In Korea, Competition Among Electricity Sellers Should Widen Rate Gaps

Profit Can Be Expected Only After Investing Billions in ESS

Local governments' energy storage system (ESS) projects are closely linked to the government's policy to expand renewable energy. This is because integrating ESS is essential to supply renewable energy, such as solar and wind power, which fluctuate in output, in line with demand. Without ESS, there are limits to stabilizing the power grid.

LG Energy Solution's ESS battery container product for power grids. Photo unrelated to the article content. Provided by LG Energy Solution.

LG Energy Solution's ESS battery container product for power grids. Photo unrelated to the article content. Provided by LG Energy Solution.

Cho Hongjong, professor of economics at Dankook University, explained, "One of the reasons the Ministry of Trade, Industry and Energy is rushing to expand ESS deployment is that there are many areas where already-installed solar power is overloading the power grid, and ESS is needed to stabilize it." He added, "There is a risk of moving toward a crisis situation that could lead to blackouts, so the rapid deployment of ESS is intended to prevent this."

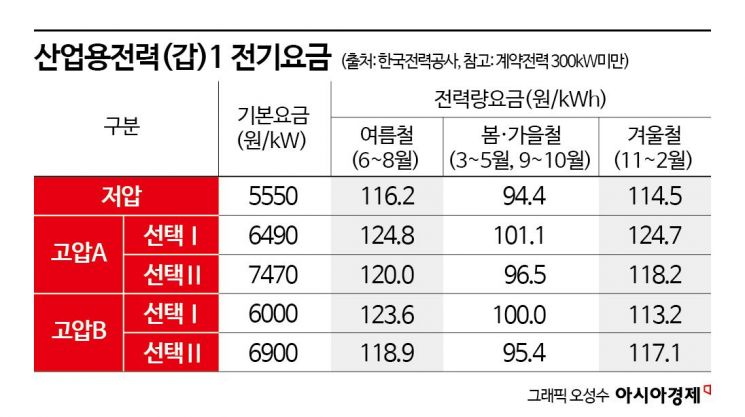

There is criticism that the spread of ESS by local governments is slower than expected because the current electricity rate structure makes it difficult to generate profits. Korea Electric Power Corporation (KEPCO) currently applies different rates for general, industrial, and educational electricity use, depending on contracted power, and varies the rates by season and time of day. For example, for 'Industrial Power Type Gap I Low Voltage' with contracted power below 300kW, the basic rate is 5,550 won. In addition, the usage rate per kWh is 116.2 won in summer, but only 94.4 won in spring and autumn. This system supplies electricity at a lower price during seasons with lower electricity consumption compared to seasons with higher usage. However, experts agree that the difference in the current rate structure is not large enough to recover the hundreds of millions or trillions of won invested in ESS.

Jung Dongwook, professor of energy systems engineering at Chung-Ang University, said, "KEPCO's electricity rate system is complex and varies depending on ESS capacity, so it is impossible to specify exactly how much the price gap needs to widen. However, even for electric vehicle charging, the seasonal and time-based price differences have become so small compared to the past that there is no practical benefit." He continued, "To encourage ESS installations that cost hundreds of millions of won, the price gap needs to be larger than it is now." Son Yanghoon, professor of economics at Incheon National University, also criticized, "KEPCO's current electricity rate system is uniformly set for industrial types Gap and Eul, leaving no room for choice. The current seasonal and time-based price differences are nowhere near sufficient to vitalize the ESS business."

There are also calls for establishing a 'market-based revenue structure' that allows ESS operators to generate profits independently, rather than simply providing subsidies. Professor Son Yanghoon pointed out, "The government or local governments can no longer provide additional subsidies, and KEPCO cannot afford further investment due to debts exceeding 200 trillion won." Professor Cho Hongjong also emphasized, "Ultimately, government subsidies, which are taxpayer money, are not a solution. The electricity pricing system should be shifted to a market-based structure that reflects supply and demand, and virtual power plant (VPP) operators that connect renewable energy and ESS businesses should emerge to establish the market and deliver benefits to consumers."

However, there are concerns that if such a system is introduced, some of the burden may be reflected in consumer electricity bills. At the same time, consumers would also gain the option to reduce their electricity costs by adjusting the time and manner in which they use electricity. The greater the price differential, the stronger the incentive to install ESS, and consumers can also enjoy real benefits by adjusting their electricity usage patterns. Professor Son Yanghoon said, "In Texas, USA, the electricity market is so active that when there is a shortage, rates can rise dozens of times. In this way, even if ESS operators earn less under normal circumstances, they should be allowed to profit during occasional price spikes. However, our government is hoping for new solutions like renewable energy or ESS without reforming the electricity market itself."

Professor Son also emphasized, "Currently, Korea has a structure where KEPCO supplies electricity exclusively, so there can be no competitors in electricity sales. For the ESS market to become active, various sellers must compete in the market, allowing electricity rates to move flexibly in real time. This would open up options for electricity consumers to choose their rates based on their consumption patterns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)