Administrative Measures Taken Against Four VC Firms This Year

Due to Capital Erosion and No Investments for One Year

The venture investment market is experiencing a downturn, causing venture capital (VC) firms to face management difficulties. Although the number of VC firms continues to increase each year, they are struggling to establish new funds due to the conservative investment approach of limited partners (LPs).

According to the Venture Investment Company Electronic Disclosure System (DIVA) on May 16, six VC firms have already received administrative measures such as warnings and corrective orders this year alone. Of these, four were found to be in violation due to capital erosion or a lack of investments over the past year.

Konan Investment and Philosophia Ventures have been ordered to improve their management due to capital erosion. Avon Investment and NKS Investment have each received a warning and a corrective order, respectively, for failing to make any investments over the past year. These VC firms must resolve the reasons for their violations within the deadline set by the Ministry of SMEs and Startups.

According to Article 41 of the Act on the Promotion of Venture Investment, a venture investment company must maintain a capital erosion rate below 50% to meet sound management standards. Article 38 of the same law stipulates the mandatory investment ratio for VC firms, and violations of these requirements are subject to administrative actions such as business suspension under Article 49.

Cases of VC firms violating regulations have been increasing each year. The number of administrative actions against VC firms rose from six cases in 2021 to 54 cases last year, a ninefold increase. Compared to 20 cases in 2022 and 17 cases in 2023, this is a significant rise. This trend is expected to continue this year. In particular, the proportion of administrative measures related to management difficulties, such as capital erosion and failure to invest for a year, is increasing. Last year, nine VC firms faced administrative action due to capital erosion, up from seven firms in 2023.

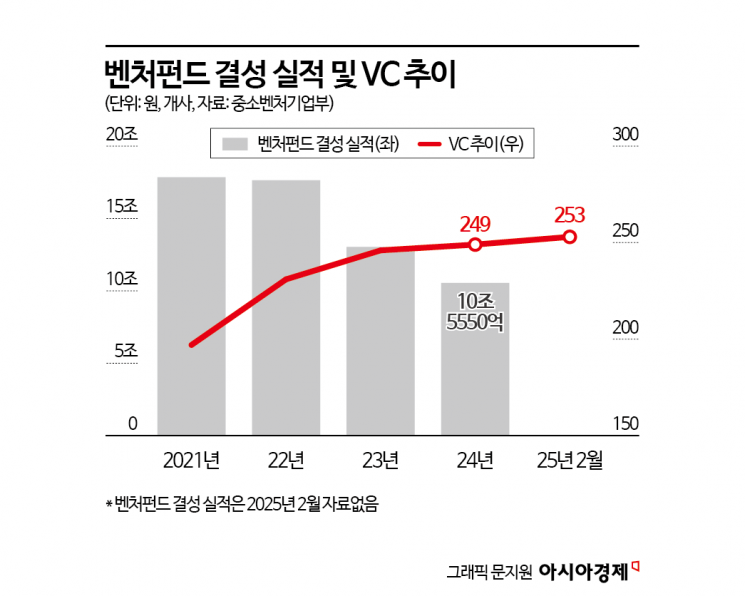

This situation has arisen because the prolonged high interest rates and economic uncertainty have dampened LPs' investment sentiment, making it difficult to form new funds. According to statistics from the Ministry of SMEs and Startups, the total amount of venture funds established in 2021 was 17.8481 trillion won. However, this figure decreased to 17.6401 trillion won in 2022, 13.0328 trillion won in 2023, and 10.55 trillion won in 2024, showing a decline each year.

In contrast, the number of VC firms increased from 197 in 2021 to 249 last year, and reached 253 as of February this year, intensifying competition. LPs tend to favor large VC firms, which offer relatively stable capital recovery, making it difficult for smaller VC firms with weaker track records to establish funds at all. The main sources of revenue for VC firms are management fees and performance fees generated from fund operations. If they are unable to form funds, they generate no revenue, leading to management difficulties.

The VC industry expects that many VC firms will close down this year. An industry insider stated, "I am aware that there are many VC firms that are effectively inactive or even unable to pay their employees' salaries," adding, "As the venture investment market is expected to remain difficult this year, we will likely see a surge in VC closures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)