Stock Price Up 105% This Month

First-Quarter Operating Profit Up 56% Year-on-Year

Wind Power Growth Expected with Government Support

Shares of Daemyung Energy, a renewable energy company, are rising rapidly. This is the result of both strong first-quarter performance this year and growing expectations for policy support.

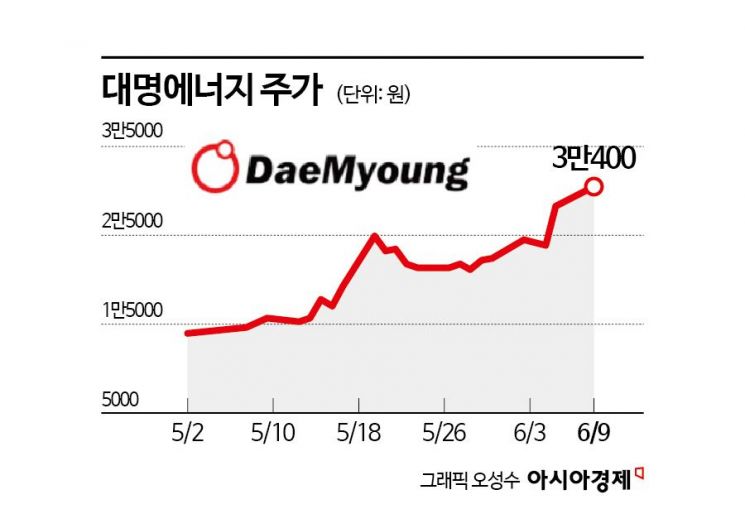

According to the financial investment industry on June 10, Daemyung Energy's stock price has increased by 105.4% compared to the end of April. During the same period, the KOSDAQ index rose by 6.5%, meaning Daemyung Energy's return outperformed the market by 98.9 percentage points (P).

Daemyung Energy directly handles every stage from business development to engineering, procurement, and construction (EPC), as well as operation and management, based on solar and wind power. Since entering the new and renewable energy business, the company has consistently strengthened its capabilities. It has established energy storage system (ESS) construction technology and an energy management system to increase the operating rate and utilization of renewable energy.

In the first quarter of this year, the company recorded sales of KRW 19.6 billion and operating profit of KRW 5.6 billion. These figures represent increases of 29.1% and 55.7%, respectively, compared to the same period last year. Net profit for the period surged by 93.2% year-on-year to KRW 8.4 billion. The company posted an operating margin of 29.7%, demonstrating high profitability. This was the result of stable operation of wind and solar-related projects.

The company’s scale is expanding as it begins to recognize revenue from multiple power generation projects in earnest starting this year. In addition, the stable profit structure of its power plant operation business has contributed to improving overall profitability.

Daemyung Energy’s business structure accumulates operation and maintenance (O&M) revenue from power plant management after EPC construction revenue. The Gimcheon Wind Power project, currently under construction, will begin commercial operation next year. The Gokseong Wind Power project, scheduled to break ground in the second half of this year, will enter commercial operation in 2028.

DS Investment & Securities estimates that Daemyung Energy will achieve sales of KRW 128 billion and operating profit of KRW 23.7 billion this year. These figures represent increases of 88.9% and 144.1%, respectively, compared to last year. Ahn Juwon, a researcher at DS Investment & Securities, stated, “EPC projects such as Gimcheon Wind Power (26MW), Gokseong Wind Power (42MW), and a battery energy storage system (BESS) in Jeju Island will drive performance improvement. We expect EPC revenue from Gokseong Wind Power alone to reach KRW 126 billion, which will impact next year’s results.”

Expectations that the government will introduce renewable energy promotion policies following the inauguration of President Lee Jaemyung are also a positive factor for Daemyung Energy’s performance.

Yoo Jaeseon, a researcher at Hana Securities, commented, “We estimate the total project cost for offshore wind power projects expected to start construction over the next three years at KRW 86 trillion. There are 20 projects, totaling 7.3GW, that have completed environmental impact assessment (EIA) consultations. We believe these will be ready for construction between 2027 and 2028.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)