Debt Adjustment Support for Vulnerable Groups Made Permanent

Principal Reduction Rate for Self-Employed Increased to 80%

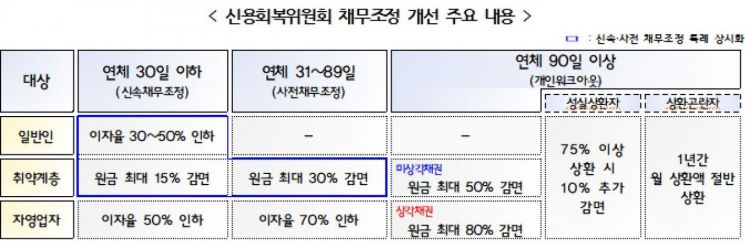

The Credit Counseling and Recovery Service (CCRS) will make its previously temporary preemptive debt adjustment program for vulnerable groups a permanent measure. The principal reduction rate for self-employed individuals undergoing debt adjustment has also been increased to a maximum of 80%.

On June 29, the CCRS announced that starting June 30, it will implement the "Measures to Strengthen Financial Support for Low-Income Households," which includes these changes. This action follows up on related measures announced by the Financial Services Commission in February 2025.

First, the special rapid and preemptive debt adjustment programs, which were temporarily operated for those at risk of delinquency and short-term delinquents, will become permanent. These programs provide stable repayment opportunities for debtors facing imminent delinquency or with a short period of delinquency. Since their introduction in 2023, there has been continued demand, and with this shift to a permanent system, those at risk of delinquency and short-term delinquents can now receive debt adjustment support at any time.

The special rapid debt adjustment program expands eligibility (from the bottom 10% to the bottom 20% of credit scores), reduces the contract interest rate for general debtors (by up to 50%), and provides principal reductions of up to 15% for vulnerable groups. The special preemptive debt adjustment program supports principal reductions of up to 30% for vulnerable groups such as recipients of basic livelihood security, persons with severe disabilities, and the elderly.

The CCRS has also strengthened customized debt adjustment support for debtors.

For vulnerable groups who have applied for debt adjustment due to long-term delinquency of 90 days or more and have poor repayment capacity, the principal reduction rate for non-amortized claims will be increased to a maximum of 50%. Previously, even though their repayment capacity was lower than that of general debtors, they were subject to the same reduction rate as general debtors (up to 30%).

Self-employed individuals and those who have suspended or closed their businesses, who are struggling with excessive debt burdens or have difficulty settling debts after closure, will also receive enhanced debt adjustment support. For self-employed individuals at risk of delinquency or with a delinquency period of 30 days or less, the contract interest rate will be reduced from the previous 30-50% to 50%. Those with a delinquency period of 31 to 89 days will see a reduction of 70% (previously 30-70%). For self-employed individuals with long-term delinquency of 90 days or more, the principal reduction rate for written-off claims (claims deemed uncollectible by creditors and written off as accounting losses) will be increased from 70% to 80%.

Debtors who faithfully repay their debts after receiving debt adjustment will also be eligible for additional reduction incentives. If a long-term delinquent repays 75% or more of the debt according to the repayment plan after debt adjustment, an additional 10% of the remaining debt will be forgiven.

Debtors who experience difficulty in repayment while using the debt adjustment program will be allowed to lower their repayment burden for a certain period. For one year, they can pay only half of the previously agreed amount, and the remaining half can be repaid in installments over the following six months. This measure is intended to help debtors flexibly respond to temporary income reductions during the debt adjustment process.

Applications for debt adjustment with the CCRS can be made by visiting one of 50 Integrated Support Centers for Financially Vulnerable Groups nationwide, or through the CCRS Cyber Counseling Department and dedicated mobile app. A CCRS official stated, "We expect these measures will provide substantial relief for vulnerable debtors facing excessive debt burdens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)