Reducing Leverage, Increasing Bond and Dividend ETFs

Cautious Optimism Amid Hopes for Easing Trade Tensions

As global trade tensions ease and the U.S. stock market heads toward recovering its previous highs, Korean retail investors in U.S. stocks?often referred to as "Seohak Ants"?are also increasing their stakes. However, while aggressive, leverage-focused investments were the norm until recently, there are now signs that investors are paying more attention to hedging by incorporating ultra-short-term bond products into their portfolios.

According to the Korea Securities Depository’s securities information portal (SEIBro) on May 14, the value of U.S. stocks held by domestic individual investors reached approximately $109.4 billion (about 155 trillion won) as of May 9, surpassing April’s record of $104.8 billion in less than ten days. This represents an increase of about 40% compared to the same period last year ($78.6 billion). After being net sellers on May 6, Seohak Ants have turned to net buying for four consecutive trading days starting the following day.

Lee Kyungmin, a researcher at Daishin Securities, commented, "With Trump’s tariff policies receding and the situation moving toward resolution, uncertainties related to tariffs are easing." He added, "In response, economic stimulus measures by non-U.S. countries such as China are expected to stabilize global financial markets and support a medium-term upward trend in stock markets."

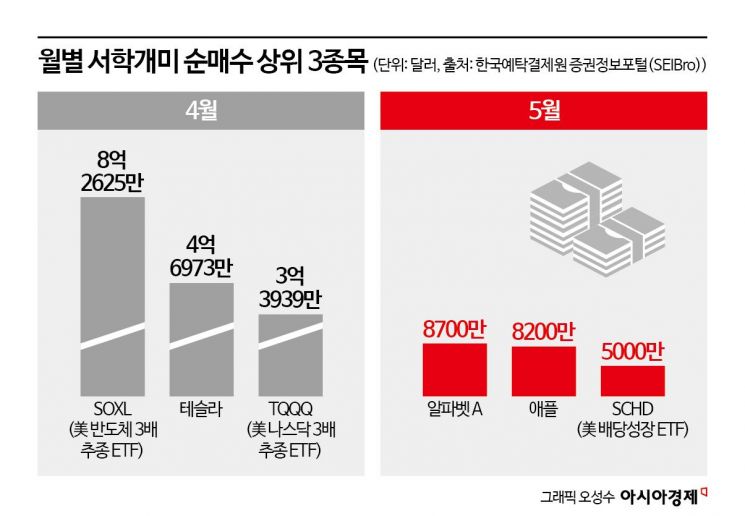

Notable changes are also being observed in the stock selection strategies of Seohak Ants, who have been vocal about "Buy America." Until last month, they had shown aggressive tendencies by purchasing around $1.2 billion (about 2 trillion won) of TQQQ and SOXL, which are leveraged ETFs that track three times the daily returns of the Nasdaq 100 Index and the ICE Semiconductor Index, respectively. However, this month, they have reduced their holdings in such leveraged ETFs and significantly increased their allocations to individual stocks such as Alphabet (ranked first in net purchases) and Apple (second), as well as U.S. ultra-short-term Treasury ETFs like SGOV (sixth). Notably, SCHD?America’s leading dividend growth ETF?has overtaken Tesla to become the third most purchased stock by net buying, signaling that Seohak Ants are starting to prioritize building stable portfolios over making aggressive bets.

With the U.S. and China agreeing to sharply lower the high tariffs they had imposed on each other for 90 days, the stock market has responded positively, and analysts are expressing optimistic outlooks. Jo Yeonju, a researcher at NH Investment & Securities, said, "As in 2019, the sensitivity to tariffs is decreasing, and I expect the lows in the U.S. stock market to gradually rise." Park Hyeran, a researcher at Samsung Securities, advised focusing on the financial sector, stating, "Since taking office, Trump has achieved most of his major deregulation pledges (AI, autonomous driving, cryptocurrency, etc.), and what remains are tax cuts and further deregulation."

However, there are also warnings against excessive optimism. Some point out that the process of the S&P 500 Index, which plunged due to U.S.-China trade conflicts, recovering its previous high is almost identical to what happened during Donald Trump’s first term. At that time, the S&P 500 Index fell by more than 7% after recovering its previous high when trade negotiations broke down. Lee Euntaek, a researcher at KB Securities, cautioned, "During Trump’s first term, after the '90-day grace period,' the S&P 500 kept rallying past its previous high until a new record was set." He advised investors to be cautious in mid to late June, ahead of the Group of Seven (G7) and North Atlantic Treaty Organization (NATO) summits.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)