Shilla and Shinsegae Duty Free vs. Incheon Airport: Rent Reduction Mediation Fails

Corporation Cites Concerns Over Fairness and Future Bidding, Maintains Rejection

Declining Sales and Passenger Numbers... Profitability Worsens for the Industry

"Need for Flexible Calculation Standards Considering Sluggish Market Conditions"

Shilla Duty Free and Shinsegae Duty Free requested a court-mediated adjustment to lower the rent they pay monthly to Incheon International Airport Corporation by 40% due to sluggish sales, but the decision has been postponed after only confirming the differences in stance between the parties. Incheon International Airport Corporation remains firm in its refusal to accept the companies' demands, making it unlikely that a compromise will be reached soon. Although there are expectations that the duty-free industry could benefit from improved Korea-China relations following the launch of the new government, operators continue to struggle with deteriorating business conditions and are voicing concerns over the burdens of rent and fees.

Duty-free shop inside the duty-free zone of Terminal 1, Incheon International Airport. Photo by Yonhap News

Duty-free shop inside the duty-free zone of Terminal 1, Incheon International Airport. Photo by Yonhap News

According to industry sources on July 2, the rent reduction mediation meeting held at Incheon District Court on June 30 ended without agreement. The court requested additional documents from the duty-free operators and rescheduled the mediation for August 14.

This failure to reach an agreement resulted from Incheon International Airport Corporation submitting a statement to the court before the mediation date, declaring it could not accept the proposed adjustment. The corporation maintains a firm stance that it cannot agree to any rent adjustments, even if the duty-free industry is requesting a temporary reduction. In its statement to the court, the corporation cited several reasons for its refusal: failure to meet the requirements for rent reduction, concerns over undermining the fairness of the bidding process, issues of equity with other operators, and potential negative impacts on future bidding markets.

Previously, Shinsegae Duty Free filed for a 40% rent reduction at the end of April, and Shilla Duty Free, operated by Hotel Shilla, submitted a similar request in early May. The request covers cosmetics, perfume, liquor, and tobacco shops in duty-free zones at Incheon Airport's Terminal 1 and Terminal 2. The companies argue that with the declining number of domestic and international customers and falling sales, the rent?calculated in proportion to the number of airport users?has become a significant burden.

Since 2023, the rent for duty-free shops at Incheon Airport has been calculated by multiplying the expected per-passenger fee submitted by the bidder by the number of airport users. Shilla and Shinsegae Duty Free reportedly bid around 10,000 won per passenger for the duty-free license that year. Last year, 35.31 million passengers departed from Incheon Airport, averaging about 3 million per month. Based on these figures, it is estimated that these duty-free shops pay around 30 billion won in rent each month. In 2024, Shilla paid 11% of its annual sales (3.2819 trillion won) as rent, while Shinsegae paid 18% of its annual sales (2.006 trillion won) as rent.

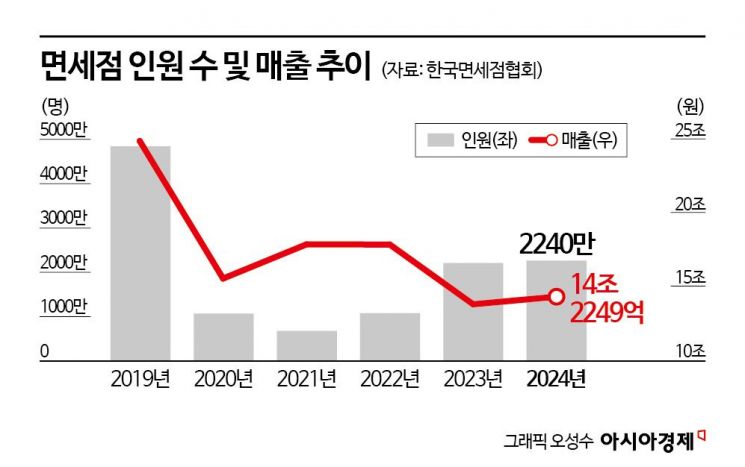

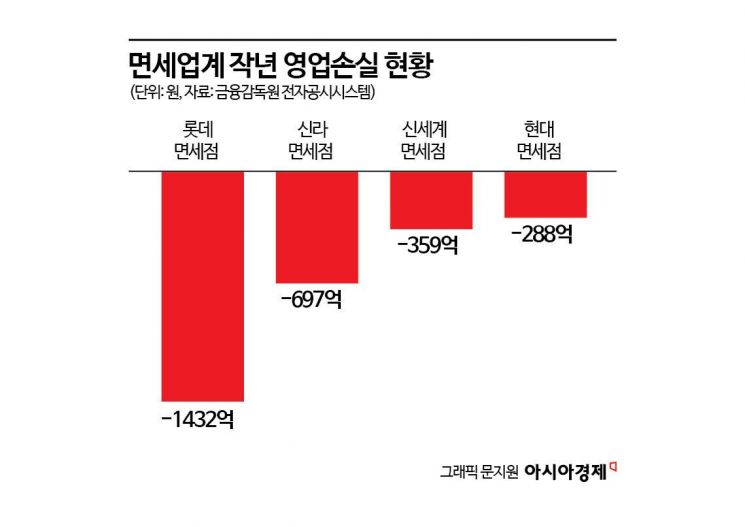

The duty-free industry, which was hit hard by the COVID-19 pandemic, is still experiencing a slow recovery. According to the Korea Duty Free Shops Association, the domestic duty-free market generated 24.86 trillion won in sales and had 48.4 million customers in 2019, but last year, sales dropped to 14.225 trillion won and the number of customers fell to 28.4 million. Major duty-free operators such as Lotte, Shilla, Shinsegae, and Hyundai recorded operating losses totaling 280 billion won.

Meanwhile, fixed costs such as rent and license fees continue to weigh on the industry, worsening profitability. The license fee system requires duty-free shops with a business license to return a portion of their revenue to society as tax. Since 2014, the fee has been calculated based on sales, ranging from 0.1% for sales below 200 billion won to a maximum of 1% for sales exceeding 1 trillion won, with different rates for each bracket.

Although the Ministry of Economy and Finance and other relevant agencies halved the license fee rate in consideration of the industry's difficulties due to COVID-19, industry insiders say the burden remains heavy. One industry official said, "Calculating the license fee based on sales reflects the situation when the duty-free industry was booming. Now, with mounting deficits, we have been asking for the standard to be changed flexibly to operating profit, but this has not been accepted." Another official added, "Both Incheon International Airport Corporation and duty-free operators are inevitably influenced by the ministries responsible for rent and fee policies, such as the Ministry of Land, Infrastructure and Transport and the Ministry of Economy and Finance. This makes it difficult to coordinate differences in position and even to express opinions openly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)