Bank of Korea and Financial Supervisory Service Release '2024 National Financial Literacy Survey'

Asset Growth Goals Such as 'Saving 100 Million Won' on the Rise... Financial Literacy Weakens Among People in Their 20s

"Preference for Saving Over Spending, Future Over Present" Financial Attitudes Show Improvement

Last year, the financial literacy score among Korean adults widened in terms of age and income gaps compared to the previous survey. Financial literacy improved among people in their 50s and high-income groups, driven by increased interest in retirement planning and asset management. However, financial literacy became more vulnerable among people in their 20s and low-income groups.

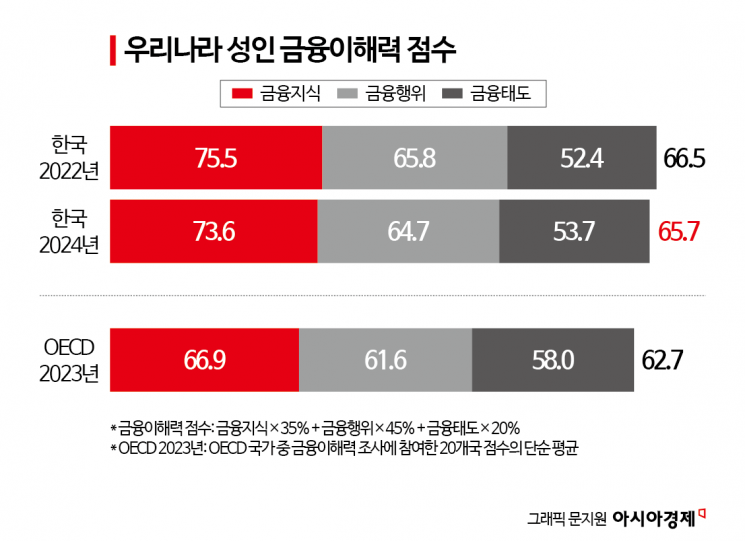

According to the "2024 National Financial Literacy Survey" released by the Bank of Korea and the Financial Supervisory Service on April 29, the financial literacy score of Korean adults (aged 18 to 79) was 65.7 points last year, down 0.8 points from 66.5 points in 2022. By category, financial attitude scored 53.7 points, up 1.3 points from 2022, while financial knowledge (73.6 points) and financial behavior (64.7 points) fell by 1.9 points and 1.1 points, respectively. However, the score still remains higher than the OECD average (62.7 points in 2023).

Financial literacy scores were higher among people in their 30s to 50s, those with annual incomes of 70 million won or more, and those with a college degree or higher. In contrast, people in their 20s, those in their 70s, people with annual incomes below 30 million won, and those with less than a high school education showed relatively low financial literacy. In particular, last year, financial literacy increased among people in their 50s (+0.9 points) and high-income groups (+0.1 points), who are more interested in retirement planning and asset management, compared to 2022. Meanwhile, it decreased among people in their 20s (-3.2 points) and low-income groups (-3.5 points), further widening the gap between groups.

The financial knowledge category dropped from 75.5 points in 2022 to 73.6 points last year, a decrease of 1.9 points. The most significant factor behind the overall decline in financial literacy was a sharp drop in understanding of "the impact of inflation on real purchasing power," which scored 56.6 points last year compared to 78.3 points in 2022. A Bank of Korea official explained, "Given that the score rose sharply in 2022 when inflation was high and returned to previous levels in this survey, it is highly likely that the decline in public interest in inflation due to slower inflation last year was reflected in the results."

In the financial behavior category, people were proactive in saving activities (98.0 points), resolving household budget deficits (88.7 points), and managing budgets (82.1 points). However, scores for financial management activities such as regular financial check-ups (43.4 points) and setting long-term financial goals (42.5 points) were lower than in 2022. Notably, among people in their 20s, the scores for financial check-ups (33.2 points) and financial goals (36.1 points) dropped significantly from 55.8 points and 48.0 points, respectively, in 2022, falling below the overall average. Among adults with long-term financial goals, the most important goals were home purchase (25.8%), asset growth (19.9%), and marriage funds (13.9%). In particular, the proportion of respondents who cited asset growth as a key financial goal?such as "saving 100 million won, investing in stocks, or accumulating gold"?rose sharply from 7.3% in 2022 to 19.9% last year.

In the financial attitude category, more respondents preferred saving over spending and favored the future over the present. However, among those who identified as risk-seeking?willing to tolerate some loss of principal when saving or investing?there was a stronger tendency to prioritize present-oriented living and consumption compared to risk-averse individuals, resulting in relatively lower financial attitude scores.

The digital financial literacy score among Korean adults was 45.5 points, up 2.6 points from 42.9 points in the 2022 survey. In particular, the scores of people in their 70s, low-income groups, and those with lower educational backgrounds rose significantly compared to 2022, narrowing the gap between groups.

A Bank of Korea official stated, "Despite the increase in financial attitude scores, there is still room for improvement. It is necessary to encourage better financial attitudes through financial education from a young age, before personal values are fully formed." The official added, "The Bank of Korea and the Financial Supervisory Service will work to improve educational accessibility for vulnerable groups such as the elderly and provide tailored financial education content that reflects the needs of learners." They also said, "We will actively produce and promote educational content on financial knowledge closely related to daily life, such as inflation and interest rates." The plan also includes actively utilizing one-on-one financial counseling for young people and the online platform 'e-Financial Education Center.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)