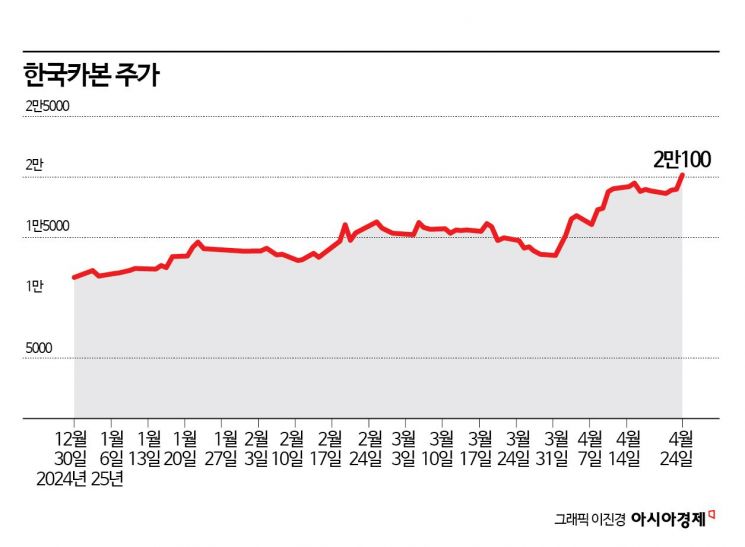

Stock Price Up 70% This Year

Produces LNG Insulation, a Key Component for LNG Carriers

Estimated Sales of 847.4 Billion Won and Operating Profit of 95.3 Billion Won This Year

Korea Carbon surpassed a market capitalization of 1 trillion won for the first time since its listing. Expectations that the company's performance will improve this year, driven by increased demand for liquefied natural gas (LNG) insulation materials, have led to a rise in corporate value.

According to the financial investment industry on April 25, the share price of Korea Carbon has risen by 71.1% so far this year. Its market capitalization has grown to 1.043 trillion won. Institutional investors have purchased 42.5 billion won worth of Korea Carbon shares this month, driving the stock price upward.

Founded in 1984, Korea Carbon is a composite materials manufacturer. The license for LNG cargo containment technology is exclusively held by the French engineering company GTT. Korea Carbon, which has received certification to produce GTT's membrane-type insulation materials, supplies domestic and international shipbuilders constructing LNG carriers. Last year, the company recorded sales of 741.7 billion won and operating profit of 45.4 billion won. Compared to the previous year, sales increased by 24.8% and operating profit by 176.0%.

Last month, Korea Carbon raised 40 billion won for facility investment by issuing exchangeable bonds (EB) and convertible bonds (CB). Through capacity expansion, the company plans to secure new foaming lines capable of handling nearly 40 vessels. By replacing outdated foaming lines, Korea Carbon aims to reduce defect rates and improve productivity. The fact that the bonds were issued at a 0% coupon rate reflects high expectations for the company's growth. Han Seunghan, a researcher at SK Securities, said, "Since there were almost no insulation material orders last year, Korea Carbon has secured more delivery slots for 2027 compared to competitors," and added, "Given the company's tendency to provide conservative performance forecasts, it is expected to achieve order results that exceed targets."

Last month, Korea Carbon signed a contract with HD Hyundai Heavy Industries to supply cryogenic insulation materials for LNG carrier cargo holds, worth 263.6 billion won. The contract runs until December 31, 2027. As orders increase, sales are expected to rise and profit margins to improve, resulting in a rapid increase in operating profit. SK Securities forecasts that Korea Carbon's operating margin will improve from 6.1% last year to 11.2% this year and 13.0% next year. The company is estimated to achieve sales of 847.4 billion won and operating profit of 95.3 billion won this year.

In the first quarter of this year, Korea Carbon posted consolidated sales of 214.3 billion won and operating profit of 22.4 billion won. Compared to the same period last year, these figures increased by 17.3% and 758.2%, respectively. Since a fire at its factory in 2023, the company has continued to invest in facilities. As process efficiency improves, profits are rising rapidly.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)