Starting in June, nonprofit organizations and virtual asset exchanges will be permitted to sell virtual assets.

On May 1, Kim Soyoung, Vice Chairman of the Financial Services Commission, held the 4th Virtual Asset Committee meeting at the Government Complex Seoul and finalized the guideline for the sale of virtual assets by nonprofit organizations and exchanges as a follow-up measure to the "Roadmap for Corporate Participation in the Virtual Asset Market."

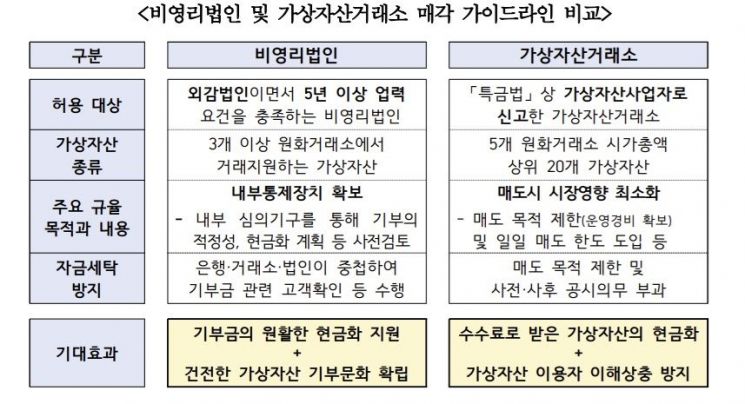

The financial authorities have decided to allow sales starting with "external audit corporations with more than five years of business history" in order to ensure internal control systems and transparency. In addition, they will require the establishment of an internal "Donation Review Committee" (tentative name) within the corporation to review the appropriateness of donations and plans for liquidation in advance.

The authorities also stated that smooth liquidation of virtual assets is a prerequisite for the proper utilization of donated virtual assets. Therefore, they have decided to limit the eligible donated assets to those traded on at least three Korean won-based exchanges.

Furthermore, the principle of "immediate liquidation upon receipt" will apply to donated virtual assets. To prevent money laundering, verification and confirmation of transaction purposes and sources of funds will be strengthened. Only donations and transfers through domestic Korean won-based exchange accounts will be permitted. Additionally, banks, exchanges, and corporations will be required to conduct overlapping customer verification procedures.

For virtual asset exchanges, the focus will be on minimizing market impact and preventing conflicts of interest with users when selling virtual assets. Only exchanges registered as virtual asset service providers under the "Act on Reporting and Using Specified Financial Transaction Information" will be allowed to sell. Sales will be permitted only for the purpose of covering operating expenses.

The assets eligible for sale will be limited to the top 20 virtual assets by market capitalization on five Korean won-based exchanges. There will also be daily sales limits (such as within 10% of the total planned sales volume), a prohibition on selling through the exchange's own platform, and other similar rules. The sale plan must go through internal control procedures such as board resolution, and both advance disclosure and post-disclosure of sales results and fund usage will be required.

With the guidelines finalized, from next month, nonprofit organizations and virtual asset exchanges will be able to obtain accounts for virtual asset sales transactions.

The Financial Services Commission stated, "We plan to establish customer verification measures for virtual asset transactions by nonprofit organizations and exchanges within this month," and added, "We will also proceed without delay to announce measures for issuing real-name accounts for listed corporations and corporations registered as professional investors in the second half of the year."

In addition, the "Revised Best Practices for Trading Support" will apply to virtual assets listed after June 1. Until now, there have been concerns about user losses due to the so-called "listing beam" phenomenon, where prices fluctuate sharply due to supply-demand imbalances immediately after trading support begins.

To prevent such occurrences, authorities will require a minimum circulating supply before trading begins and will restrict market orders for a certain period after trading commences. The minimum circulating supply will be set reasonably, taking into account the pre-deposit scale of assets that have not experienced listing beam phenomena. Exchanges will also be required to establish their own standards for "zombie coins" with low trading volumes or market capitalization and "meme coins" whose purpose or value is unclear.

The government plans to incorporate the core elements of the revised best practices for trading support into future comprehensive legislation on virtual assets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)