Announcement of Spin-off on the 22nd

Samsung Biologics and Samsung Epis Holdings to Adopt Horizontal Structure

Strengthening New Drug Development and Bio Investment Expected

The Samsung Group is undertaking a comprehensive overhaul of its bio business governance structure. The company plans to separate its new drug and biosimilar (biopharmaceutical generic) research and development (R&D) business, which has so far been subordinate to its contract development and manufacturing organization (CDMO) business, and establish a new, horizontally structured entity. This move aims to further strengthen the new drug development division. The decision reflects Samsung Group's determination to rapidly enhance the competitiveness of its bio sector, which it views as a future growth engine to follow semiconductors.

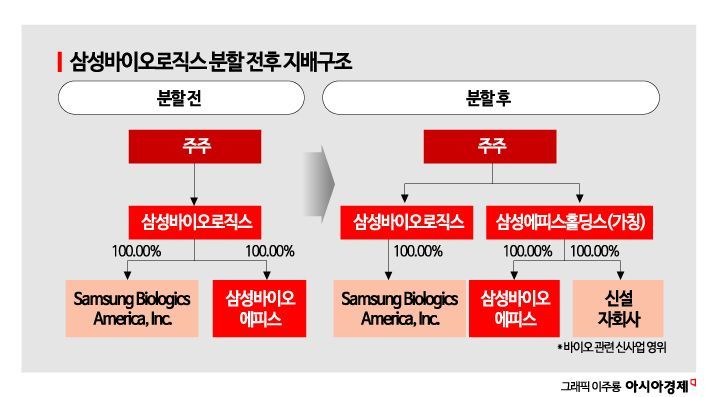

On May 22, Samsung Biologics announced that it will establish 'Samsung Epis Holdings' through a simple physical division, thereby completely separating its CDMO business from its biosimilar business.

Separation of CDMO and New Drug Businesses: Samsung Bio Adds a Second Growth Engine

Samsung Epis Holdings will be established by splitting off the division within Samsung Biologics that has been responsible for managing subsidiaries and making new investments. As a pure holding company, the newly created Samsung Epis Holdings will make Samsung Bioepis, a biosimilar company, its wholly owned subsidiary. In addition, a new subsidiary dedicated to pursuing new bio-related businesses will also be established and wholly owned by Samsung Epis Holdings. The inaugural CEO of Samsung Epis Holdings will be Kim Kyungah, who will concurrently serve as CEO of Samsung Bioepis. Samsung Biologics will become a pure CDMO company.

The restructuring of Samsung Bio's governance is intended to strengthen business specialization. The CDMO business acts as a partner that assists client companies in manufacturing and developing their pharmaceuticals under contract. From the perspective of clients outsourcing production, there have been concerns that development information could be leaked to the R&D subsidiary. Such concerns about technology leakage have made it difficult for the CDMO business to secure contracts, and have also hindered meaningful growth for the new drug development subsidiary. For this reason, among major global CDMO companies, only WuXi Biologics in China has a structure where a new drug development company is a subsidiary. In the industry, the principle that "CDMO companies do not compete with their clients" has been regarded as an unwritten rule. Samsung Biologics' physical division is seen as an extension of this industry trend.

The division will be finalized after a series of procedures, including the submission of a securities report on July 29 and a shareholders' meeting for approval of the division on September 16. Samsung Epis Holdings is scheduled to be established on October 1, at which point Samsung Bioepis will become its wholly owned subsidiary, completing the split. Subsequently, on October 29, the surviving company, Samsung Biologics, will undergo a change in listing, and the newly established Samsung Epis Holdings will be relisted.

This corporate split will proceed as a physical division, in which shareholders will receive shares in both the existing and newly established companies in proportion to their current holdings. Existing shareholders of Samsung Biologics will receive shares in Samsung Biologics and Samsung Epis Holdings in a ratio of 0.6503913 to 0.3496087. The split ratio was determined based on the current book value of net assets.

Samsung Bio's Growing Presence Within the Group: Faster, More Specialized Decision-Making Expected

