An Additional 404 Million Won Allocated in the Second Supplementary Budget

Increased Funding for Representative Appointment and Public Relations

"Execution Rate Must Be Raised and Follow-up Management System Established"

The "Debtor Representative Appointment Support" program, which assists debtors who have suffered from illegal debt collection practices, is expected to be expanded through the second supplementary budget. With the increased budget, more debtors will be able to benefit from the program. However, there are concerns that practical protection measures, such as improving the actual execution rate and guaranteeing the right to legal defense, must also be implemented in parallel.

According to the National Assembly and other sources on July 2, the National Assembly's Political Affairs Committee held a plenary session that afternoon and approved the second supplementary budget bill under the jurisdiction of the Financial Services Commission. Among these, the budget for the Debtor Representative Appointment Support program was increased to 1.69 billion won by adding 404 million won to the existing budget of 1.205 billion won (including the first supplementary budget). The budget was increased after the Political Affairs Committee's Budget and Accounts Review Subcommittee decided to add 50 million won for public relations and accessibility enhancement to the original second supplementary budget proposal of 354 million won.

The Debtor Representative Appointment Support program is a project in which the Korea Legal Aid Corporation provides free support for the appointment of debtor representatives and related litigation for debtors who have suffered from illegal debt collection by lending companies, with the Financial Services Commission subsidizing the costs to the corporation. Specifically, when a debtor expresses their intention to appoint a representative or to file a lawsuit to the Financial Supervisory Service, the FSS requests the Legal Aid Corporation to appoint a representative. When an attorney affiliated with the corporation undertakes the debtor representation and related work, the Financial Services Commission subsidizes the required budget to the corporation. The debtor representative system, which forms the basis for this program, is stipulated in Article 58-2 of the Act on the Fair Collection of Claims. Under this system, if a debtor appoints a representative such as an attorney, the debt collector is only allowed to contact the representative, not the debtor directly.

The reason the Financial Services Commission wanted to increase the budget for this program through the second supplementary budget is to respond to the rising number of representative appointments. As of May, the number of supported representative appointments stood at 3,001 cases, which is nearly the total number of 3,096 cases supported throughout last year. The Financial Services Commission stated that if the entire main budget, excluding the public relations expenses, is used for debtor representative appointments, about 5,500 appointments would be possible. "Since the average monthly number of appointments in the first half of this year has already reached 600 per month, we reflected the budget increase in the supplementary proposal to support up to 7,200 appointments annually based on the current trend," the commission explained.

The Financial Services Commission and the National Assembly agree that an increase in the budget is necessary because the number of complaints related to illegal private lending continues to rise. According to the preliminary review report published ahead of the budget review, the number of reports and consultations regarding illegal private lending received by the Financial Supervisory Service's Illegal Private Lending Reporting Center and the Legal Aid Corporation last year was 15,768 cases. Starting with 8,382 cases in 2020, the number surpassed 10,000 for the first time in 2021 (10,223 cases), then continued to increase to 11,382 cases in 2022 and 14,226 cases in 2023. The report stated, "Due to the recent economic situation and the strengthening of regulations related to illegal private lending, disputes related to illegal private lending are expected to spread further," and added, "To meet the demand of debtors using illegal private lending within this year, it is necessary to provide an appropriate level of financial support, taking into account the execution trend."

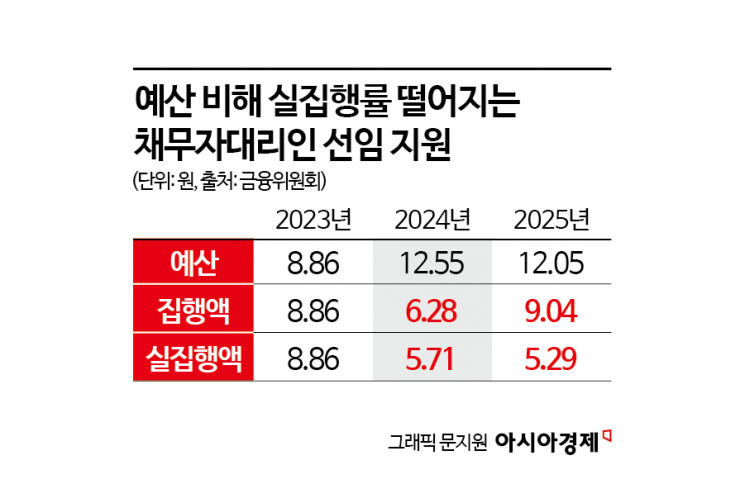

However, the actual budget execution rate remains low, partly due to insufficient publicity. Of the 1.255 billion won allocated last year, only 628 million won was disbursed to the Legal Aid Corporation. Of the amount disbursed, only 571 million won was actually used for the program, resulting in an actual execution rate of just 45.5%. The Financial Services Commission cited several reasons for this, including many cases where applications were not accepted if the debtor failed to provide the illegal debt collector's phone number, a lack of application channels or dedicated personnel, and insufficient publicity budget.

Furthermore, there are calls for improvements because practical protection measures remain inadequate, with illegal debt collection practices such as threats continuing even after the appointment of a debtor representative. According to the report, a survey of users of the support program last year found that among those who said the program was not helpful, 56.8% cited insufficient sanctions when illegal collection activities continued, and 45.5% said they continued to receive contact from illegal private lenders. The report stated, "The ultimate goal of the support program is to guarantee the legal defense rights of vulnerable debtors and to prevent illegal private lending," and added, "In addition to institutional improvements to raise the execution rate, the Financial Services Commission should also consider measures to establish a follow-up management system so that the program does not end with simply notifying the appointment of a representative, but enables swift coordination and response with the police and financial authorities to provide practical protection for vulnerable debtors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)