KOSPI200 and KOSDAQ150 Regular Rebalancing Approaching

Stock Price Momentum Expected from Passive Fund Inflows

Beware of Volatility from Profit-Taking on Rebalancing Day

As the June regular rebalancing season for the KOSPI200 and KOSDAQ150 indices, which represent the domestic stock market, approaches, market attention is intensifying. With preemptive buying strategies focusing on candidate stocks expected to benefit from capital inflows coming into the spotlight, experts are urging caution regarding short-term stock price volatility caused by short selling.

According to the financial investment industry on May 2, the Korea Exchange is scheduled to conduct the regular rebalancing of the KOSPI200 and KOSDAQ150 indices on June 13. The review period covers six months from November 1 of last year to April 30 of this year, and the final list of constituent stocks will be confirmed through the index management committee's deliberation in May.

The market is already speculating on which stocks will newly join the two indices. This is because inclusion in the indices, each tracked by as many as 29 ETF products such as TIGER 200 and KODEX KOSDAQ150, can be expected to bring significant capital inflows. Choi Byungwook, a researcher at Meritz Securities, explained, "These two indices attract the largest amount of tracking funds among exchange indices, so regular rebalancing leads to mechanical inflows from passive funds."

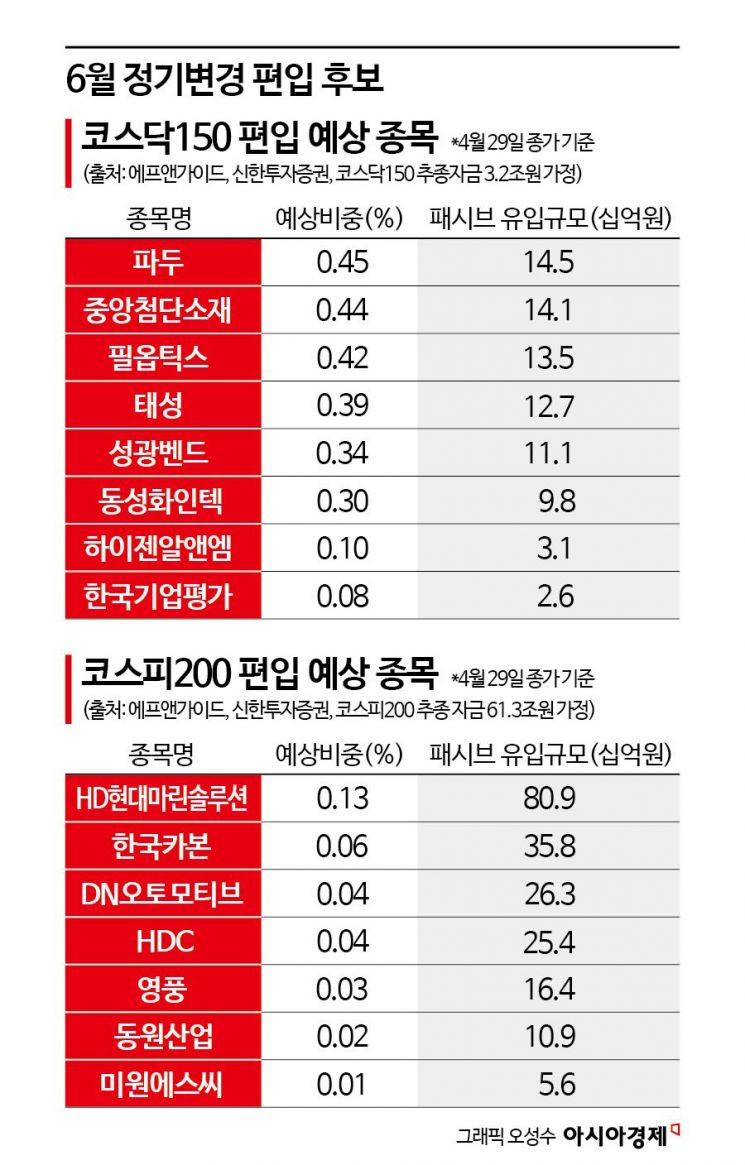

The expected candidates for inclusion in the KOSPI200 index this time are seven stocks: HD Hyundai Marine Solution, Korea Carbon, DN Automotive, HDC, Young Poong, Dongwon Industries, and Miwon SC. Notably, HD Hyundai Marine Solution recorded an operating profit of 83 billion won in the first quarter (up 61.2% year-on-year), contributing to HD Hyundai's highest quarterly operating profit since its transition to a holding company structure. The expected list of additions to the KOSDAQ150 index includes eight stocks: Padu, Joongang Advanced Materials, Philoptics, Taesung, Sung Kwang Bend, Dongsung FineTec, HiZen R&M, and Korea Investors Service.

Experts advise that investors should pay attention to new inclusion candidates even before the regular rebalancing, as active funds employing event-driven strategies can drive up the stock prices of newly added stocks. Researcher Choi stated, "Investors managing index funds typically buy inclusion stocks at the closing price after hours on the rebalancing day, but preemptive buying by those anticipating inclusion begins as early as three months prior to the rebalancing." He added, "This preemptive strategy proved effective in 10 out of 16 cases since 2010, achieving a median excess return of 5.2 percentage points over the KOSPI."

However, the full resumption of short selling, now in its second month, is cited as a variable. Cho Minkyu, a researcher at Shinhan Investment Corp., said, "Looking at each phase, stocks being added to (or removed from) the KOSPI200 tended to dip (or rebound) slightly just before the rebalancing date," interpreting this as the result of increased (or decreased) short selling balances due to index inclusion (or removal). He diagnosed that among the inclusion candidates, stocks with sharply rising returns and increased stock lending balances since the beginning of the year may see short position selling due to rapid short-term gains.

Volatility in the stock prices of expected removal candidates should also be watched. Noh Donggil, a researcher at Shinhan Investment Corp., warned, "The average ratio of capital outflows to trading value for expected removal stocks is 1,247%, which is relatively high," and advised caution regarding volatility before and after the rebalancing date. Seven stocks have been flagged for potential removal from the KOSPI200: Cosmo Advanced Materials, Doosan Fuel Cell, LX International, SK Networks, Hansae, Sam-A Aluminium, and Iljin Hysolus. For the KOSDAQ150, eight stocks are at risk of removal: Dawonsys, WCP, JO, GC Cell, Mirae Nanotech, Yoonsung FNC, Nepes, and TEMC.

Meanwhile, the constituent stocks of the KOSPI200 and KOSDAQ150 indices are changed twice a year (June and December). In addition to these two regular rebalancing events, ad hoc changes can also occur. For example, in March, Geumyang was removed from the KOSPI200 index after being designated as an unfaithful disclosure company, and Taekwang Industrial filled the vacancy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)