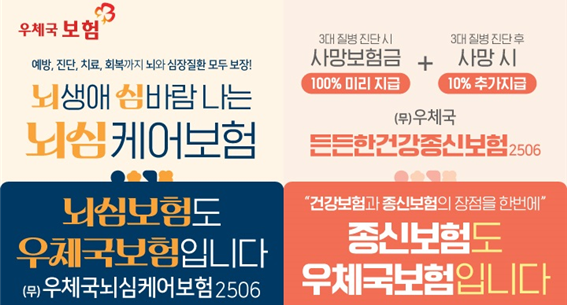

Korea Post Headquarters (hereinafter referred to as Korea Post) announced that it will begin selling two new insurance products starting June 5: the "(Non-Participating) Korea Post Reliable Health Whole Life Insurance," which provides full advance payment of death benefits upon diagnosis of any of the three major critical illnesses, and the "(Non-Participating) Korea Post Brain and Heart Care Insurance," which covers the entire process of treatment for cerebrovascular and cardiovascular diseases.

The Korea Post Reliable Health Whole Life Insurance expands coverage for brain and heart diseases and is designed to pay 100% of the death benefit in advance upon diagnosis of cancer, stroke, or certain ischemic heart diseases.

Policyholders can immediately use the advance payment of the death benefit for critical illness treatment expenses. Even if the insured passes away after receiving the advance payment, a minimum death benefit (10%) will be paid additionally.

By adding the "Special Rider for Coverage of Critical Illness Patients Eligible for Cost Reduction," policyholders can receive reduced health insurance treatment costs upon registration for the special program and use the rider benefit as living expenses during the treatment period. The cost reduction program is a National Health Insurance system that reduces the out-of-pocket rate for patients with high medical expenses due to critical illnesses (cancer, cerebrovascular, or heart diseases) when they receive outpatient or inpatient care.

According to Korea Post, selecting the "50% Surrender Value Payment Type" for the Korea Post Reliable Health Whole Life Insurance allows policyholders to lower their premiums, reducing the financial burden. In addition, depending on the main contract coverage amount, premiums can be discounted by up to 5%, further alleviating the typically high cost of whole life insurance.

For example, by enrolling in the main contract (male, age 40, 30-year payment period, Type 1 50% Surrender Value Payment, coverage amount of KRW 10 million), the cancer diagnosis rider (20-year renewable), and the critical illness (cancer) cost reduction rider (20-year renewable), the monthly premium is KRW 37,180. In the event of a cancer diagnosis, the policyholder can receive up to KRW 30 million (including advance payment).

The Korea Post Reliable Health Whole Life Insurance is available to individuals aged 15 to 70. Policyholders can choose from 19 different riders, select whether each is renewable or non-renewable, and determine the insurance period according to their needs.

The Korea Post Brain and Heart Care Insurance provides comprehensive coverage for the entire process of prevention, diagnosis, treatment, and recovery for cerebrovascular and cardiovascular diseases. Diagnosis benefits can be structured in stages according to the severity of the disease, and for severe brain and heart diseases (cerebral hemorrhage, acute myocardial infarction), coverage is available up to KRW 60 million.

In particular, hospitalization and outpatient benefits are differentiated to provide additional coverage for costs incurred at advanced general hospitals (up to KRW 100,000 per day for hospitalization, with a limit of 120 days; up to KRW 180,000 per outpatient visit, with an annual limit of 10 to 30 visits). Hospitalization is covered from the first day, and surgeries are broadly covered by distinguishing between open and non-open procedures according to difficulty. Policyholders can choose from 11 different riders.

For example, by enrolling in the main contract (male, age 40, maturity at age 90, 30-year payment period, Type 1 Enhanced Coverage, coverage amount of KRW 10 million) and the brain and heart disease treatment rider (20-year renewable), the monthly premium is KRW 18,600. In the event of a diagnosis of cerebral hemorrhage or acute myocardial infarction, the policyholder can receive up to KRW 15 million for each, and up to KRW 100,000 per day for hospitalization (with a limit of 120 days).

Eligibility for enrollment is from ages 15 to 70. Policyholders can choose between the "Enhanced Coverage Type," which provides broad coverage from severe to mild diseases, and the "Basic Coverage Type," which offers core coverage with more affordable premiums. Some riders also allow policyholders to select whether they are renewable or non-renewable and to set the insurance period.

Inquiries and applications for Korea Post insurance products can be made at the nearest post office.

Cho Haekeun, Director General of Korea Post Headquarters, stated, "The Korea Post Reliable Health Whole Life Insurance and Korea Post Brain and Heart Care Insurance are products that expand coverage benefits for the three major critical illnesses and brain and heart diseases. We have maximized coverage to reflect customers' needs, considering that diagnosis, treatment, and recovery from critical illnesses can take a long time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)