Hanwha Solutions, SK Oceanplant, and Other Eco-Friendly Stocks Hit Record Highs

Expectations Rise for Gains Amid Stronger Regulations on Chinese Solar Products

As presidential candidates continue to announce their campaign pledges, the stock prices of solar energy companies are experiencing significant fluctuations.

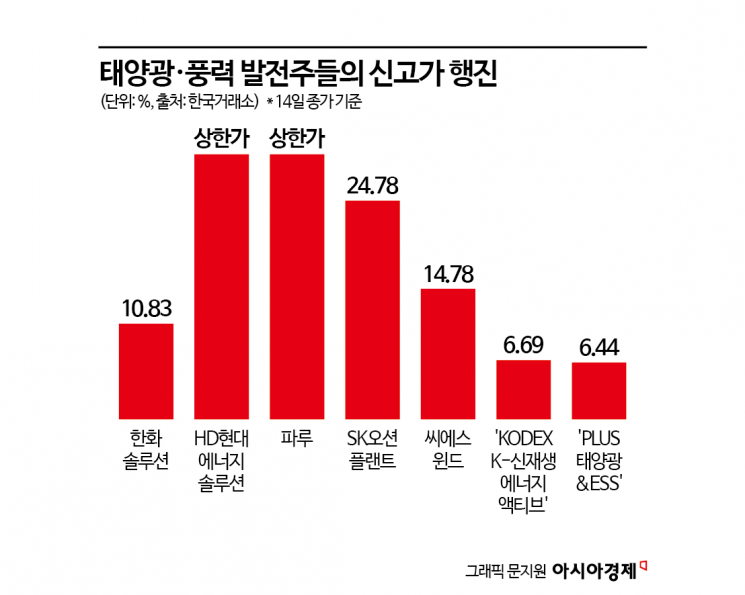

According to the financial investment industry on May 15, solar-related stocks such as Hanwha Solutions (up 10.83%), HD Hyundai Energy Solutions (hitting the upper price limit), and Paru (hitting the upper price limit) all reached new 52-week highs the previous day. Wind power stocks, including SK Oceanplant (up 24.78%) and CS Wind (up 14.78%), as well as related exchange-traded funds (ETFs) such as 'KODEX K-New Renewable Energy Active' and 'PLUS Solar&ESS,' also surged by more than 6%, ranking among the top five performers in terms of returns.

In addition to expectations of an improved solar energy market both domestically and internationally, Democratic Party presidential candidate Lee Jaemyung's pledge to expand the 'Sunlight Pension' has further fueled investor sentiment. The Sunlight Pension is a system in Sinan County, Jeonnam, where 30% of the profits from solar power companies are distributed to local residents. Jeju Island implements a similar system called the 'Wind Pension' for its residents. On May 11, Lee announced plans to expand solar power for farms and create 'Sunlight Income Villages.' During a recent campaign event in Gumi, North Gyeongsang Province, Lee also expressed his commitment to this pledge, stating, "If several solar power plants are built, residents can directly receive profits through the Sunlight Pension."

An official from a securities firm commented, "As the presidential election approaches, the stock prices of related sectors are being heavily influenced by the remarks of leading candidates, resulting in a theme-driven market." The official also noted, "Especially since the renewable energy sector was somewhat neglected under the previous administration, this election could serve as an opportunity for renewed attention." In fact, according to the Ministry of Trade, Industry and Energy, renewable energy accounted for more than 10% of the nation's total power generation for the first time last year, and its role continues to grow.

The global environment is also favorable. Previously, the U.S. Department of Commerce announced that Chinese solar components were being rerouted through Southeast Asian countries to the U.S., and decided to impose anti-dumping duties (ranging from 6.1% to 271.28%) and countervailing duties (ranging from 14.64% to 3,403.96%) on solar parts from Cambodia, Thailand, Vietnam, and Malaysia. With some countries, such as Cambodia, facing punitive tariffs of over 3,500%, expectations for windfall gains among domestic solar companies have increased, especially as China announced it would reduce subsidies for renewable energy businesses starting in June. The final tariff rates will be determined after a review by the U.S. International Trade Commission (ITC) in June.

Lee Jin-ho, a researcher at Mirae Asset Securities, stated, "In 2025, the U.S. residential solar market is expected to grow by 14% year-on-year, driven by momentum in the TPO (third-party ownership) sector and additional benefits from the Investment Tax Credit (ITC)." He identified Hanwha Solutions, which holds a market share of over 30% in the residential module segment, as his "top pick." Ahn Juwon, a researcher at DS Investment & Securities, said, "The declaration of RE100 (100% renewable energy usage) by major corporations is increasing demand for solar power, and with the government announcing measures to protect domestic products, the domestic market environment is improving." He raised the target price for HD Hyundai Energy Solutions from 33,000 won to 36,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)