Domestic Parts Suppliers’ Operating Margins in the 3% Range, Half the Global Level

Causes of Low Profitability: High Dependence on Certain Automakers and Lack of R&D Capabilities

Tier-2 and Tier-3 Suppliers Have Not Even Begun the Transition to Future Mobility

R&D Leadership Must Shift from Automakers to Suppliers

Restructuring of the Parts Industry Is Unavoidable... Selective Government Support Needed

Rihan, a tier-1 supplier for Hyundai Motor, filed for a workout (corporate restructuring) in 2018. News that a tier-1 parts supplier with annual sales exceeding 200 billion KRW had filed for a workout due to a liquidity crisis sent shockwaves through the domestic auto industry. Although Rihan has been making continuous efforts to improve its fundamentals, its situation remains difficult. Up until 2023, the company could not even cover its interest payments with its operating profit. Last year, as it restructured its business to focus on its main product (air filters), its operating profit rose to around 5 billion KRW, but its liabilities still exceeded its assets. This means that without external financing, the company lacks the ability to repay its debts in the short term (within one year, based on current assets and liabilities). The accounting firm that audited the company’s finances assessed, “There is significant uncertainty that casts substantial doubt on the company’s ability to continue as a going concern.”

Rihan was once a solid company with sales reaching 200 billion KRW. However, after deciding to recall some products exported to the United States and experiencing poor performance in its joint venture in China with Hyundai Motor, it fell into financial trouble. The industry is gripped by fear, recognizing that even mid-sized companies can be eliminated from the market by a single business failure or misstep. A parts industry insider commented, “Even tier-1 suppliers can tumble into ruin with a single mistake?imagine the situation for tier-2 and tier-3 suppliers. Aggressive R&D investment or business diversification is out of the question.”

While the global auto industry is pushing for a transition to electric vehicles and software-defined vehicles (SDVs), most tier-2 and tier-3 suppliers in Korea have not even begun to prepare for the future. If the domestic parts ecosystem collapses, it could immediately become a supply chain risk for automakers. Recently, strikes by suppliers over profit-sharing have emerged as another production risk for Hyundai Motor and Kia. If a supplier producing key components goes on strike for an extended period, it can disrupt finished vehicle production. In 2024, a prolonged strike at Hyundai Transys resulted in production losses of up to 1 trillion KRW for Hyundai Motor and Kia. This is why there are renewed calls to re-examine the structure of Korea’s automotive parts ecosystem.

Domestic Parts Suppliers’ Operating Margins in the 3% Range, Half the Global Level

According to analysis by the Korea Automotive Technology Institute on May 27, the average operating margin of domestic small and medium-sized parts companies (with sales less than 180 billion KRW) listed on the electronic disclosure system is 2.22%. This figure is less than half the average loan interest rate for small and medium-sized enterprises (4.8%) as compiled by the Bank of Korea. These small and medium-sized parts companies are unable to pay even their loan interest with profits from their business operations. As a result, they are forced to survive as “zombie companies,” relying on government support and automakers.

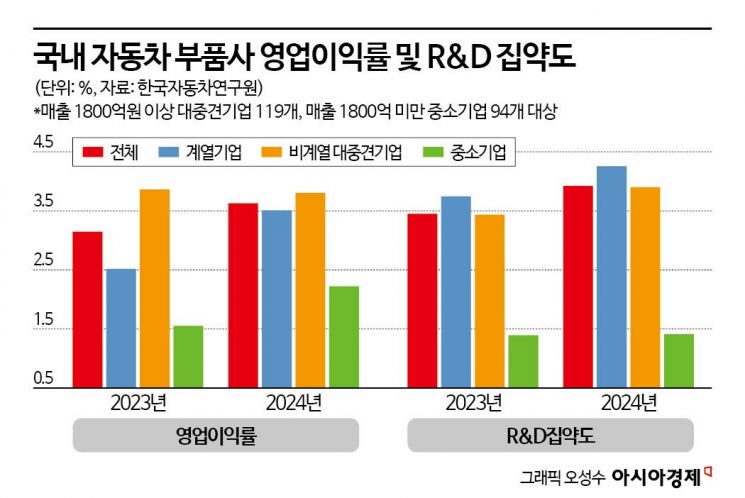

Compared to global peers, the profit margins of domestic parts suppliers are only about half as high. The average operating margin of domestic parts suppliers is estimated to be around 3%. According to a Korea Automotive Technology Institute survey of 213 large and small domestic parts companies, the average operating margin was 3.62% in 2024 and 3.13% in 2023. In contrast, the European Commission’s “Industry R&D Scoreboard” reported that the average operating margin of major global parts suppliers in 2023 was 6.02%.

