Medicube, Joseon Minyeo, Dalba:

Key Success Factors of Young Male CEOs in Their 30s and 40s

Leading the K-Beauty Wave

In the domestic cosmetics industry, three male CEOs are currently in the spotlight. The leading figures are Byunghoon Kim, CEO of APR APR, Seongyeon Ban, CEO of Dalba Global Dalba Global, and Juhyuk Chun, CEO of Gudai Global, all of whom are driving the recent global "K-beauty" boom. These three, born in the 1980s and belonging to the MZ generation, share the distinction of being men succeeding in an industry traditionally considered the domain of women. Another similarity is that they all entered the startup market early and have achieved success through outstanding product positioning.

According to the cosmetics industry on June 17, APR, led by CEO Byunghoon Kim (age 36), surpassed 700 billion KRW in annual sales last year, overtaking Aekyung Industrial and joining the ranks of the "Big 3" domestic cosmetics companies. The cosmetics brand "Medicube" and the beauty device "Age-R" gained explosive popularity in the global market, resulting in a 38% year-on-year sales growth last year. Kim, born in 1988, founded APR in 2014 and, just over a decade later, took the company public on the KOSPI market in February last year through an initial public offering (IPO).

Seongyeon Ban, CEO of Dalba Global (age 43), who was born in 1981, is another male CEO who has drawn attention for the cosmetics brand Dalba (d'Alba), famous for its "flight attendant mist." Dalba Global launched its mist serum in August 2016, using ingredients sourced from Alba, Italy, renowned for its white truffles. The product quickly gained popularity through word of mouth about its quality, leading to rapid growth, especially in overseas sales. The proportion of overseas sales, which was in the single digits in 2021, surpassed 10% in 2022 and reached 45.6% last year. As a result, Dalba Global's sales grew by 54%, from 69 billion KRW in 2021 to 309.1 billion KRW last year. The company was listed on the KOSPI market on May 22.

Juhyuk Chun, CEO of Gudai Global (age 37, born in 1987), saw the basic cosmetics brand "Joseon Minyeo" become a sell-out sensation on Amazon in the United States during the COVID-19 pandemic. The sales of Joseon Minyeo soared from 100 million KRW in 2020 to 40 billion KRW in 2022, and then to 140 billion KRW last year. As a result, Gudai Global's total sales last year reached 323.7 billion KRW, up 131.9% year-on-year, while operating profit jumped by 104.2% to 140.7 billion KRW.

A Common Thread: Entrepreneurial Experience... Leveraging Know-how for Public Listing

All three of these men are young and share a background in entrepreneurship. Byunghoon Kim, a graduate of Yonsei University's business administration department, nurtured his entrepreneurial ambitions during college and even launched a mobile application service called "Gilhanasai" while studying as an exchange student in the United States. Noticing the growing demand for Korean cosmetics in China while still in school in 2014, he took a leave of absence and founded "Inno Ventures" (now APR) that same year.

Juhyuk Chun of Gudai Global, who graduated from Soongsil University with a degree in Chinese language and literature, also leveraged his fluency in Chinese to introduce Korean cosmetics to China in 2015, when the K-beauty boom was sweeping the country. However, after the Chinese government's Hallyu ban (Hanhanryeong) in 2016, "Joseon Minyeo" became available for acquisition. Chun established Gudai Global in December 2016 and acquired Joseon Minyeo in April 2019.

Recently, Gudai Global has been actively pursuing mergers and acquisitions (M&A) to diversify its portfolio, which has been heavily focused on the US market. The company is targeting acquisitions of highly profitable firms with the goal of becoming a global player in the US, Europe, Japan, and Southeast Asia. Last year, Gudai Global acquired beauty brands such as Tir Tir, Laka, and Craver Corporation (Skin1004), and more recently took over Seorin Company, known for "Dokdo Toner," while also moving to acquire the road shop brand "Skinfood." Gudai Global's growth strategy is described as an "assembly-type multi-brand platform," earning it the nickname "the L'Oreal of Korea."

After graduating from Seoul National University's industrial engineering department, Seongyeon Ban of Dalba Global began his career in the search strategy planning division at NHN (now Naver), then moved on to global strategy consulting firms ADL and AT Kearney, where he provided business strategy consulting for various cosmetics companies. Drawing on this experience, he entered the cosmetics business in 2016 by founding "B Monument" (now Dalba Global).

Low Entry Barriers and High Margins in the Cosmetics Market

The domestic cosmetics market is built on original equipment manufacturers (OEMs) such as Kolmar Korea and Cosmax. As long as the distributor pays the costs, the OEM company handles production, resulting in low entry barriers. Recently, these OEM companies have also begun handling product development, so even those with modest capital can enter the cosmetics market.

Another advantage of cosmetics is their "high profit margin," due to low manufacturing costs. The manufacturing cost of cosmetics is around 10% of the retail price, with the remaining 90% going to distribution, marketing, and sales margins. The average operating margin in the cosmetics industry exceeds 10%, which is higher than the manufacturing industry average of 7%. In fact, APR's operating margin last year was 16.25%, while Dalba Global's was 14.14%.

Their ability to leverage youthful sensibilities in marketing has also been cited as a key factor in their success. While large cosmetics conglomerates have complex decision-making structures that slow down new product launches, emerging beauty brands can make quick decisions and rapidly release products tailored to trends. In addition, as more consumers purchase cosmetics through platforms like TikTok Shop and Instagram Marketplace, MZ generation CEOs who are familiar with these platforms have actively utilized them.

For example, APR's business model is based on social networking services (SNS) and its own online mall, planning marketing concepts and producing products accordingly. This allows the company to quickly identify trends and rapidly manufacture products. Gudai Global's "Joseon Minyeo" brand, under CEO Juhyuk Chun, capitalized on content about sun allergies and skin cancer that surged on TikTok and Instagram in the US during the COVID-19 pandemic, successfully targeting American consumers with its sunscreen products.

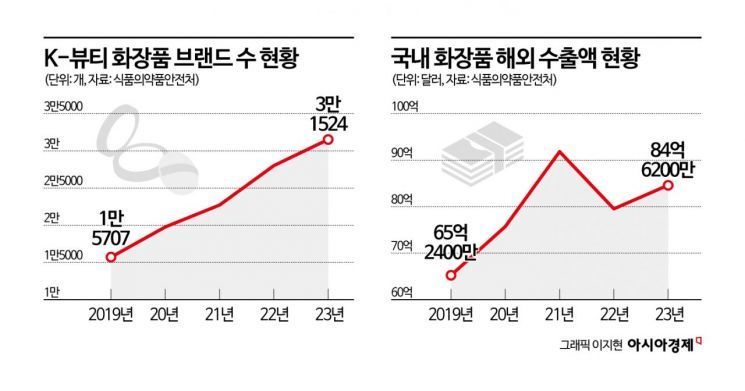

With the continued success of K-beauty, the number of cosmetics brands in Korea has grown exponentially. According to the Ministry of Food and Drug Safety, the number of registered cosmetics distributors increased from 4,853 in 2014 to 31,524 in 2023. Overseas exports of Korean cosmetics also rose from about $6.5 billion in 2019 to approximately $8.5 billion in 2023.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)