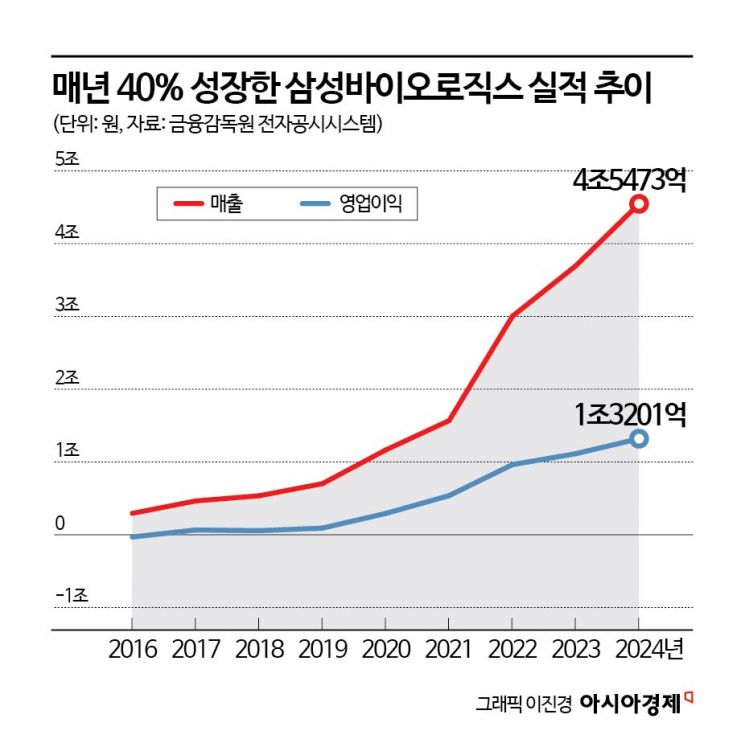

This governance restructuring is expected to further solidify the presence of the bio sector as a future growth engine at the group level. Since 2016, Samsung Biologics has recorded an unrivaled growth rate within the group. An analysis of the performance of 11 major non-financial affiliates of Samsung Group from 2016 through last year shows that Samsung Biologics achieved a compound annual growth rate (CAGR) of 40.79% in sales over the past eight years, the highest growth rate within the group.

This far outpaces Samsung SDI (23.44%) in second place, Samsung SDS (16.11%) in third, and even the group's core company, Samsung Electronics (5.24%). The organizational restructuring of the bio division is particularly significant given the recent stagnation in the semiconductor business, which has traditionally been the group's backbone.

This move is also closely linked to the strengthening of Jay Y. Lee's control over the bio sector. Jay Y. Lee holds approximately 18.9% of Samsung C&T, which in turn is the largest shareholder of Samsung Biologics with about 43.06% ownership. If Samsung Epis Holdings is relisted and Samsung C&T acquires additional shares, Jay Y. Lee's control over the bio business could be further strengthened. The relisting also raises the likelihood that the market value of Samsung Bioepis will be reassessed. In this process, the increase in the corporate value of Samsung Epis Holdings and the asset value of Samsung C&T could both contribute positively to strengthening Jay Y. Lee's control.

Through this split, Samsung Biologics and Samsung Epis Holdings are now able to make faster and more specialized decisions tailored to the characteristics and strategies of each business segment. This will enable them to pursue business operations more quickly and flexibly. Samsung Biologics, now a pure-play CDMO company, plans to continue its growth strategy with the goal of becoming a "global top-tier CDMO." Based on its "three-pillar growth strategy"?expanding production capacity, diversifying its portfolio, and increasing its global presence?the company will not only strengthen its CDMO capabilities, but also expand investments in new business areas such as antibody-drug conjugates (ADC), adeno-associated virus (AAV), and pre-filled syringes (PFS).

Samsung Epis Holdings has presented a growth strategy to secure more than 20 biosimilar product lines in order to develop Samsung Bioepis into the "world's number one biosimilar company." The company also plans to continue exploring next-generation technology areas for future growth, such as establishing new modality development platforms. Upon listing, the company will also be able to actively expand its business through venture investment and M&A. For Samsung Bioepis, which is preparing to become a new drug developer, this means gaining multiple competitive advantages.

John Rim, CEO of Samsung Biologics, stated, "We made this decision to proactively and swiftly respond to rapid changes in the global environment, and to enable both companies to secure unrivaled competitiveness in their respective businesses through selection and concentration. This split will serve as a catalyst for both companies to accelerate their growth and become global top-tier bio companies."

No Listing of Samsung Bioepis for Five Years: "Unlocking the Hidden Value of Biosimilars to Enhance Shareholder Value"

Yoo Seungho, Executive Vice President and Head of Management Support Center at Samsung Biologics, stated during a conference call on the physical division held earlier in the day, "Through the transition to a pure CDMO company, Samsung Biologics will be able to completely eliminate any potential risks that may arise in future business. We also expect to enhance shareholder value based on the expansion and acceleration of global partnerships and a high-profit business structure."

He continued, "The newly established company will focus on discovering new growth drivers as an investment holding company and pursue aggressive growth through R&D and mergers and acquisitions (M&A). The biosimilar business will continue to launch new products, and by being re-evaluated as a top-tier biosimilar platform, it will further solidify its position as a global leading biosimilar company. We believe that the 'hidden value' of the biosimilar business will play a major role in enhancing shareholder value for the newly established company."

The company also announced that it will not consider listing Samsung Bioepis for the next five years. Kim Hyungjun, Executive Vice President of Samsung Bioepis, said, "The listing of Samsung Bioepis has been a topic of interest among many investors, but for the time being, we plan to focus on stabilizing the business as the main subsidiary of the holding company. Discussing a listing at this point could cause confusion among investors, so it is not under consideration at this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)