Bank of Korea, "May 2025 Consumer Survey Results"

May Consumer Sentiment Index at 101.8, Above Baseline

Expectations for Reduced Political Uncertainty and Eased Tariff Shocks

This month, the Consumer Sentiment Index (CSI) rebounded significantly, surpassing the baseline of 100 for the first time in six months. This was driven by expectations that economic policies to stimulate the economy would gain momentum with the launch of the new government. Analysts also attribute this to a base effect, as consumer sentiment had dropped well below the baseline last December due to the 12·3 Martial Law incident, causing a freeze in consumer confidence.

May Consumer Sentiment Index at 101.8, 'Above Baseline'... Expectations for Reduced Political Uncertainty and Eased Tariff Shocks

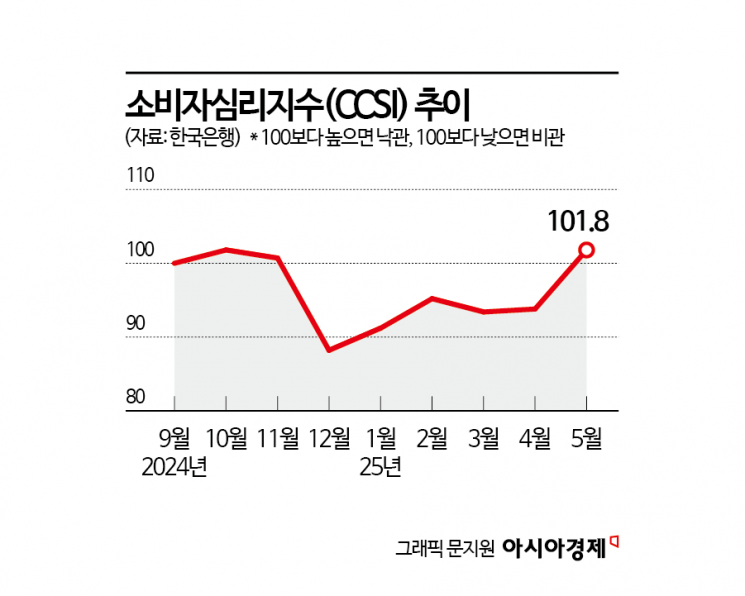

According to the "May 2025 Consumer Survey Results" released by the Bank of Korea on the 27th, this month's Composite Consumer Sentiment Index (CCSI) was 101.8, up 8.0 points from the previous month. This is the largest monthly increase since October 2020, when the index jumped 12.3 points in a single month. The CCSI surged mainly due to the passage of the supplementary budget bill in the National Assembly, the easing of trade risks such as the United States' reciprocal tariff suspension, and expectations for the new government's launch and economic policies.

The CCSI is a sentiment indicator calculated using six major indices that make up the Consumer Survey Index (CSI). The long-term average is set at 100; a reading above 100 indicates optimism compared to the long-term average, while a reading below 100 indicates pessimism.

Until November last year, the CCSI consistently stayed above 100. However, following the 12·3 Martial Law incident in December last year, consumer sentiment cooled rapidly, and the index plummeted to 88.2. Over the following five months, it fluctuated slightly but remained below the baseline until this month's sharp rebound. Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Economic Statistics Department 1, said, "The recent easing of political uncertainty and tariff factors, which had previously constrained sentiment recovery, resulted in a base effect," adding, "Since this reflects expectations for future economic conditions, we need to watch whether it will actually lead to a full-fledged recovery in consumption."

Ahead of Chuseok, food prices have reached an emergency level. According to the Statistics Korea National Statistical Portal (KOSIS), the food and non-alcoholic beverage price index in July was 113.12 (2020=100), rising 8.0% compared to a year ago. Food prices saw the largest increase in one year and five months since February last year. In particular, prices of processed foods such as edible oils (34.7%) and fresh foods such as vegetables and seaweed (24.4%) rose significantly. Citizens are shopping at a large supermarket in downtown Seoul on the 7th. Photo by Moon Honam munonam@

Ahead of Chuseok, food prices have reached an emergency level. According to the Statistics Korea National Statistical Portal (KOSIS), the food and non-alcoholic beverage price index in July was 113.12 (2020=100), rising 8.0% compared to a year ago. Food prices saw the largest increase in one year and five months since February last year. In particular, prices of processed foods such as edible oils (34.7%) and fresh foods such as vegetables and seaweed (24.4%) rose significantly. Citizens are shopping at a large supermarket in downtown Seoul on the 7th. Photo by Moon Honam munonam@

"Expectations for New Government Economic Policies" Future Economic Outlook CSI Up 18 Points... Largest Increase Since May 2017

By category, outlook-related indices such as living conditions and future economic prospects showed marked improvement. The Future Economic Outlook CSI (91), which reflects the six-month-ahead economic outlook compared to the present, jumped 18 points due to expectations for the new government's launch and economic policies, as well as progress in Korea-U.S. reciprocal tariff negotiations. This is the largest increase since the 22-point rise in May 2017, bringing the index above the long-term average at once. The Living Conditions Outlook (97) also rose by 5 points, surpassing the long-term average.

In addition, the Current Economic Assessment CSI (63), which compares the present to six months ago, also rose by 11 points to recover to the 60 level, thanks to the passage of the 2025 supplementary budget bill in the National Assembly, the U.S. reciprocal tariff suspension, and progress in U.S.-China trade negotiations. The Current Economic Assessment CSI, which started at 69 early last year and remained in the low 70s, had not exceeded the mid-50s since December last year. The Housing Price Outlook CSI (111) rose by 3 points as apartment prices in the Seoul metropolitan area continued to climb, despite the re-designation and expansion of Seoul's Land Transaction Permission Zones.

The expected inflation rate for the next year was 2.6%. Although the consumer price inflation rate remained at the previous month's level, falling prices of petroleum products and agricultural goods brought the figure down by 0.2 percentage points compared to the previous month. The expected inflation rates for three years and five years ahead were both 2.5%, each down 0.1 percentage points from the previous month. The proportion of responses identifying key items expected to influence consumer prices over the next year was 51.3% for agricultural, livestock, and fisheries products; 47.0% for public utility charges; and 33.4% for industrial goods. Compared to the previous month, the response rate for public utility charges increased by 2.6 percentage points, and for personal services by 2.3 percentage points, while the rate for industrial goods decreased by 4.9 percentage points.

This survey was conducted from the 13th to the 20th, targeting 2,500 households in cities nationwide, with 2,282 households responding.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)