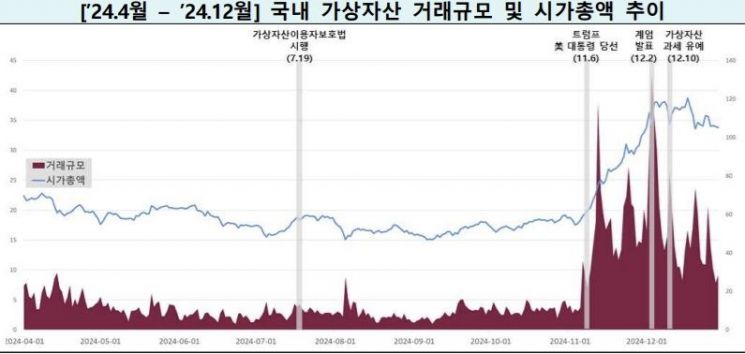

In the second half of last year, the domestic virtual asset market capitalization nearly doubled compared to the first half, reaching 108 trillion won.

On May 20, the Financial Services Commission and the Financial Supervisory Service announced the results of the "2024 Second Half Virtual Asset Service Provider Survey," which covered 25 virtual asset service providers, including 17 exchanges and 8 custody and wallet operators. According to the survey, the domestic virtual asset market capitalization in the second half of last year reached 107.7 trillion won, which is a 91% increase (56.5 trillion won) compared to the first half.

The growth rate outpaced that of the global virtual asset market capitalization. According to CoinGecko, the global virtual asset market capitalization was 3,125 trillion won in June last year and rose to 4,989 trillion won by the end of the same year, marking a 60% increase.

The financial authorities explained, "The upward momentum from the first half of last year continued, leading to a bull market with Bitcoin reaching new all-time highs," and added, "Investor sentiment significantly improved due to the official inflow of institutional funds following the launch of multiple Bitcoin spot ETFs in the United States, as well as expectations for pro-virtual asset policies."

By market capitalization, Bitcoin accounted for 32.82 trillion won, representing 29.7% of the total. This was followed by Ripple (XRP) at 25.58 trillion won, Ethereum at 10.02 trillion won, and Dogecoin at 4.79 trillion won.

The number of virtual assets traded domestically was 1,357 (including duplicates). This is an increase of 150 compared to the end of June last year (1,207). Excluding duplicate listings, the number of unique virtual asset types distributed domestically was 598.

In the second half of last year, a total of 127 new virtual assets were supported for trading (including duplicates), representing a 19% decrease compared to the first half. The number of virtual assets delisted (including duplicates) was 31.

◆ Most Virtual Asset Exchange Users Are in Their 30s

As of the end of last year, the number of registered accounts at 17 virtual asset trading companies stood at 20.02 million, an increase of 400,000 (2%) compared to the first half. By market, the number of KRW market accounts was 19.83 million, while coin market accounts totaled 190,000.

The number of individuals and corporations who completed customer verification and were eligible to trade was 9.7 million, an increase of 1.92 million (25%) compared to the first half. Of these, individuals accounted for 9.7 million, representing the vast majority, while corporations numbered only 171.

The age group that used virtual assets the most in the second half of last year was those in their 30s, accounting for 28.8% of the total. This was followed by those in their 40s (27.6%), those in their 20s or younger (18.8%), and those in their 50s (18.1%).

By asset holdings per age group, 6.37 million people (66%) held less than 500,000 won. In contrast, the proportion of users holding assets worth 10 million won or more was 1.21 million (12%), an increase of 2 percentage points compared to the first half. The proportion of users holding more than 100 million won was 220,000 (2.3%).

◆ Improved Performance for Virtual Asset Exchanges Due to Market Boom

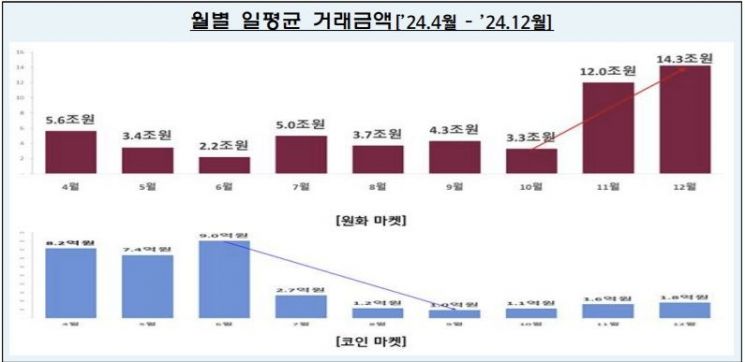

Thanks to the favorable market conditions, the domestic virtual asset trading volume increased by 24%, from 1,087 trillion won in the first half to 1,345 trillion won in the second half. In addition, the average daily trading volume at domestic virtual asset exchanges rose by 22%, from 6 trillion won to 7.3 trillion won.

With the increase in trading volume, the total revenue of the 17 virtual asset trading companies grew by 15%, from 1.0546 trillion won in the first half to 1.216 trillion won in the second half.

Operating profit also increased by 27%, from 585.9 billion won to 744.6 billion won. However, there was a stark contrast between the KRW market and the coin market operators. For the KRW market, operating profit in the second half of last year was 757.2 billion won, a 26% improvement from 599.5 billion won in the first half. In contrast, the coin market recorded an operating loss of 12.6 billion won.

The total number of employees at virtual asset trading companies was 1,862, an increase of 280 (18%) compared to the first half. On average, KRW market operators had 319 employees, while coin market operators had 22. In addition, there were a total of 207 employees engaged in anti-money laundering (AML) operations.

As of the end of last year, the total assets under custody at the eight virtual asset wallet and custody service providers stood at 1.5 trillion won, a decrease of 12.3 trillion won (89%) compared to the first half. In the second half of last year, the revenue of virtual asset wallet and custody service providers was 9.7 billion won, a 5.6 billion won (56%) increase from 6.2 billion won in the first half. However, they recorded an operating loss of 3.2 billion won.

Their total number of executives and employees was 179, an increase of 62 (53%) compared to 117 in the first half of last year. In addition, there were 21 employees engaged in AML-related work.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)