Financial Services Commission to Announce Equity Mortgage Roadmap in June

New Housing Finance Structure Proposed for Household Debt Management

Similar Systems Introduced in the Past, but with Limited Success

"Demand Varies with Economic Cycle, Making Risk Management Design Crucial"

Discussions are ongoing regarding the introduction of an "equity mortgage," a system in which a policy financial institution participates as an equity investor when an individual purchases a home. The Financial Services Commission plans to announce a detailed roadmap for the equity mortgage policy by June. While there are positive aspects, such as stabilizing housing for the middle class, experts point out that a multifaceted review is needed for the system to take root in the market, including considerations of demand changes according to the economic cycle and securing funding.

Heo Yoonkyung, a research fellow at the Construction Industry Research Institute, explained in a report titled "Equity Mortgage and Analysis of Korean-Style New REITs" that "despite its various advantages, this system has not been activated in the Korean housing market." She added, "When the economy is strong, demand is concentrated on direct sales, and when the economy is weak, the likelihood of sharing equity with the public sector increases. Therefore, risk management design for such products is a key challenge."

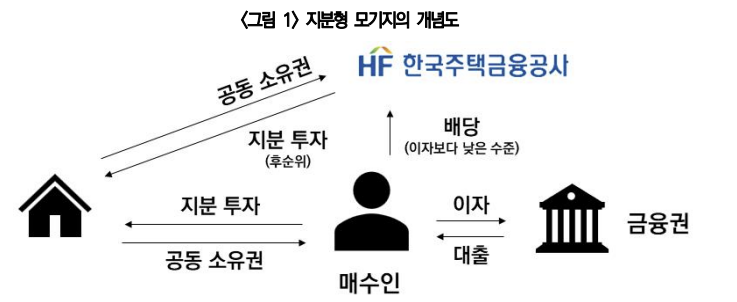

The Financial Services Commission mentioned the need for introducing equity mortgages in March and announced that it would unveil a detailed policy roadmap by June. Equity mortgages were suggested as a solution to address issues such as household debt, asset inequality, and improving access to the housing market. One proposed structure is for the Korea Housing Finance Corporation to bear losses first in the event of a loss, meaning the public sector would invest as a form of subordinated equity.

Equity Mortgage Concept Diagram. Excerpt from Construction Industry Research Institute Trend Briefing

Equity Mortgage Concept Diagram. Excerpt from Construction Industry Research Institute Trend Briefing

In November last year, the Bank of Korea also proposed the "Korean-Style New REITs," which have a similar purpose to equity mortgages. The aim was to convert housing-related funding from loans to investments in order to curb the increase in household debt. In the Korean-Style New REITs model, homebuyers participate as investors in the REITs and become shareholders with voting rights. If desired, they can invest in the REIT using their rental deposit and reside in the property. Funding is raised through public offerings and borrowing, and the REIT can acquire housing assets and even go public. Individual investors can secure dividends from profits, live in the property at a rent lower than the market price, and maintain their qualification as non-homeowners.

The Construction Industry Research Institute diagnosed that the financial authorities' proposal for a housing finance structure involving equity participation stems from concerns over the surge in household debt. As of the end of 2024, the household debt-to-GDP ratio stands at 91.7%, the second highest in the world. Most of the recent increase in household debt has originated from real estate, and corporate loans are also highly concentrated in the real estate sector, which is evaluated as having a significant negative impact on securing long-term growth momentum.

Heo emphasized, "Although various systems have been implemented so far in which individuals and the public sector share equity, there has been little public awareness or acceptance of sharing profits with the public sector during periods of rising home prices, making it difficult for such systems to take root."

Up to now, several systems such as land leasehold housing, shared mortgages, equity accumulation housing, and profit-sharing housing have been introduced, but none have been pursued continuously. For example, SH Corporation supplied land leasehold housing in areas such as Godeokgangil and Magok through pre-subscription, but the possibility of additional supply outside these complexes is slim. In the case of equity accumulation housing, project delays mean that 865 units are scheduled to be sold in Gwangmyeonghakon, Gyeonggi Province this year. The shared mortgage announced in 2013 became virtually defunct as the housing market recovered and demand faded.

The Construction Industry Research Institute pointed out that, given the lack of activation of various alternative housing finance products in the Korean housing market, a multifaceted review is needed, including the principles of the housing market and funding procurement. Risk management design and securing cost competitiveness are also important challenges.

Heo noted, "The REITs structure faces the challenge of attracting investors in Korea's rental market, which is centered on Jeonse and makes dividend distribution difficult." She added, "The public sector must also establish stable funding measures to support equity investments that could incur losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)