Baek Jongwon Announces Halt to Broadcasting Activities

① Strengthening Brand Competitiveness Beyond Paikdabang

② Expanding Scale Through M&A

③ Addressing Concerns Over Company Overvaluation

With Baek Jongwon, CEO of Theborn Korea, announcing his decision to halt all broadcasting activities, attention is now focused on his next moves. As Theborn Korea, under Baek's leadership, has faced various controversies, including allegations of false labeling of product origins, Baek has declared his intention to concentrate on management as a 'businessman.' Many point out that he now faces the formidable task of restoring both his damaged image and the company's value.

According to Theborn Korea on May 7, Baek recently stated on his official YouTube channel, "I will make 2025 the first year of a new beginning for Theborn Korea," and added, "Except for programs currently being filmed, I will cease all broadcasting activities. As a businessman, not a broadcaster, I will devote all my passion and energy solely to the growth of Theborn Korea."

Baek also said, "Although I have already issued apologies in writing and at the shareholders' meeting regarding the many issues and criticisms raised intensively this year, today I wanted to bow my head and apologize directly through this video," and added, "We are identifying the root causes of all matters, including quality, food safety, and hygiene at festival sites, and are making improvements one by one."

This marks the third official apology from Baek regarding controversies related to Theborn Korea. Previously, on March 13, he posted an apology on the company website concerning product and quality issues. After further allegations emerged, such as Theborn Korea violating the Food Sanitation Act by spraying juice from a pesticide sprayer at a local festival, he posted a second apology on March 19.

Since its listing in November last year, Theborn Korea has been embroiled in a series of controversies. Since February, issues have included quality concerns over 'Paekham,' allegations of violating the Farmland Act, errors in product origin labeling, accusations that a company executive invited a female job applicant to a drinking party under the pretense of an interview, monopolizing local festivals, and neglecting equipment and ingredients at event sites. Public criticism of Baek's overall management of Theborn Korea has intensified. Baek has been criminally charged three times due to these allegations.

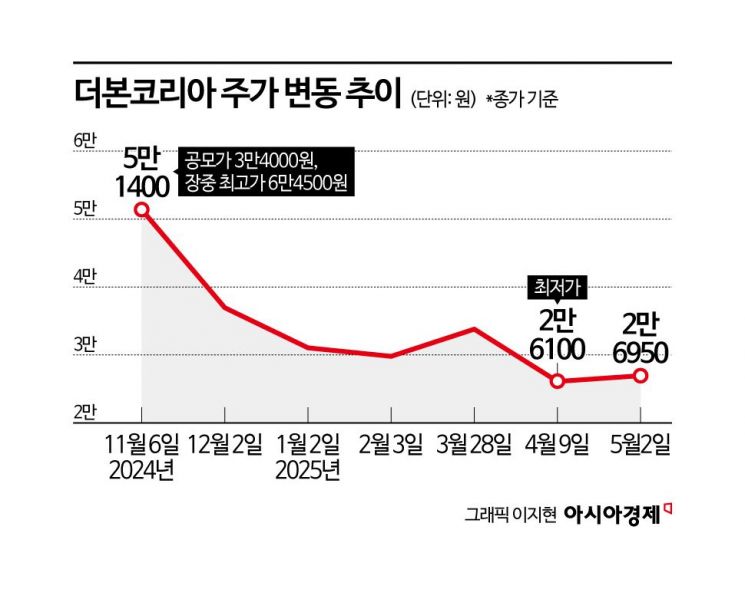

As the controversies continued, Theborn Korea's stock price was halved. When Theborn Korea debuted on the Korea Exchange on November 6 last year, its share price soared to 64,500 won?about twice the IPO price of 34,000 won. Despite a sluggish IPO market last year due to weakened investor sentiment, the company's value soared on the back of Baek Jongwon's fame. The popularity of the Netflix cooking competition program 'Black and White Chef,' featuring Baek just before the IPO, also contributed.

However, Theborn Korea's share price has since retreated to less than half its opening day high. On this day, Theborn Korea closed at 26,400 won, down 2.04% from the previous day.

Within the franchise industry, the consensus is that strengthening the company's core business competitiveness is now the top priority.

Until now, Baek has rapidly expanded the number of outlets by turning brands such as Hanshin Pocha and Saemaeul Sikdang into nationwide franchise names. However, these brands' growth has recently stalled. Last year, 13 of Theborn Korea's brands?including Saemaeul Sikdang, Bonga, Mijeong Noodle 0410, and Paik's Beer?saw more closures than new openings. As a result, Theborn Korea currently operates 25 brands, but most outlets are concentrated in Paikdabang. Theborn Korea has about 3,066 outlets in total, with Paikdabang accounting for 1,712?well over half.Additionally, Paikdabang and Hong Kong Banjeom 0410 together generate half of Theborn Korea's total sales.

Some argue that in order to regain investor trust, the company must not only improve its brand image but also present a clear growth strategy. When Theborn Korea announced its IPO plans in October last year, it stated in its securities registration statement that 93.5% of the funds raised?93.5 billion won?would be used for mergers and acquisitions (M&A). However, more than half a year after the listing, there has been no news of any acquisitions. At one point, there were rumors of an acquisition of 'Norang Tongdak,' but Theborn Korea denied having any such plans.

Industry insiders believe that for Theborn Korea, whose brands are strongly associated with Baek Jongwon, any M&A should involve companies with brands not already in his portfolio, or businesses that can support Theborn Korea's existing brands. They suggest that if M&A is pursued in a way that strengthens current brands, it will have a positive impact on public opinion and the stock price going forward.

Currently, Theborn Korea is reportedly being introduced to potential acquisition targets by various underwriters and private equity fund (PEF) managers. In particular, the company is said to be considering sauce and powder companies, as well as meat processing companies. Both inside and outside the industry, it is said that Theborn Korea is looking for 'bolt-on M&A' opportunities?acquiring businesses that can reinforce its core operations.

Addressing concerns about the company's overvaluation is also necessary. The company's share price has not once exceeded the IPO price of 34,000 won this year. An industry source commented, "Among Theborn Korea franchisees, there are significant concerns about the potential damage caused by the Baek Jongwon risk. Once a franchise's image is tarnished, it is not easy to recover, but since the company has grown thanks to Baek Jongwon's symbolic presence, if he demonstrates a changed attitude toward the overall business, consumer perceptions could also shift in a positive direction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)