Big Data Analytics Firm Based on Generative AI to Be Listed on July 4

Public Subscription Draws 6.11 Trillion Won in Deposits

Strengths in Unmatched Data Volume and AI Analysis Capabilities

As the domestic stock market continues its upward trend, expectations for the initial public offering (IPO) market in the second half of this year are rising. In this context, attention is focused on the share price movement of NewenAI on its first day of listing on the KOSDAQ market, scheduled for July 4. NewenAI has maintained a profitable business based on its artificial intelligence (AI) technology-driven business model. There is growing confidence that the company will achieve further growth following its listing.

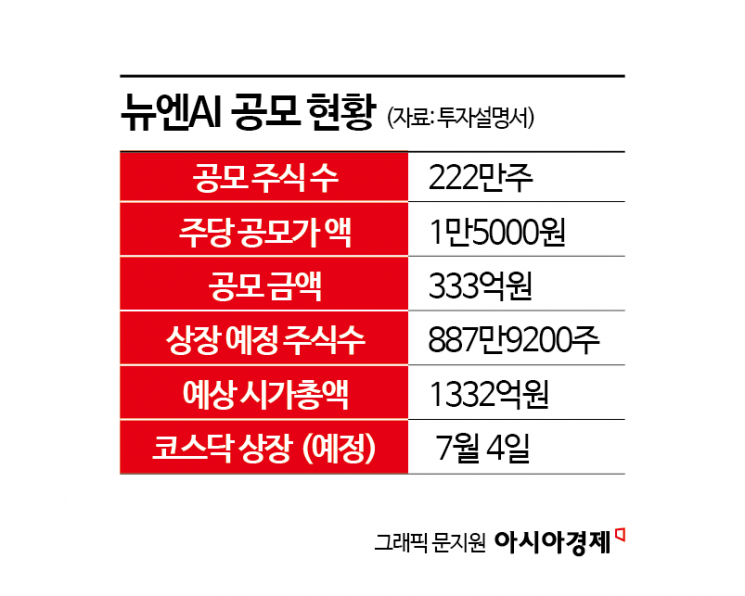

According to the financial investment industry on July 2, NewenAI conducted a public subscription for general investors over two days, from June 23 to 24. The subscription attracted 6.114 trillion won in deposits. Based on the offering price of 15,000 won per share, the company’s market capitalization amounts to 133.2 billion won.

Founded in 2004, NewenAI provides enterprise subscription services based on its proprietary conversational language model, “Quetta” AI technology. Its business model includes: ▲ Quetta Enterprise, a customized big data AI analytics service; ▲ Quetta Service, a general-purpose big data AI analytics service; and ▲ Quetta Data, a data cleansing and processing service.

NewenAI has secured approximately 200 billion data records, the largest volume in Korea, which is more than seven times the scale of its competitors. The company processes an average of 22 million real-time data records per day and more than 9 billion records annually, including data from social networking services (SNS). Its data collection accuracy reaches 99.9%.

Quetta Enterprise, which accounts for 40% of total revenue, is a customized data analytics service that reflects the characteristics of customers’ industries, sectors, job functions, and work environments. It provides tailored data and analytics results that address all business requirements, including reputation, marketing, public relations, and product development, across various industries such as manufacturing, fashion, food, and finance. The service can be used for a wide range of purposes, including consumer experience analysis, new product discovery, and sales demand forecasting. NewenAI has carried out more than 550 projects, including for Korea’s top 10 business groups.

Quetta Data Service collects, cleanses, labels, and processes data according to client requirements. In addition to providing raw data, it also offers statistical reports and management modules based on data supply volume, enabling clients to analyze data more conveniently.

“Quetta K-Beauty Insight,” a service specializing in K-beauty, analyzes consumer trends and market responses in real time based on domestic and international SNS and commerce platform data. It collects commerce data from platforms such as Amazon, Sephora, Coupang, and Olive Young. The service provides analytical data that offers practical support for product planning and marketing strategy development.

From 2020 to 2024, NewenAI’s revenue grew at an average annual rate of 20.5%. The company has maintained operating profit for 14 consecutive years. The 32.8 billion won in public offering funds secured through the listing will be used for ▲ research and development (R&D) investment for new product development and ▲ various expenses related to overseas market expansion.

Park Jongseon, a researcher at Eugene Investment & Securities, said, “NewenAI is pursuing new service launches and overseas market entry as part of its mid- to long-term growth strategy,” adding, “Starting next year, the company plans to launch new services in phases.” He also stated, “Given the proportion of long-term customers of more than three years and the share of private sector clients, we expect the company to achieve stable performance.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)