Net Profit of Domestic Banks in Q1 Reaches 6.9 Trillion Won

Up 28.7% Year-on-Year

Base Effect from Last Year's ELS Compensation Payments in Q1

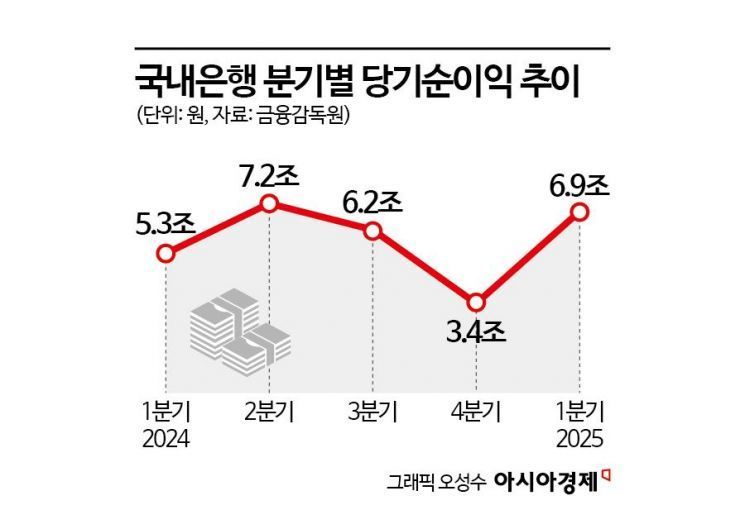

In the first quarter of this year, domestic banks in South Korea recorded net profits approaching 7 trillion won, an increase of approximately 29% compared to the previous year. Although interest income declined, the base effect was evident as there were no compensation payments related to Hong Kong equity-linked securities (ELS) in the first quarter of this year, which had negatively impacted results in the first quarter of last year.

According to the "Preliminary Business Performance of Domestic Banks" released by the Financial Supervisory Service on May 23, net profit for domestic banks in the first quarter reached 6.9 trillion won, up about 1.5 trillion won (28.7%) from the same period last year.

Breaking down the profits into interest income and non-interest income, interest income for the first quarter was 14.8 trillion won, a decrease of 1 trillion won compared to the same period last year. Although interest-earning assets in the first quarter increased by 5.3% year-on-year to 1,717 trillion won, the net interest margin (NIM) contracted by 0.1 percentage points due to factors such as a decline in market interest rates.

Non-interest income was 2 trillion won, an increase of 1 trillion won compared to the same period last year. This was mainly driven by a 1.5 trillion won increase in securities-related profits, such as gains on valuation of securities, which totaled 2.4 trillion won, following the decline in market interest rates.

Total profit, which combines interest income and non-interest income, stood at 16.8 trillion won, showing little change from the first quarter of last year. However, in the first quarter of last year, net profit fell sharply due to 1.8 trillion won in compensation payments for Hong Kong ELS, which was recorded as non-operating loss. With the end of these compensation payments, net profit for the first quarter of this year improved significantly.

By type of bank, net profit for commercial banks in the first quarter was 3.8 trillion won, up 30.3% year-on-year. Specialized banks recorded 2.7 trillion won, an increase of 39.7%. Regional banks posted net profit of 300 billion won, and internet banks 200 billion won, representing decreases of 27.7% and 2.6% year-on-year, respectively.

As net profit increased, overall financial soundness also improved. The return on assets (ROA) for domestic banks in the first quarter was 0.71%, up 0.13 percentage points from 0.57% in the same period last year. The return on equity (ROE) also improved by 1.75 percentage points to 9.55%, compared to 7.80% a year earlier.

Selling and administrative expenses for domestic banks in the first quarter amounted to 6.8 trillion won, up 400 billion won year-on-year. Personnel expenses rose by 300 billion won to 4.2 trillion won, while material expenses increased by 100 billion won to 2.6 trillion won, compared to the same period last year.

A Financial Supervisory Service official stated, "Despite a decrease in interest income and an increase in credit loss expenses in the first quarter of this year, net profit increased due to the base effect of the one-off ELS compensation payments in the first quarter of last year." The official added, "We plan to continue encouraging banks to strengthen their loss-absorbing capacity so that they can faithfully perform their core financial intermediation function even amid ongoing domestic and external uncertainties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)