Taekwang Group and Anchor PE Make the Shortlist

Will Aekyung Industry Meet the 600-700 Billion Won Target?

Humidifier Disinfectant Issue Draws Attention; Negotiation Outcome Remains to Be Seen

As Aekyung Group proceeds with the sale of a 63.38% stake in Aekyung Industry, held by its holding company AK Holdings and Aekyung Asset Management, the shortlist of qualified preliminary bidders has been finalized. With increasing investment demand for cosmetics companies both domestically and internationally, expectations are rising for a competitive bidding process.

Aekyung Industry Gains Momentum as Acquisition Candidates Narrowed Down

According to the investment banking (IB) industry on July 2, Aekyung Group and its sale advisor Samjong KPMG have selected five candidates from those who submitted Letters of Intent (LOI) for the acquisition of Aekyung Industry and have invited them to participate in the main bidding process. Major candidates include Taekwang Group and Hong Kong-based private equity fund Anchor Equity Partners. In addition, several financial investors (FI) and strategic investors (SI) have formed consortiums to participate in the bidding.

In the securities industry, there is analysis that the acquisition battle is likely to develop into a two-way race between Taekwang Group and Anchor Equity Partners. Taekwang Group stated, "We plan to invest trillions of won in new businesses such as cosmetics, energy, and real estate development," adding, "We will inject 1.5 trillion won by 2025." The acquisition of Aekyung Industry is a core part of this strategy. Taekwang is planning to foster the cosmetics business as a new growth engine for the group and is pushing to amend its articles of incorporation to add 'cosmetics manufacturing and sales' as a business objective at an extraordinary shareholders' meeting scheduled for July 31. Anchor Equity Partners has owned the mid-sized K-beauty brand Dermafirm since 2019. The acquisition of Aekyung Industry is seen as an effort to increase its investment in the cosmetics sector.

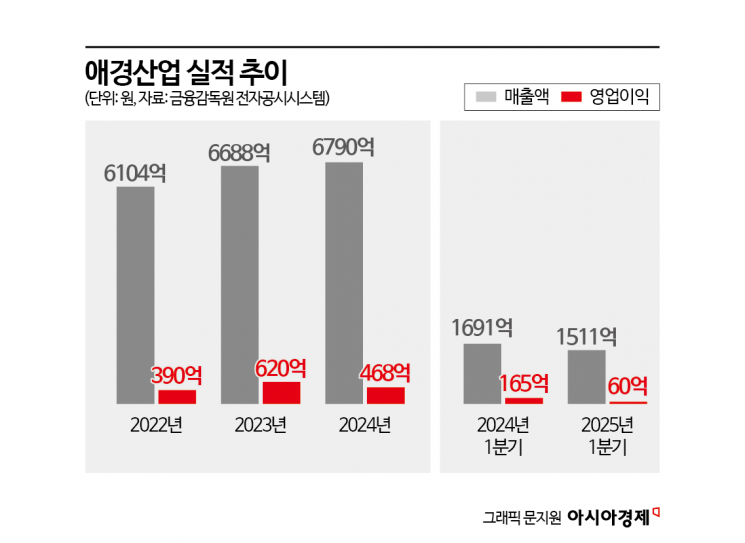

Aekyung Industry currently has a market capitalization of about 430 billion won (based on the closing price of 16,300 won on July 1). Aekyung Group is expecting a sale price of between 600 billion and 700 billion won for the 63.38% stake, factoring in a management control premium. This represents a premium of over 60% compared to the value of the stake.

Initially, there were concerns that the sale of Aekyung Industry would not attract much interest, as the company, despite having its own manufacturing facilities, had a relatively low proportion of cosmetics sales. The high proportion of sales in China, which limited earnings growth, also played a role. In fact, as of the first quarter of this year, the cosmetics segment accounted for 30% of Aekyung Industry's sales, down from 37% in the first quarter of last year. Revenue and operating profit stood at 45.9 billion won and 1.1 billion won, respectively, representing year-on-year declines of 27% and 88.4%.

Despite the slowdown in performance, the reason for the influx of acquisition candidates is the growth potential of the cosmetics industry. K-beauty remains competitive in the global market, and Aekyung Industry's in-house manufacturing facilities and brand management experience are considered strong advantages. After rumors of a sale surfaced in April, Aekyung Industry's share price dropped to the 13,000 won range, but has since risen to 16,300 won on the back of acquisition expectations.

