'Traditional and Pure' Boram vs 'Bundled and Convertible' Kyowon

Last Year’s Advance Payment Gap Fell Below 100 Billion KRW

Will the Funeral Service Landscape Shift?... Fair Trade Commission Announcement in Focus

With Woongjin's completion of the acquisition of 'Woongjin Preedlife' on June 16, the company has officially entered the funeral service industry. Now, industry attention is focused on the competition between Boram Sangjo and Kyowon Life for the second-place position. In particular, the industry is closely watching as the Fair Trade Commission is scheduled to release key information at the end of this month that will provide an overview of the entire funeral service sector.

According to the government and industry sources on June 17, the Fair Trade Commission will announce the '2025 Key Information on Prepaid Installment Transaction Companies' on June 30. Since 2023, the Fair Trade Commission has annually disclosed in June the number of prepaid installment transaction companies, the number of subscribers, the scale of advance payments, and other key data as of the end of March of that year. Among these, as of last year, 99% of all advance payments were concentrated in funeral service companies. Advance payments, which represent the cumulative amount of funeral service fees prepaid monthly by subscribers during the contract period, are used as a core indicator not only of the industry's scale but also of each company's competitiveness. In the Fair Trade Commission's announcement in June last year, Preedlife ranked first, followed by Boram Sangjo and Kyowon Life.

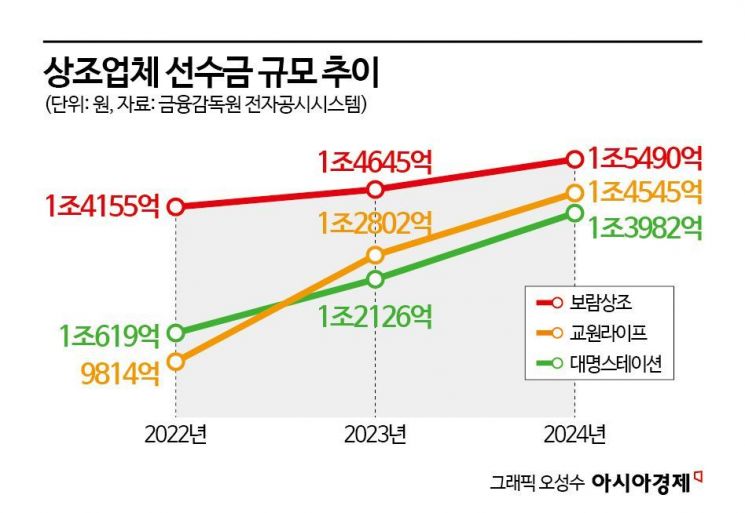

However, the gap in advance payments held by the second- and third-ranked companies is narrowing rapidly. At the time of the Fair Trade Commission's announcement, the gap was about 157 billion KRW, but according to each company's '2024 audit report' released earlier this year, it has shrunk to about 95 billion KRW. This represents a 39% decrease in just nine months.

Kyowon Life has achieved remarkable growth in recent years. In particular, it recorded a 30.5% increase in advance payments in 2023, overtaking Daemyung Station to become the industry's third-largest player. Last year, it continued its double-digit growth with a 13.6% increase. In contrast, Boram Sangjo has maintained relatively moderate growth, recording a 3.5% increase in advance payments in 2023 compared to the previous year, and a 5.8% increase last year. Industry insiders note that if this trend continues in the upcoming Fair Trade Commission announcement, Kyowon Life may surpass Boram Sangjo within this year.

Kyowon Life's upward momentum is also closely linked with the recent 'conversion service' trend gaining attention in the funeral service industry. Unlike its competitors who have focused on funeral services, Kyowon Life has sought differentiation by leveraging group affiliates' services such as rental appliances, education, and travel. By emphasizing a 'conversion structure' that allows customers to switch their funeral service products to other services at any time, Kyowon Life has rapidly attracted new customers. According to Kyowon Life, usage of conversion services increased by 16% in 2022 compared to the previous year, by 122% in 2023, and by more than 80% last year.

Kyowon Life plans to continue expanding exclusive membership benefits for its members. In particular, it is focusing on travel products through collaboration with Kyowon Tour. Currently, the company offers more than 40 exclusive conversion travel products for members, including trips to Europe, Southeast Asia, cruises, and themed travel. This year, it introduced new offerings such as 'Two Weeks Living in Bali' and 'Pilgrimage Package.' A Kyowon representative stated, "We will continue our strong growth by expanding the role of funeral services to all aspects of life."

On the other hand, Boram Sangjo draws a line when it comes to simple numerical comparisons with Kyowon Life. While Kyowon Life's business centers on bundled products with appliances, Boram Sangjo maintains that it has focused on the core funeral service itself. In particular, Boram Sangjo argues that bundled products include various price components, resulting in relatively higher monthly payments, and therefore, the net increase in pure funeral service products should be the standard for comparison.

Boram Sangjo is seeking a turnaround through internal structural improvements and business diversification. Last month, the company reorganized its executive team by recruiting seven external experts in fields such as bio, F&B, construction, and marketing. This move is aimed at advocating for the 'Funeral Service 3.0' era and strengthening its position as a 'total life care specialist,' a key topic in the industry. A Boram Sangjo representative stated, "We are expanding our service scope to provide tangible benefits across all aspects of customers' lives," adding, "We will continue to introduce highly practical life care services going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)