Up to 520,000 won per person in consumption coupons...

"Consumption likely to surpass COVID-19 levels"

Distribution sector shaken by surging international oil prices...

Pressure on logistics and manufacturing costs

As the government has decided to distribute "Livelihood Recovery Consumption Coupons" to all citizens, expectations for a recovery in consumption are rising, particularly in the food and dining sectors. In a situation where domestic demand has been sluggish for an extended period due to an economic downturn and high inflation, the measure is expected to provide much-needed relief. However, there are also concerns that rising international oil prices, driven by geopolitical risks in the Middle East, could increase cost burdens for businesses.

Up to 520,000 won per person in consumption coupons... "Consumption likely to surpass COVID-19 levels"

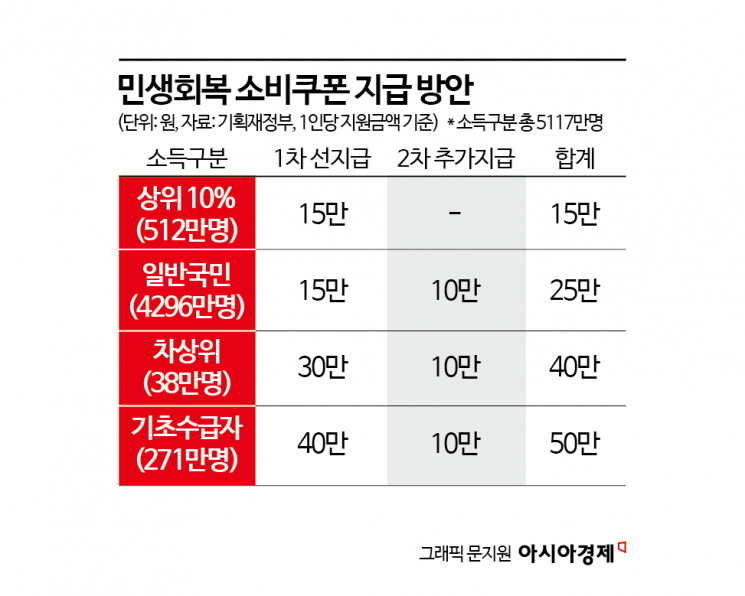

The government plans to begin distributing "Livelihood Recovery Consumption Coupons" of up to 520,000 won per person as early as next month. The program will cover all 51.17 million citizens, with 150,000 won for the top 10% income group, 250,000 won for the general public, 400,000 won for the near-poor, and 500,000 won for basic livelihood security recipients. Residents in 84 rural areas at risk of depopulation will receive an additional 20,000 won per person. Recipients can choose to receive the coupons as local gift certificates, prepaid cards, or credit/debit cards.

Although the specific places where the coupons can be used have not yet been disclosed, the food and beverage industry expects consumption to be concentrated in everyday sectors such as groceries, daily necessities, and dining out. A food industry representative said on the 24th, "When COVID-19 relief funds were distributed, sales increased significantly. With 13.2 trillion won worth of consumption coupons being released, we expect consumer sentiment to improve as people gain more purchasing power."

Looking back at the distribution of the "Emergency Disaster Relief Fund" in 2020 and the "COVID-19 National Support Fund" in 2021, the sectors where the largest portion of the funds were spent were restaurants and grocery stores. According to the Korea Development Institute (KDI)'s report "Analysis of the Effects of the Emergency Disaster Relief Fund," the government injected a total of 14.2 trillion won, and card sales subsequently increased by about 4 trillion won. This means that approximately 30% of the total fiscal input led to new consumption. In sectors where the funds could be used, sales increased by 26.2% to 36.1% compared to the total budget.

The industry expects the scale of consumption to be even larger this time. When the Emergency Disaster Relief Fund was distributed in 2020, the creation of new consumption in face-to-face service and dining sectors was relatively limited due to the pandemic. However, as face-to-face consumption has now become more active, the effect of stimulating consumption is expected to be greater.

Nam Sung-hyun, a researcher at IBK Investment & Securities, analyzed, "Considering that the proportion of home meals was high in 2021 due to gathering bans, the proportion of spending at restaurants is expected to be the highest with this supplementary budget. The 'supplementary budget effect' will be most pronounced in the dining and food and beverage sectors." Kim Taehyun, also a researcher at IBK Investment & Securities, added, "As with the cases of the Emergency Disaster Relief Fund and the Win-Win Consumption Support Fund, we expect to see a recovery in overall food-related consumption, including dining out, supermarkets, and convenience stores, and there is also a possibility that demand for alcoholic beverages will improve."

On the 23rd, as the United States struck Iran's nuclear facilities, escalating tensions in the Middle East and raising concerns about rising oil prices, drivers were refueling at Mannam Square in Seocho-gu, Seoul. 2025.6.23. Photo by Kang Jinhyung

On the 23rd, as the United States struck Iran's nuclear facilities, escalating tensions in the Middle East and raising concerns about rising oil prices, drivers were refueling at Mannam Square in Seocho-gu, Seoul. 2025.6.23. Photo by Kang Jinhyung

Distribution sector shaken by surging international oil prices... Pressure on logistics and manufacturing costs

However, there are also risk factors. As the United States conducted airstrikes on three of Iran's nuclear facilities and Iran responded by threatening to close the Strait of Hormuz, concerns are mounting over rising oil prices, inflation, and a potential contraction in consumption.

In fact, international oil prices hit a five-month high after news broke that Iran's parliament had approved the plan to close the strait. According to the Financial Times (FT), since Israel's surprise attack on Iran on the 13th, tensions in the Middle East have escalated and international oil prices have already risen by 14%. At one point, Brent crude oil futures, the international oil price benchmark traded on the London ICE exchange, soared as much as 5.7%, surpassing $81 per barrel, while West Texas Intermediate (WTI) traded on the New York Mercantile Exchange (NYMEX) also jumped by up to 4.6%.

The surge in international oil prices directly increases cost burdens for the domestic food industry, which is highly dependent on raw material imports. There is a growing possibility that the prices of key raw materials such as wheat, sugar, and chocolate will rise, and the increase in logistics and production costs could also intensify pressure to raise prices.

A food industry representative explained, "If negative developments from the Middle East persist, business performance in the second half of the year could be at risk. While the immediate direct impact appears to be limited, we are closely monitoring the situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)