Hyundai and Kia's Share in Global Sales from China Drops to 3%

Market Share Once Near 10%, Now Down to 1%

In-Depth Analysis of Causes Behind Declining Market Share in China

Rapid Rise of Local Chinese Brands...Lack of Low-Priced SUVs

Failure of Localization Strategy...Delayed Response to New Energy Vehicles

"Visiting the Shanghai Motor Show for the first time in several years after the end of the COVID-19 pandemic was a shock. In a market dominated by Chinese brands, I was at a loss about how to compete... It was truly overwhelming."

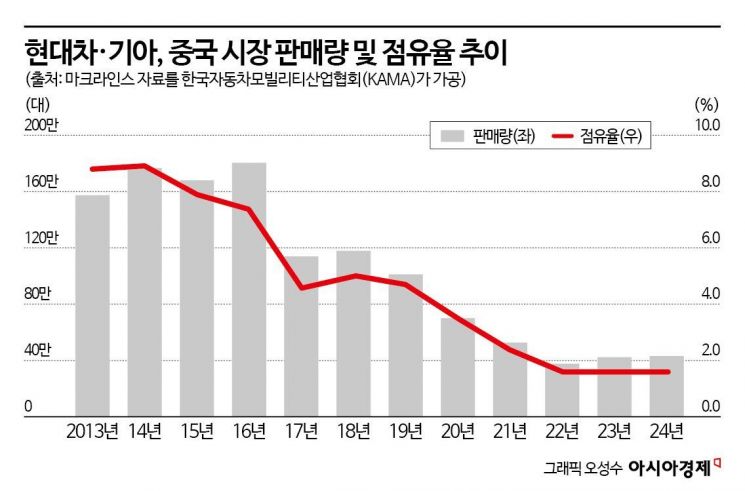

This is how one executive from Hyundai Motor Group described the situation in a private conversation. For Hyundai Motor Group, the Chinese market has become a sore spot. Up until 2016, China accounted for 23% of Hyundai and Kia's global sales, but by last year, this share had shrunk to just 3%. In terms of units sold, sales peaked at 1.8 million vehicles in 2016 and have been on a steady decline ever since. In 2024, Hyundai and Kia's sales volume in China is expected to be around 430,000 units. Market share, which once approached 10%, has now dropped to just 1.6%.

The sharp decline in Hyundai and Kia's sales in China began with the 2017 THAAD (Terminal High Altitude Area Defense) incident. At that time, the Chinese government restricted the entry of Korean companies into China, and a wave of anti-Korean sentiment among the public triggered a drop in market share. In addition, the COVID-19 pandemic gave Chinese local companies time to accelerate their transition to electric vehicles. While global automakers were forced to shut down factories worldwide due to COVID-19, Chinese factories continued to operate, and the patriotic consumption tendencies of Chinese consumers, who were effectively locked down, grew even stronger. With the rapid rise of Chinese electric vehicle manufacturers, Hyundai and Kia's market share in China has ultimately shrunk to just 1% in 2024.

Let us rewind the clock for a moment. It is clear that the decline in Hyundai and Kia's market share accelerated after the THAAD incident. However, signs of this decline were already apparent around 2015, even before the THAAD crisis. This is why experts argue that a more complex and in-depth analysis is needed to understand the fundamental reasons why Hyundai and Kia lost their competitiveness in China.

Hyundai Falls Behind Chinese Local Brands...Lack of Low-Priced SUVs

After entering China as a joint venture in 2002, Hyundai enjoyed rapid growth until 2010. Beijing Hyundai, a joint venture established by Hyundai and BAIC (Beijing Automotive Group), maintained double-digit growth rates and reached annual sales of 1 million units in 2013. This was the fastest achievement among foreign automakers.

Beijing Hyundai aggressively increased sales to 1.76 million units by 2014, but in 2015, sales declined to 1.67 million units, marking the first decrease in eight years. In the first half of 2015, Beijing Hyundai lost its top-five position in the Chinese market to Changan Automobile. Headlines from the time included: "Hyundai Overtaken by Chinese Local Brands After Six Years" (Asia Economy), "Hyundai Loses Ground to Local Brands in China After Six Years...The Inevitable Has Come" (Yonhap News), and "Hyundai and Kia's Global Market Share Stagnates at 8% for Five Years...Chinese Brands Grow" (Chosun Biz).

The key phrase here is "the growth of Chinese local brands." In 2015, overall passenger car sales in China grew by about 6%, but sales of local Chinese brands grew by more than twice that rate, at 15%. In the past, the Chinese market was dominated by foreign brands from Germany, Japan, the United States, and Korea. Foreign brands held an advantage over Chinese brands in terms of technology, brand recognition, and production efficiency. As a result, the Chinese government prohibited foreign brands from entering the market independently, requiring them to form joint ventures with Chinese companies and transfer technology in order to profit in China.

Thanks to these protectionist policies, the technological capabilities of Chinese companies gradually improved. Around 2015, local brands began to gain recognition from Chinese consumers in terms of vehicle development and product quality. By aggressively recruiting famous designers from overseas, Chinese brands also began to receive positive reviews for their designs. In particular, Chinese brands pursued a differentiated strategy by expanding their lineup of low-priced sport utility vehicles (SUVs). In 2015, four out of the ten best-selling SUVs in China were from Chinese brands.

In contrast, at that time, Hyundai and Kia had a weak SUV lineup globally. Although they offered local strategic SUVs such as the ix35 and ix25 in China, their main models remained sedans like the Avante (Langdong) and Sonata. Chinese companies released new SUV models at half the price of Hyundai's vehicles. For example, the new Hyundai Tucson was priced at 27 million KRW (150,000 RMB) at the exchange rate of the time, while Chinese SUV models were priced between 10 million and 12 million KRW (60,000 to 70,000 RMB), or about half as much.

