After the Introduction of the "Daily Balance Report" in September Last Year, Card Loan Balances Have Increased

Major Companies Like Shinhan, Hyundai, and Samsung Continue Card Loan Operations

A Series of "Events" Including a Meeting with Woori and Lotte on the 27th

It has been eight months since the Financial Supervisory Service (FSS) instructed credit card companies to report their card loan balances daily starting in September last year, but the actual card loan balances have instead increased. This is because major card companies such as Shinhan, Hyundai, and Samsung have not reduced their card loan operations, citing the need to maintain profitability. While the supervisory authorities have issued strong warnings, emphasizing that "soundness is the top priority," the industry is struggling, saying that reducing card loan balances is not an easy task.

According to the financial industry on the 27th, since the end of September last year, the FSS has been receiving daily loan management plans from eight dedicated credit card companies (Lotte, BC, Samsung, Shinhan, Woori, Hana, Hyundai, and KB Kookmin Card) as well as NH Nonghyup Card for eight months. For eight consecutive months, the card companies have been submitting daily reports to the FSS on card loans (card loans, cash advances, revolving credit) and household loans (mortgage loans, auto loans, unsecured loans, others). The so-called "daily balance report" was intended to reduce card loan balances, but eight months after its implementation, the balances have actually increased.

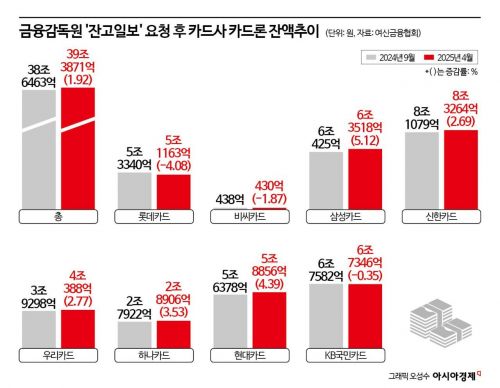

According to the Credit Finance Association, the card loan balance of the eight dedicated card companies increased by 1.92%, from 38.6463 trillion won at the end of September last year, right after the daily balance reporting system was introduced, to 39.3871 trillion won at the end of last month. During this period, the card loan balances of Samsung Card (5.12%), Hyundai Card (4.39%), Hana Card (3.53%), Woori Card (2.77%), and Shinhan Card (2.69%) increased by 2-5%. In contrast, BC Card (-4.08%), Lotte Card (-1.87%), and KB Kookmin Card (-0.35%) saw slight decreases.

The increase in card loan balances at major companies such as Shinhan Card (8.3264 trillion won as of the end of last month), Samsung Card (6.3518 trillion won), and Hyundai Card (5.8856 trillion won) drove up the total card loan balance across the industry. In particular, Samsung Card and Shinhan Card have been competing for the top spot in net profit, making it difficult for them to abruptly reduce card loan operations as requested by the supervisory authorities.

As a result, card companies are paying close attention to the FSS’s "events," which are not directly related to the daily balance reports. On the afternoon of the same day, the FSS plans to hold a meeting at its Yeouido headquarters in Seoul with the CEOs of two card companies?Jo Jwajin of Lotte Card and Jin Sungwon of Woori Card?as well as Kidongho, CEO of Woori Financial Capital, and representatives from four capital companies, to discuss internal control issues such as misuse of customer information and loan delinquencies. This is a "relay meeting" following the soundness enhancement workshop held for CEOs of 79 savings banks at the Yeouido headquarters on the 19th.

Card companies see such meetings as additional warning measures, separate from the daily balance reports, and are feeling tense. In particular, the FSS’s recent action on the 25th, when it issued a management improvement demand to Hyundai Card for "insufficient soundness management," came as a considerable shock to the industry. Despite Hyundai Card’s card loan balance being in the 5 trillion won range?lower than Shinhan, Samsung, and KB Kookmin Card (6.7346 trillion won)?and its delinquency rate being low, it was still sanctioned, which is seen as evidence that the supervisory authorities’ standards have become stricter than before.

The problem is that while the supervisory authorities are increasing pressure on not only card companies but also the entire secondary financial sector to manage soundness, there are no effective ways to reduce card loan balances. The instruction to submit daily balance reports is already a strong measure that affects the autonomous management of card companies to some extent, and it is difficult to impose even stricter regulatory measures than this.

An industry official said, "Card loans are a business for ordinary citizens who are pushed into the secondary financial sector because they cannot get loans from primary financial institutions due to their credit ratings, so it is a very sensitive and burdensome issue for the supervisory authorities to regulate openly. For the time being, the supervisory authorities will likely have no choice but to continue collecting daily balance reports and occasionally issue verbal warnings or requests for soundness management through industry meetings. Similarly, it will not be easy for major card companies to reduce their card loan operations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)