Headquarters Post Operating Margins of 20-40%

Store Sales and Employee Wages Remain Stagnant

As of this month, the total number of stores operated nationwide by the eight major brands, including MegaMGC Coffee, Compose Coffee, and Paikdabang, has surpassed 13,000. This is the result of consumers shifting their coffee selection criteria from "premium" to "value for money" amid prolonged high inflation. However, unlike the rapid expansion in the number of outlets, store-level profitability and employment stability are declining.

According to the food service industry on May 23, MegaMGC Coffee was operating 3,670 stores as of the previous day. This represents an increase of more than 1,500 stores in three years, up from 2,173 in 2022. Compose Coffee has also added hundreds of stores each year, now operating 2,893 locations, surpassing Ediya Coffee (2,821 stores). Paikdabang (1,839 stores), The Venti (1,264 stores), Coffee Evanhada (413 stores), Mammoth Coffee (385 stores), and Coffee Bay (284 stores) are also actively competing to expand their store networks. The price of an Americano at these brands is generally between 1,700 and 1,800 won, which is more than half the price of traditional franchise brands.

The steady increase in franchise stores is underpinned by robust coffee demand. According to the Ministry of Food and Drug Safety, the domestic production value of coffee products in 2023 reached 2.7 trillion won, up 5.1% from the previous year. Global market research firm Euromonitor reported that the annual per capita coffee consumption in Korea is 405 cups, about 2.7 times the global average of 152 cups. As of the same year, there were 106,452 coffee shops in Korea, employing 289,400 people. Of these, franchise coffee and other non-alcoholic beverage shops accounted for 32,241 stores and 128,895 employees, making up about 30% of the total in each category.

Headquarters See High Profits... Store-Level Growth Stagnant

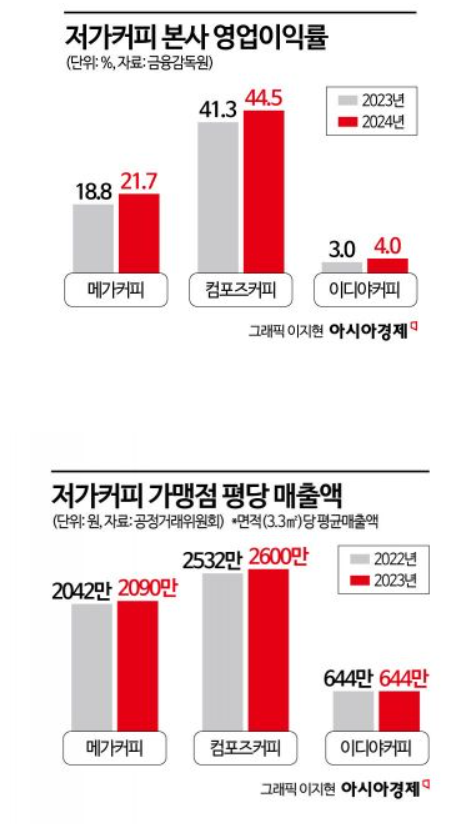

While franchise headquarters are experiencing rapid growth, it is widely acknowledged that individual store profitability has in fact declined. MegaMGC Coffee's operating profit increased by 55% from 69.3 billion won in 2023 to 107.6 billion won last year, with an operating margin of 21.7%. Compose Coffee recorded an operating margin of 41.2% during the same period. In contrast, Ediya Coffee's operating margin was relatively low at 4.0%.

However, the growth in sales per store has been limited. MegaMGC Coffee's average sales per 3.3 square meters rose only slightly from 20.25 million won in 2021 to 20.9 million won in 2023, and Ediya Coffee saw little change, from 6.26 million won to 6.44 million won over the same period. An industry insider pointed out, "Although the headquarters have grown in scale, sales at individual stores have stagnated, so the profits felt by store owners are actually decreasing."

Even With 12-Hour Workdays, Wages Remain the Lowest

Behind the low-priced coffee market lies unstable employment. According to the "2024 Food Service Industry Trend Report" by the Korea Rural Economic Institute, the proportion of regular employees in the food service industry remained at 19% in 2022, unchanged from the previous year, while the share of temporary and daily workers increased from 21% to 23%. This trend is attributed to reduced hiring of full-time employees as fixed cost reduction and demand for flexible employment have increased since the COVID-19 pandemic.

In particular, working conditions for employees at coffee shops are among the lowest in the food service industry. The average annual salary for regular employees at coffee shops is 16.94 million won, and for temporary and daily workers it is 6.12 million won, both falling short of the overall food service industry averages (23.56 million won for regular employees and 10.68 million won for temporary and daily workers).

Working conditions are also poor. The daily average operating hours for coffee shops, including non-alcoholic beverage stores, are between 10 and 12 hours, with most operating in two shifts. A franchise industry official commented, "Although the entry barrier is low, many store owners do not even make a net monthly profit of 2 million won," adding, "Now, business area and operational strategy are more important for survival than brand recognition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)