Strengthening Support for Venture Investors

...Revitalizing the Venture Ecosystem through Awards and Education

The Ministry of SMEs and Startups and the Korea Venture Capital Association (VC Association) announced on the 2nd that they will present the '2025 Venture Investment Promotion Merit' awards to limited partners (LPs) and conduct introductory education on VC investment.

This award and training program have been organized to encourage LPs to invest in venture funds and to support the enhancement of their investment capabilities, thereby fostering a private sector-driven investment ecosystem.

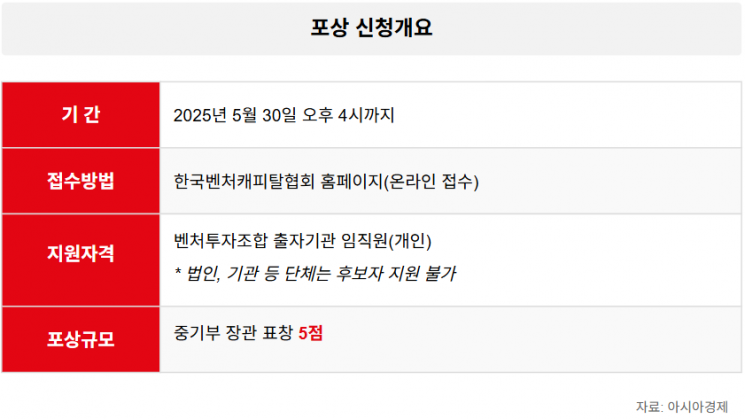

Applications and submissions for the Venture Investment Promotion Merit awards open today. The awards include five commendations from the Minister of SMEs and Startups, and applications can be submitted via the VC Association's website until 4:00 p.m. on the 30th.

The award ceremony, along with the presentation of the VC Association President's Award (for LPs), will take place at the LP and GP (general partner) networking event hosted by the VC Association on July 17. The event will also provide networking opportunities among venture fund LPs, award recipients, and VC Association member companies.

Meanwhile, the Korea VC Institute (KVCI), an affiliate of the VC Association, will open an introductory VC investment course for institutional LPs such as pension funds, mutual aid associations, and local governments, and will begin recruiting participants in July.

This training program is focused on increasing the understanding of the venture investment market among pension funds and institutional LPs, as well as strengthening their practical investment skills. The curriculum systematically covers key topics in venture investment, including the structure of the VC industry, investment processes, risk management, major legal issues, and sector-specific investment cases.

A representative from the Korea VC Institute stated, "Interest in venture investment among pension funds and institutional LPs is growing rapidly. This training program will make a practical contribution by strengthening the investment expertise of LP institutions and expanding their strategic connections with the venture ecosystem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)