The rapid rise of Chinese brands also had a direct impact on Hyundai's market share from a brand positioning perspective. Among foreign brands, Hyundai was known as the best value-for-money option among Chinese consumers. Previously, Chinese brand vehicles lagged significantly in technology, design, and safety, so Chinese consumers had little choice but to opt for foreign brands. Among these, Hyundai was favored by the price-conscious Chinese middle class. However, around 2015, as the product quality of Chinese brand SUVs improved rapidly, Hyundai's position in the market became ambiguous. Hyundai lost out to Chinese brands in terms of price competitiveness, to German brands in terms of premium brand image, and to Japanese brands in terms of technology and durability.

Failure of Localization Strategy...Joint Venture Strained by Supplier Issues

"At the time, there was talk in the industry that Hyundai's partner suppliers who entered China together were like 'golden geese that laid golden eggs.' There was no way the Chinese government wouldn't have heard such rumors."

A senior Hyundai official familiar with the situation made this diagnosis. This relates to the second reason for Hyundai's declining position in China: the failure of its localization strategy. Up until the mid-2010s, Hyundai and Kia aggressively expanded their production facilities in China. As of 2016, China accounted for 23% of Hyundai and Kia's global sales, and an even higher share of their revenue and profits.

After quickly entering the top five among Chinese automakers, Hyundai aimed for the top three and made large-scale investments in China. In addition to three plants in Beijing, Hyundai operated two more in Changzhou and Chongqing, bringing its Chinese production capacity to 1.65 million units. Including Kia's Yancheng plant, annual production capacity reached 2.5 million units. About 150 Hyundai partner suppliers who entered China together also enjoyed the benefits of increased production. Although Hyundai sourced some parts from Chinese local suppliers, at the time, most key parts were supplied by Korean companies due to the technology gap.

A representative from Beijing Hyundai participating in the 2024 Beijing International Motor Show is announcing a new car model. Photo by Hyundai Motor Company

A representative from Beijing Hyundai participating in the 2024 Beijing International Motor Show is announcing a new car model. Photo by Hyundai Motor Company

There were no problems when the market was strong. However, when the THAAD incident strained relations between the two countries and sales plummeted, the excessively high profit margins of Korean parts suppliers became a major issue. This problem was so serious that it even threatened the joint venture with BAIC. BAIC had consistently demanded that Hyundai switch to local Chinese suppliers, but claimed that these requests were ignored. In September 2017, BAIC demanded a 20% price cut from Korean suppliers and even delayed payments. At the time, domestic media criticized this as part of the Chinese government's retaliatory measures over THAAD and as nitpicking.

However, I have a different view. I believe that Hyundai and Kia's internal control systems failed to function properly due to their intoxication with rapid market share growth in China. There was a lack of consideration as to whether the profitability of Korean suppliers was at an appropriate level and how to build a local supply chain to maintain trust with the joint venture partner.

In China, while the power of networks through "guanxi" is important, the market is even more calculating than capitalist countries when it comes to capital. Since the early 2000s, the Chinese government has actively attracted foreign investment in the automotive industry for its own reasons. It relaxed regulations and provided economic incentives to encourage the transfer of advanced technology, create local jobs, and establish a manufacturing base centered on the automotive industry. At the same time, it regulated that foreign capital could not hold more than a 50% stake in joint ventures. This was a kind of warning to prevent foreign companies from taking profits earned in the Chinese market out of the country.

From this perspective, Hyundai and Kia's initial localization strategy in China was overly simplistic. They lacked the localization capability to analyze the Chinese government's intentions and the nature of Chinese capital from multiple angles. The aforementioned senior official commented, "Looking back, I wonder what would have happened if we had built more trust with BAIC and operated our business differently. The THAAD incident was merely the trigger for conflict with the joint venture, not the fundamental cause."

Delayed Response to New Energy Vehicle Transition

Another reason for Hyundai and Kia's declining market share in China lies in the structural changes in the Chinese market. The companies failed to keep up with China's rapidly changing policies and consumer demands, which were shifting toward New Energy Vehicles (NEVs). Since the 1990s, the Chinese government has made electric vehicles a key national research focus and has shown a strong commitment to nurturing the industry. In the 2000s, the government set the direction for industrial policy, established standards for the electric vehicle industry, and fostered the development of core component businesses to create an EV ecosystem. By the 2010s, China's electric vehicle industry began to flourish. Sales of NEVs in China grew from 13,000 units in 2012 to 9.5 million units in 2023. The share of NEVs in new car sales also rose from about 1% in 2015 to 31% in 2023.

In the internal combustion engine market, China had been a latecomer, but in the newly leveled playing field of electric vehicles, China began to take the lead. In contrast, Hyundai and Kia were unable to accelerate their electrification transition as quickly as Chinese local brands and naturally fell behind. At the 2015 Shanghai Motor Show, when the Chinese EV market was just beginning to emerge, 103 NEV models were unveiled, and Chinese local companies introduced 51 of them, accounting for 49%. While Hyundai and Kia also showcased eco-friendly models such as the Sonata Plug-in Hybrid (PHEV) and Soul Electric Vehicle (EV), these were not their main models.

At the time, it was difficult to predict that electric vehicles would become mainstream in China. In contrast, emerging brands such as BYD revealed major electric vehicles and electrification visions, establishing their presence in the market. In the next installment, we will analyze in greater depth the background behind the rapid rise of Chinese local companies, the current state of the Chinese market, and Hyundai Motor Group's response strategies.

In April 2017, a Kia model introduced the compact SUV Pegasus at the Shanghai Motor Show in China. Photo by Kia

In April 2017, a Kia model introduced the compact SUV Pegasus at the Shanghai Motor Show in China. Photo by Kia

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)