Mortgage Loans Reach 587.74 Trillion Won in April

Up 2.3 Trillion Won from Previous Month

Policy Loans Drive the Increase

Credit Loans Expected to Shift to Upward Trend

"Net Increase Minimal This Year Except for KB"

The scale of household loans in April is expected to be similar to the significant increase seen in February. This is because mortgage loans (jumdadae) have risen, mainly due to policy loans, and personal credit loans (sinyeongdaedae) have shifted to an upward trend. If the amount of credit loan repayments at the end of the year is small, the increase in household loans could even surpass that of February.

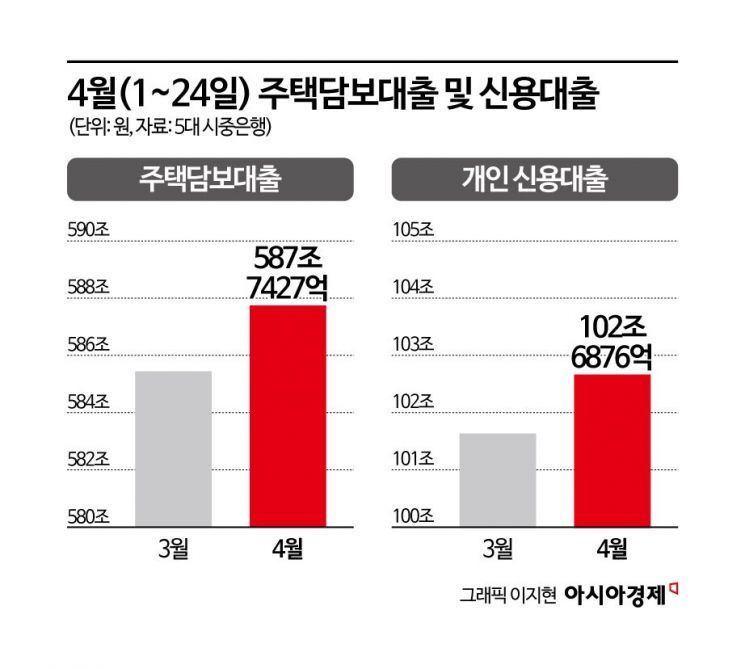

According to the financial sector on the 30th, as of April 24, the outstanding balance of mortgage loans at the five major commercial banks (KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup) was recorded at 587.7427 trillion won. This represents an increase of 2.3015 trillion won compared to the end of March during the same period (585.4415 trillion won).

Among mortgage loans, policy loans are known to have driven the overall scale of household loans. An industry official explained, "If you look at the details of household loan increases in April, most of the growth came from policy loans," and added, "Since policy loans are intended for actual demand, it is difficult to regulate them."

In fact, looking at this year's mortgage loan status at the five major commercial banks, bank-originated loans are reported to be at a similar level to last year. A senior official at a commercial bank stated, "Except for KB Kookmin Bank, there is no net increase in household loans at the other four banks," and explained, "In the case of KB Kookmin Bank, there was surplus lending capacity at the end of last year, and as this volume was approved early this year, it was counted as a net increase."

The lifting of the Land Transaction Permission System (Toheoje) did not have a direct impact on loans in the Gangnam area, but appears to have stimulated loan demand in Seoul and the metropolitan area. On February 12, the Seoul Metropolitan Government removed 291 apartments in the Jamsamdaechung (Jamsil, Samseong, Daechi, Cheongdam) area from the list of land transaction permit zones.

According to the housing statistics for March announced by the Ministry of Land, Infrastructure and Transport the previous day, the total number of housing transactions in Seoul at the end of last month was 12,854. This is a sharp increase of 75.6% compared to the previous month (7,320 transactions). Compared to the same month last year (6,098 transactions), it surged by 110.8%. In particular, the increase in housing transactions in the Gangnam area of Seoul stands out. In March, the number of housing transactions in the four Gangnam districts was 3,238, up 92.7% from the previous month (1,680 transactions). Compared to the same month last year (1,188 transactions), it soared by 172.6%.

The financial industry is paying close attention to the upward trend in credit loans. In March, personal credit loans saw a slight decrease, and in February, the decline from the previous month was smaller. For April, there is reportedly a possibility of a net increase.

During the same period, the volume of personal credit loans at the five major commercial banks was 102.6876 trillion won, a sharp increase of 1.0356 trillion won compared to the previous month (101.6520 trillion won). Given the nature of credit loans, some repayments occur at the end of the month, so the scale of the increase may decrease slightly.

An industry official said, "It is estimated that individuals have taken out credit loans to invest in risky assets, resulting in an increase compared to the previous month," and added, "Depending on whether credit loans continue to increase, the rise in household loans could surpass the increase seen in February."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)