale because it was unable to attract sufficient investment. Although several major companies emerged as potential buyers, Jeongyukgak was selected as the one with the most synergy potential."

However, the aggressive fundraising for the acquisition became problematic. Of the 90 billion won acquisition fund, Jeongyukgak covered about 50 billion won with company cash and loans (37 billion won). This was because the funds to be raised externally fell far short of the target.

In March last year, Jeongyukgak secured a 10 billion won investment from NH Investment & Securities, Atinum Investment, and Capstone Partners. Subsequently, it raised 30 billion won in short-term funds from Shinhan Capital using Chorokmaeul shares as collateral. However, these measures were insufficient to resolve the cash crunch.

The overall reduction in investment in the commerce sector also exacerbated the financial difficulties. After large-scale stagnation at Tmon and Wemakeprice last year, many small and medium-sized e-commerce companies either closed down or entered court receivership.

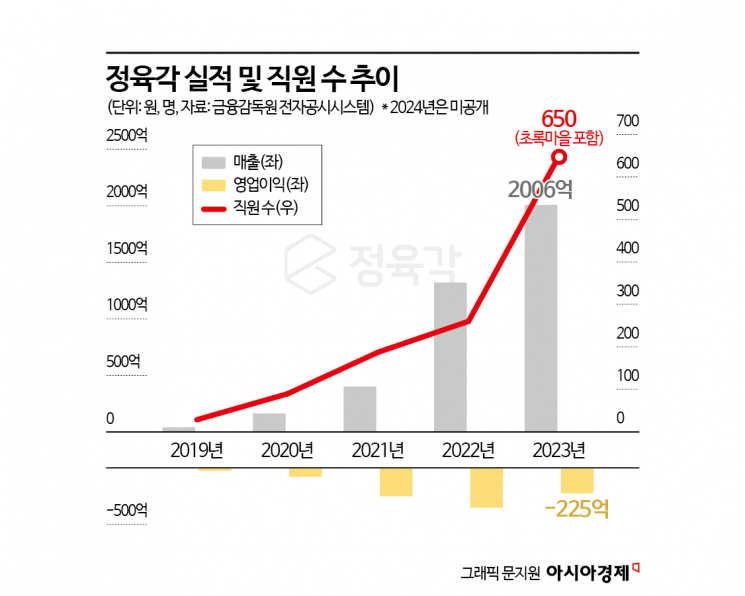

Meanwhile, the company's losses ballooned. After acquiring Chorokmaeul, Jeongyukgak's sales grew explosively, reaching 200.6 billion won in 2023. However, operating losses increased from 2.6 billion won in 2019 to 22.5 billion won in 2023. The lack of offline distribution experience and increasing losses at Chorokmaeul contributed to this. Chorokmaeul's sales fell by 6.3%, from 190.9 billion won in 2022 to 178.8 billion won in 2023, while operating losses grew from 8.3 billion won in 2022 to 8.7 billion won in 2023. Although last year's audit report was not released, the company is currently known to be in a state of complete capital erosion. A Jeongyukgak representative said, "The audit report was also uploaded in August two years ago," adding, "As of last year, we are in a state of capital erosion."

Industry observers believe that Jeongyukgak's competitiveness was weak due to the quick commerce sector's reliance on large-scale logistics networks. Chorokmaeul currently operates a total of 289 stores, including both directly managed and franchise locations. Another industry source pointed out, "There were probably various business issues, but it would have been difficult to adapt to the rapidly changing e-commerce environment after COVID-19. While the products were recognized for their quality, there were weaknesses in logistics and delivery, and the activation of the platform was also likely slow."

Jeongyukgak and Chorokmaeul plan to pursue restructuring and business normalization according to the court's decisions going forward. A Jeongyukgak representative said, "We will follow the court's procedures, but we are open to various possibilities, including attracting investment, selling shares, or M&A."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)