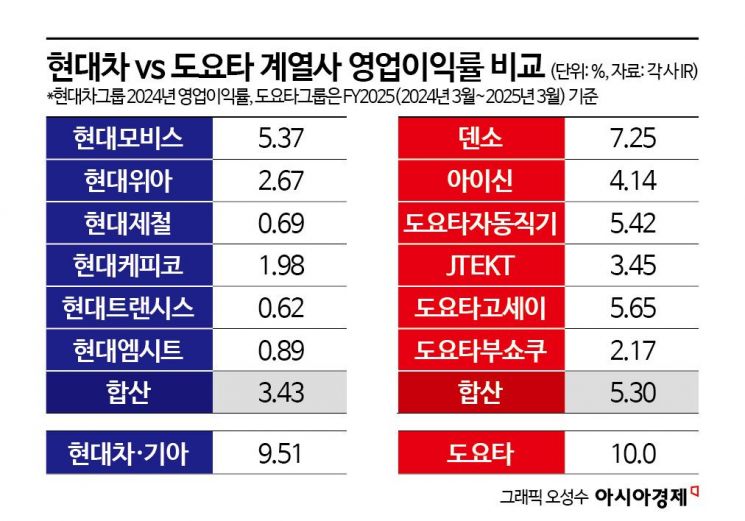

The widening gap in profitability between automakers and major parts suppliers is also a concern. Let’s compare the combined operating margins of the top six parts suppliers for Hyundai Motor Group and Toyota Group in 2024 (see table). The automakers’ operating margins were similar at around 10%: Hyundai Motor and Kia combined at 9.5%, and Toyota at 10%. In contrast, the operating margin for Toyota’s six core parts suppliers was about half that of the automaker (5.3%), while Hyundai Motor Group’s parts subsidiaries were only one-third as high (3.43%).

Calculating the combined operating margin of Hyundai Motor Group’s six major parts subsidiaries (Hyundai Mobis, Hyundai Wia, Hyundai Steel, Hyundai Kefico, Hyundai Transys, Hyundai MC) yields 3.43%. This figure was boosted by improved performance at Hyundai Mobis, the leading parts subsidiary, which posted an operating margin of 5.37%. However, even this was largely due to profits from Mobis’s after-sales (AS) business, and the operating margin of its core modules and parts division was actually negative (-0.1%). Excluding the sales and profits of Mobis’s AS business, the combined operating margin of Hyundai Motor Group’s six core parts subsidiaries falls to just 0.51%.

Why Domestic Parts Suppliers Have Low Profitability

We held in-depth discussions with representatives from automakers, parts suppliers, research institutes, and labor organizations to examine the reasons behind the low profitability of domestic parts suppliers. One point of consensus among experts was the excessive dependence of domestic parts suppliers on Hyundai Motor and Kia for both sales and R&D. Many experts agreed without exception that the current structure is not promising for the parts industry as it prepares for the era of future mobility, nor is it hopeful for automakers like Hyundai Motor and Kia.

From the perspective of the parts industry, low profit margins inevitably lead to insufficient R&D investment. Without in-house technology development capabilities, it is virtually impossible for suppliers to secure profits through price negotiations with automakers. This results in a vicious cycle that repeats itself. The dilemma of whether to prioritize profits or technology investment is akin to the “chicken or the egg” question.

This structure stems from Hyundai Motor Group’s vertically integrated production system, which has continued from the past. When the automaker invests heavily in R&D to develop new products, suppliers simply receive the automaker’s “recipe” (blueprints) and focus solely on meeting production deadlines and yield rates. Parts suppliers become dependent on automakers not only for technology development, but also for information gathering and securing stable customers. However, since technological leadership remains with the automaker, it is the automaker that determines profit margins (supply prices). A labor representative pointed out, “Under the current structure, parts suppliers must run their entire business according to the operating margin set by the automaker, so they inevitably neglect their own R&D or competitiveness. Maintaining the business relationship with the automaker becomes the top priority for suppliers.”

