Securing Two LPG Carriers, Achieving 35% of Annual Target

Jung Kiseon, Senior Vice Chairman, Tours Shipyard with U.S. Secretary of the Navy

Accelerating Defense Sector Expansion... Portfolio Diversification Strategy

HD Hyundai has secured a series of commercial vessel orders this year, achieving 35% of its annual order target. With the recent visit of a high-ranking U.S. Navy official to Korea, the company’s order portfolio, which had been limited to the civilian sector, is now expected to expand into the defense sector. Both inside and outside the shipbuilding industry, there is analysis that HD Hyundai has initiated a mid- to long-term strategy aimed at securing leadership in the shipbuilding industry by simultaneously targeting two pillars: the restructuring of the global supply chain and the strengthening of defense cooperation.

On May 2, HD Korea Shipbuilding & Offshore Engineering, the intermediate holding company for HD Hyundai’s shipbuilding business, announced via a regulatory filing that it had signed a contract with a shipping company based in Africa to build two liquefied petroleum gas (LPG) carriers. The total order amount is 212.2 billion KRW, and the vessels will be built by HD Hyundai Mipo and delivered sequentially by the second half of 2027. HD Hyundai Mipo, a shipbuilding affiliate of HD Hyundai, specializes in medium-sized gas carriers. It is known that this order also involves vessels equipped with technology for environmentally friendly fuels such as methanol and ammonia.

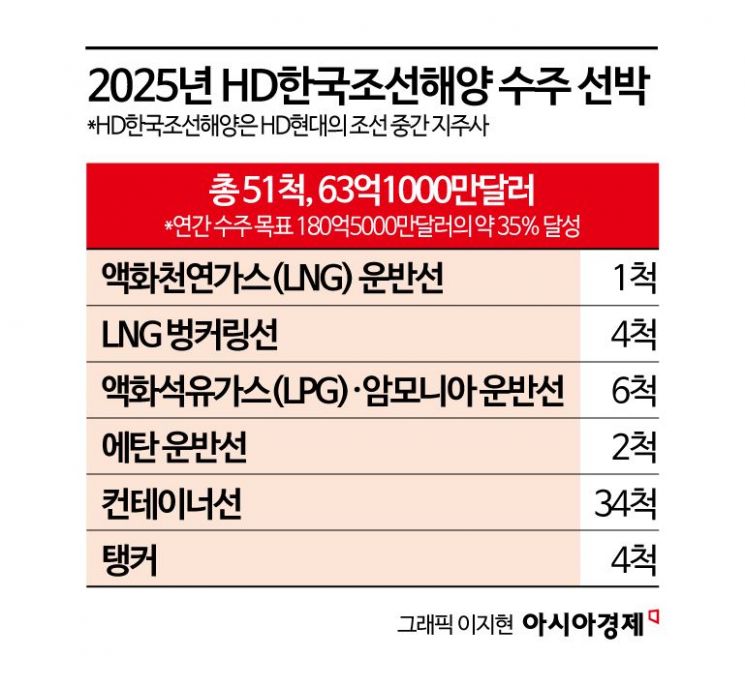

Including this contract, HD Korea Shipbuilding & Offshore Engineering has secured orders for a total of 51 vessels (provisional figure) so far this year: one liquefied natural gas (LNG) carrier, four LNG bunkering vessels, six LPG/ammonia carriers, two ethane carriers, 34 container ships, and four tankers. In terms of value, this amounts to $6.31 billion, which is about 35% of the annual order target of $18.05 billion. Notably, orders for container ships account for more than half of the total, reflecting expectations for a market recovery.

HD Hyundai is steadily accumulating commercial vessel orders while also taking steps toward entering the global defense market. On April 30, two days prior, John Philip, U.S. Secretary of the Navy, visited the Ulsan headquarters of HD Hyundai Heavy Industries, toured the shipbuilding facilities, and called for strengthened cooperation between the two countries’ shipbuilding industries. Jung Kiseon, Senior Vice Chairman of HD Hyundai, accompanied Secretary Philip, directly explaining the shipyard and emphasizing the company’s construction capabilities.

During the visit, Secretary Philip stated, “By cooperating with a shipyard with such outstanding capabilities, timely maintenance and repair activities will be possible, enabling U.S. Navy vessels to perform at their best.” Jung Kiseon, Senior Vice Chairman, said, “Korea and the United States are friends bound by a blood alliance and are the closest allies. Based on HD Hyundai’s top-tier technology and shipbuilding capabilities, we will contribute to the rebuilding of the U.S. shipbuilding industry.”

On the 30th of last month, Jung Kiseon, Senior Vice Chairman of HD Hyundai (third from the left), along with John Philip, U.S. Secretary of the Navy (second from the left), toured the HD Hyundai Heavy Industries Special Shipyard and introduced the vessels under construction. HD Hyundai

On the 30th of last month, Jung Kiseon, Senior Vice Chairman of HD Hyundai (third from the left), along with John Philip, U.S. Secretary of the Navy (second from the left), toured the HD Hyundai Heavy Industries Special Shipyard and introduced the vessels under construction. HD Hyundai

The U.S. Navy has recently determined that domestic shipyards have reached their limits in terms of shipbuilding capacity, and is now open to the possibility of collaborating with shipbuilders from allied countries. HD Hyundai has consistently explored opportunities for cooperation with U.S. defense authorities, leveraging its experience in building special-purpose vessels such as landing platform docks (LPDs), high-speed patrol boats, and auxiliary support ships. In fact, HD Hyundai possesses the design and construction capabilities to build large special-purpose vessels even without a dedicated defense subsidiary. There are also assessments that the company is well positioned to meet the U.S. Navy’s mid- to long-term demand for naval vessels.

Unlike Hanwha Ocean, a subsidiary of Hanwha Group, which is targeting the U.S. defense market with a defense-focused strategy, HD Hyundai is pursuing a dual strategy of commercial and defense shipbuilding, based on the production capacity of its large civilian shipyards. An industry official said, “The U.S. Navy has determined that it is difficult to meet vessel demand solely through domestic procurement networks, and is now turning its attention to Korean shipbuilders with production flexibility and a proven track record. HD Hyundai is currently being highlighted as a key production hub in the global supply chain.”

For the time being, HD Hyundai is expected to maintain its main order-taking strategy centered on environmentally friendly commercial vessels, while gradually expanding into the defense and special-purpose ship sectors, depending on market conditions and policy environments. How well the company can finely balance its dual portfolio of commercial and defense shipbuilding is expected to be a crucial turning point for the competitiveness and survivability of the shipbuilder going forward.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)