"Reevaluating the Chaebol System and Seeking a New Model"

Amid an uncertain economic environment and active discussions on amendments to the Commercial Act, there has been a call to establish "creative owners, dutiful professional managers, and strong boards of directors" as the desirable future for corporate governance in Korea.

On July 3, the Samil PwC Governance Center announced the publication of the 29th issue of "Governance Focus," which includes a research report by Samil PwC advisor and Sungkyunkwan University business professor Choyongdoo. This report, titled "The Future of K-Corporate Governance for Growth and Innovation," analyzes the evolution of Korean corporate governance over the past 25 years and proposes a desirable development model for the future.

The current corporate governance structure in Korea is classified into two types: the owner-management system of large conglomerates with clear controlling shareholders, and the professional management system of privatized companies with thoroughly dispersed ownership.

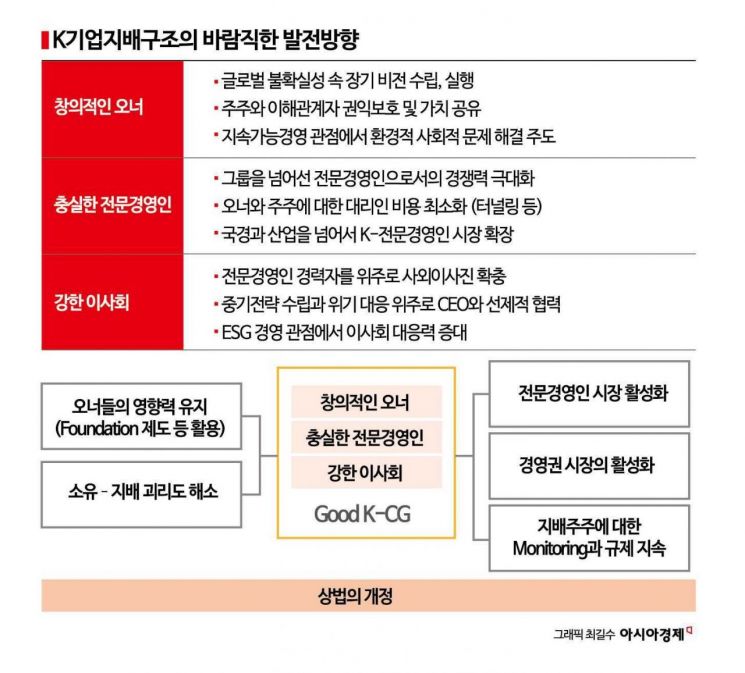

Professor Cho pointed out, "While the professional management system is often regarded as the direction for advanced governance, in Anglo-American countries where it was first introduced, companies have reported side effects such as managers' obsession with short-term, quarterly targets." In contrast, the owner-management system, commonly referred to as "chaebol" and often negatively evaluated from a governance perspective, has the advantage of enabling long-term growth and the execution of an entrepreneur's unique vision. He also argued that issues such as conflicts of interest between controlling and minority shareholders have been largely addressed through amendments to relevant laws and the strengthening of shareholder activism.

Professor Cho suggested, "It is necessary to reinterpret the characteristics of the 'chaebol' system, which has long been viewed negatively, and to seek new potential within it." One proposed example is the corporate foundation-based governance model used by Sweden's Wallenberg Group and Denmark's Novo Nordisk Group.

These companies utilize foundation systems, whereby if the founding family transfers its shares to a foundation at a certain point, the state, in return, offers substantial inheritance tax reductions and recognizes dual-class voting rights. This allows large business groups to be protected from hostile external mergers and acquisitions (M&A) and to pursue long-term business objectives. However, since dual-class voting rights are fundamentally prohibited in Korea, benchmarking the Nordic model would require amendments to relevant tax laws and a grand compromise among labor, management, and government.

As the desirable future for Korean corporate governance, Professor Cho proposed the model of "Creative Owner, Dutiful Manager, Strong Board." He explained, "In the face of increasing management uncertainty, we need owners who can implement long-term strategies and build sustainable companies, professional managers who fulfill their responsibilities as agents of owners or shareholders, and strong boards with extensive management experience that can collaborate with and supervise professional managers."

He further added, "In the Korean economy, where low growth is becoming entrenched, companies must serve as the engine for growth and innovation, and at the core of this is a paradigm shift in corporate governance." He emphasized, "At a time when large companies are facing various changes, including high inheritance tax rates, it is essential to develop institutional wisdom to reduce risk factors so that they can focus on innovation and long-term growth." Further details can be found on the Samil PwC Governance Center website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)