Aekyung Industry Sale to Secure Funds... Humidifier Disinfectant Issue Also Addressed

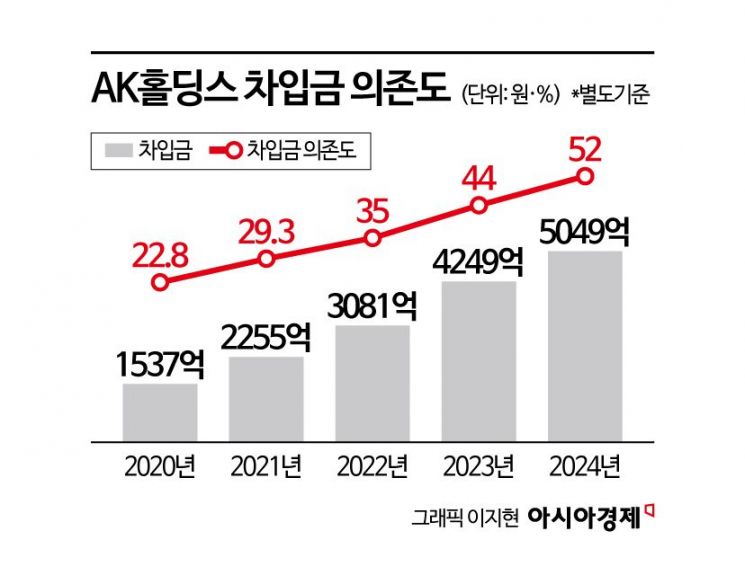

Aekyung Group plans to secure liquidity for the group through the sale of Aekyung Industry. Over the years, AK Holdings has supported struggling affiliates (such as Aekyung Chemical, Jeju Air, and Aekyung Department Store) by injecting funds, which has kept the companies afloat. As a result, AK Holdings' debt ratio rose significantly to 52% as of last year, compared to 2020. As the situation became more difficult, the group made the decision to sell Aekyung Industry, the 'foundation' of the company, to raise funds.

Aekyung Industry originated from Aekyung Yuji Industry, founded in 1954 by the late founder Chae Mongin. Chairman Chae made the company known by successfully launching the beauty soap 'Mihyang,' and later expanded the business by excelling in household goods such as the dishwashing detergent 'Trio.' In 1970, after Chae Mongin passed away, his wife Jang Youngshin took over management as the executive chairwoman. Chairwoman Jang laid the foundation for Aekyung Group by using cash raised from household goods sales to enter the chemicals, department store, and airline businesses.

The decision by Aekyung Group to put its 'foundation company' up for sale is seen as a move to improve its financial structure and to escape another risk?the 'humidifier disinfectant incident.' Aekyung Industry, along with SK Chemicals, has been embroiled in controversy over the harmfulness of its 'Humidifier Mate' product. The product is known to contain toxic substances that cause lung disease, and there have been 98 reported deaths and cases of harm as a result.

While Oxy Reckitt Benckiser received a prison sentence for its involvement in the related incident, former CEOs of Aekyung Industry and SK Chemicals had their original four-year prison sentences overturned by the Supreme Court last year, which cited difficulties in proving a causal relationship with lung disease. The case is now awaiting retrial.

A distribution industry official said, "It is Aekyung Industry, not Aekyung Group, that is involved in the humidifier disinfectant issue, so the responsibility will transfer to the new owner," adding, "However, how the issue will be resolved during negotiations remains to be seen." Meanwhile, the Fair Trade Commission has announced that it will take action, stating that the two companies concealed the fact that the main ingredients were toxic substances and failed to comply with fines and corrective orders.

Employee Morale Drops Due to Employee Stock Ownership Losses

Losses on the employee stock ownership plan, caused by the decline in share price after listing, are also cited as a factor in declining internal morale. Aekyung Industry was listed on the Korea Exchange in 2018, with an initial public offering price of 29,100 won. The share price rose to as high as 79,000 won immediately after listing, but has since declined and now stands more than 40% below the IPO price.

Employees acquired the entire allotment of 1.36 million shares allocated to them at the time of the IPO, and some department managers are known to have purchased 3,000 to 4,000 shares each (worth about 100 million won). At the current share price, significant losses are unavoidable.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)