As Demand for Group Catering Grows, CJ, Hyundai, and Shinsegae See Balanced Growth in Food Materials and Catering Services

Catering Industry Outlook Remains Positive Despite Weak Consumer Sentiment

As 'lunchflation' (lunch + inflation), a phenomenon where office workers' lunch expenses rise due to inflation, continues to worsen, group catering and food distribution companies generally posted stable results in the first quarter of this year. As demand for relatively affordable meal services is expected to keep increasing amid persistently high prices, food material companies focusing on catering are likely to continue their growth trajectory for the time being.

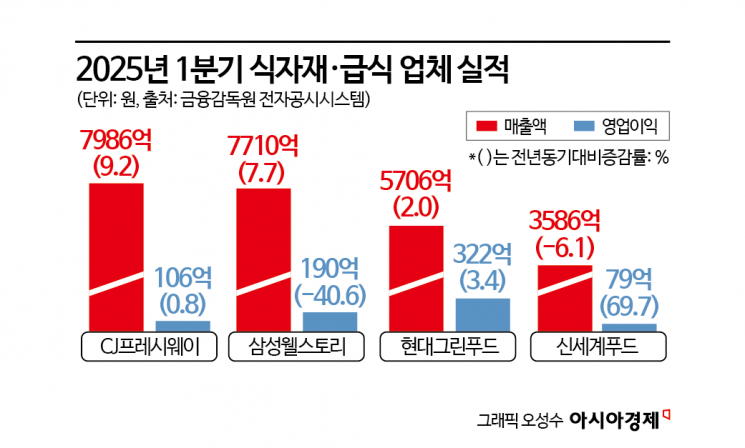

According to the Financial Supervisory Service's electronic disclosure system on May 13, CJ Freshway's sales in the first quarter of this year reached 798.6 billion won, up 9.2% from the same period last year. Operating profit rose by 0.8% to 10.6 billion won, and net profit increased by 21.0% to 1.6 billion won.

CJ Freshway concession site 'Incheon Airport Gourmet Bridge Terminal 2 Central Branch' exterior view.

CJ Freshway concession site 'Incheon Airport Gourmet Bridge Terminal 2 Central Branch' exterior view.

At the end of last year, CJ Freshway reorganized its business structure to strengthen its response to different markets, dividing operations into 'food service ingredients and food raw material distribution' and 'catering ingredients distribution and group catering.' Both divisions continued to show top-line growth. In the food service ingredients and food raw material distribution segment, which targets restaurants, distribution agents, and food manufacturers, the number of restaurant operators familiar with online ordering increased. As a result, CJ Freshway diversified its delivery services, and online channel distribution sales rose by about three times compared to a year ago.

The catering business segment, which combines catering ingredient distribution and group catering, also saw balanced growth across all segmented distribution channels, from infants to seniors. In particular, in the group catering business, the company opened a premium food court at Incheon International Airport, one of the largest business sites, leading to increased sales, and new order volume rose by 65% compared to the same period last year. However, sales through hospital and school channels dropped by 7.3%, as the sluggish performance in major hospital channels due to the strike by medical residents continued.

Hyundai Green Food also achieved solid results as both its catering and food service sales increased. Hyundai Green Food's consolidated sales in the first quarter of this year were provisionally tallied at 570.6 billion won, up 1.98% from the same period last year, and operating profit rose by 3.36% to 32.2 billion won. The catering business saw an increase in meal counts as client companies performed well and demand for ready-to-eat meals grew. The food service business also benefited from the performance of new outlets such as 'Jaggers Burger' and 'Eataly,' as well as an increase in customers at existing outlets. However, as the number of business days decreased by about five compared to last year, profitability improvement was limited.

Shinsegae Food also posted positive results by efficiently controlling promotional expenses and shifting to high-margin channels. Shinsegae Food's first-quarter sales were 358.6 billion won, down 6.1% year-on-year, reflecting a somewhat sluggish performance. This was due to the downsizing of unprofitable food service brands and group catering sites, which reduced the company's scale. Nevertheless, by increasing the proportion of high-margin channels and restructuring its business strategy to focus on profitability, operating profit rose significantly.

Since the appointment of CEO Kang Seunghyup at the end of last year, Shinsegae Food has been accelerating its business restructuring. In the food service business, the company is decisively withdrawing from unprofitable brands and focusing its franchise operations on 'No Brand Burger.' Recently, through the 'No Brand Burger 2.0' model, the company introduced a plan to reduce the initial burden on prospective franchisees and increase the number of outlets, thereby strengthening brand competitiveness. In the catering business, the company is reducing its reliance on group affiliates and revising its strategy to focus on external business sites.

However, Samsung Welstory could not avoid a sharp decline in operating profit, which fell by more than 40%. Samsung Welstory's first-quarter sales reached 771 billion won, up 7.7% from the same period last year, but operating profit dropped significantly to 19 billion won, compared to 32 billion won a year earlier. A Samsung Welstory official explained, "Sales increased due to a rise in meal counts for catering and new orders from food material clients, but operating profit declined due to higher base wages and rising food material prices." Samsung Welstory's group catering business accounts for over 60% of its operations, the highest proportion in the industry, and the company is known to provide services at the largest number of business sites.

As consumer sentiment deteriorates, the profitability of large group catering sites is increasing, so the growth trend in this sector is expected to continue. In particular, beyond the overall favorable market conditions, there is potential for expansion in military catering and other contract markets. Demand for large companies continues to grow as the efficiency of directly managed and small-to-medium-sized catering companies declines.

Nam Sung-hyun, a researcher at IBK Investment & Securities, explained, "As the military catering market gradually opens up, changes are expected in the military and school catering markets, increasing the likelihood of higher demand for large companies." He added, "Although the first quarter is a seasonally slow period with a high proportion of fixed costs, in the second quarter, as the absolute scale of top-line sales increases, the operating leverage effect is expected to become more pronounced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)