This concentration of R&D in automakers is a burden for both automakers and parts suppliers as they prepare for the era of future mobility. The Korea Automotive Technology Institute estimates that R&D investment in Korea’s automotive industry will reach at least 14 trillion KRW in 2024. Of this, more than 70% is believed to be invested by Hyundai Motor Group. Looking at R&D intensity (R&D investment as a percentage of sales), Hyundai Motor Group’s subsidiaries have an intensity of 4.26%, three times higher than that of small and medium-sized parts suppliers (1.41%).

In particular, large tier-1 suppliers suffer a double burden, as they must both accept the automaker’s control over profit margins and share the burden of R&D investment. In 2024, the operating margin of Hyundai Motor Group’s parts subsidiaries was 3.49%, even lower than that of non-affiliated large and mid-sized parts suppliers (3.81%). In 2023, the gap was even wider: 2.52% for affiliated suppliers versus 3.86% for non-affiliated suppliers.

In the Era of Future Mobility, the Role of Parts Suppliers Will Change

In the era of internal combustion engines, the vertically integrated production system overwhelmingly favored automakers. Hyundai Motor and Kia maintained technological leadership and reduced the risk of technology leaks by internalizing parts technologies. At the same time, they secured control over suppliers and maximized production efficiency and cost savings.

From the perspective of the parts industry, the situation was not entirely negative. They secured stable customers and steady profits. Once the automaker’s annual production plan was announced, parts suppliers could make large-scale business plans. They also received ongoing advice and support for production technologies such as automation and smart factories. Of course, these positive evaluations set aside the issue of labor-management conflicts that often arise in vertical integration structures.

However, in the era of future mobility, the relationship between automakers and parts suppliers will shift completely from a vertical to a horizontal structure. In the past, technology development was the responsibility of automakers, and parts suppliers focused on improving production efficiency. Now, collaborative partners are needed to share tasks and participate in joint development from the early stages of technology development.

In the era of internal combustion engines, R&D was focused on mechanical engineering and automakers held the initiative. In the era of electric vehicles and SDVs, only parts suppliers with competitive technologies in batteries, electrical/electronic systems, and software?areas beyond the reach of automakers?will survive. Furthermore, the number of required parts for electric vehicles is about two-thirds (around 20,000) compared to internal combustion engine vehicles. Recently, as protectionist trade policies have strengthened, there is a growing demand to restructure supply chains around local suppliers. In particular, the United States, which accounts for more than one-third of Hyundai Motor and Kia’s sales, is demanding a supply chain centered on domestic suppliers, further complicating matters for automakers. These changes are spreading the perception that restructuring across the entire parts industry, both domestically and internationally, is inevitable.

Many domestic tier-2 and tier-3 suppliers still rely heavily on producing internal combustion engine parts using machine tools. Moreover, of the approximately 20,000 domestic parts suppliers, 68% are small businesses with fewer than 10 employees. For these companies, rapidly acquiring software capabilities and transforming their business models is virtually impossible. According to the Korea Automotive Technology Institute’s “2024 Automotive Parts Industry Status Report,” 97.9% of 20,992 domestic automotive parts suppliers responded that they have no plans or preparations for business transformation. The most common reason cited for not having such plans was “difficulty securing new customers and sales channels” (58%).

Experts unanimously agree that restructuring of domestic parts suppliers focused on internal combustion engines and hardware is unavoidable. Instead, they argue for selectively supporting key companies to enhance the health of the ecosystem. To compete with Chinese parts suppliers on price, it is essential to secure parts technologies that are vastly superior. Hangoo Lee, a research fellow at the Korea Automotive Technology Institute, emphasized, “Of the more than 15,000 domestic parts suppliers, about 30% are estimated to be so-called ‘zombie companies.’ We need to intensively nurture 300 companies with core competencies and pursue restructuring and upgrading simultaneously.”

Expanding government support for non-affiliated tier-1 parts suppliers could also be an option. In particular, there are calls to increase support for non-affiliated suppliers that possess original technologies and can aggressively win contracts from overseas automakers. The reasoning is that reducing Hyundai Motor and Kia’s dominance in R&D investment and fostering the growth of non-affiliated large parts suppliers will create a much healthier structure, allowing the benefits to trickle down to tier-2 and tier-3 suppliers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)