KB Completes Share Buyback Ahead of Schedule

Hana Executives Continue Share Purchases,

Demonstrating Commitment to Responsible Management

▲ (From left) Jonghee Yang, Chairman of KB Financial Group; Okdong Jin, Chairman of Shinhan Financial Group; Youngju Ham, Chairman of Hana Financial Group; Jongryong Lim, Chairman of Woori Financial Group

▲ (From left) Jonghee Yang, Chairman of KB Financial Group; Okdong Jin, Chairman of Shinhan Financial Group; Youngju Ham, Chairman of Hana Financial Group; Jongryong Lim, Chairman of Woori Financial Group

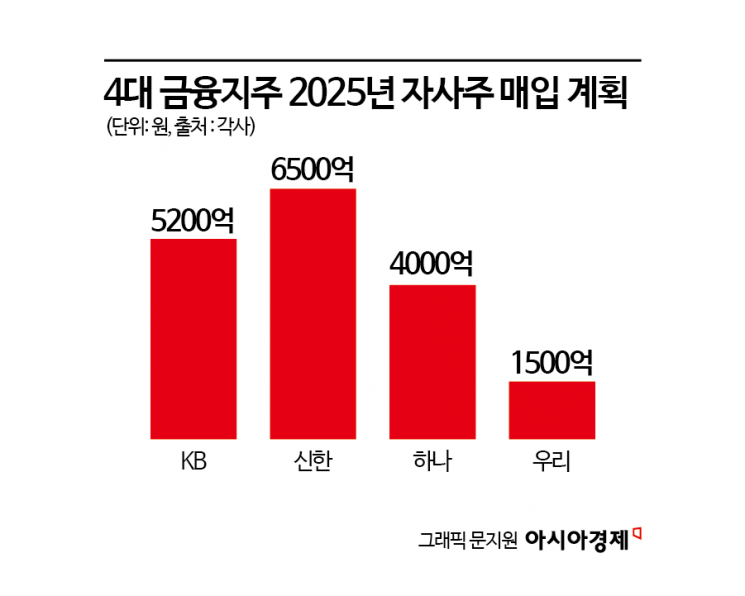

As the first quarter earnings announcements approach, the four major financial holding companies (KB, Shinhan, Hana, and Woori) are accelerating their share buyback programs. This is part of their value-up (corporate value enhancement) plans, which have emerged as a key priority since last year. With increasing volatility in the financial markets due to political instability and the onset of a tariff war triggered by Trump, management is directly participating in share buybacks to demonstrate their commitment to responsible management to investors.

According to the Financial Supervisory Service's electronic disclosure system on April 24, KB Financial Group acquired a total of 6,401,349 shares of its own stock from February 6 to April 14. This represents 1.6% of the total number of shares issued. The average purchase price was 81,233 won per share, with a total purchase amount of 520 billion won. KB Financial Group had initially announced plans to buy back 520 billion won worth of shares by the end of the first half of the year, but completed the program ahead of schedule. KB Financial Group also disclosed that it will cancel all of these shares on May 15. Jonghee Yang, Chairman of KB Financial Group, owns 5,914 shares, representing 0.002% of the total shares issued.

Hana Financial Group is notable for the successive share purchases by its management. After Youngju Ham, Chairman of Hana Financial Group, purchased 5,000 shares last year, executives have joined the share buyback movement this year, further demonstrating their commitment to responsible management. Just this month, Vice Chairman Seungyeol Lee purchased an additional 2,400 shares, bringing his total to 7,200 shares; EGS Group Head (Vice President) Jungtaek Oh purchased 600 shares; Money Market Group Head Beomjun Cho purchased 500 shares; and Chief Risk Officer (CRO) Jaeshin Kang purchased 500 shares. The total number of shares purchased by Hana Financial Group executives amounts to 4,000 shares. Youngju Ham, Chairman of Hana Financial Group, owns 15,132 shares, representing 0.005% of the total shares issued, the highest among the four major financial group chairmen. Hana Financial Group has announced a plan to achieve a 50% shareholder return rate by 2027.

Shinhan Financial Group has announced plans to reduce the number of shares in circulation to 450 million by buying back and canceling more than 3 trillion won worth of shares by 2027. For the first half of this year, the company plans to buy back 650 billion won worth of shares. As of April 21, Shinhan Financial Group had purchased a total of 9,617,700 shares, worth 457.9 billion won. Okdong Jin, Chairman of Shinhan Financial Group, owns 18,937 shares, representing 0.004% of the total shares issued.

Woori Financial Group plans to buy back and cancel 150 billion won worth of shares this year. As of April 21, the company had purchased 3.4 million shares worth 55.6 billion won. Although this is smaller in scale compared to other financial holding companies, Woori Financial Group intends to steadily increase the amount. Jongryong Lim, Chairman of Woori Financial Group, owns 10,000 shares, representing 0.001% of the total shares issued.

The main reason these major financial holding companies are competitively buying back their own shares is as part of their 'value-up program' plans. Since 2023, they have been consistently working to enhance market value, but following the December 3, 12·3 Martial Law Incident last year, the market capitalization of the four major financial holding companies plummeted by approximately 14 trillion won within a week, causing significant damage. This year, increased exchange rate volatility due to the Trump-triggered tariff war has led to sharp fluctuations in the stock market, and share prices have yet to recover. In response, the chairmen of the financial holding companies are not only buying back shares but also sending shareholder letters to foreign investors and participating directly in investor relations (IR) meetings in their efforts to enhance corporate value.

An official from one of the financial holding companies stated, "It is expected that the financial holding companies will deliver solid results in the first quarter this year, so the focus of the first quarter earnings announcements is likely to be on shareholder returns rather than earnings themselves," and added, "The recent share buybacks by financial holding companies demonstrate their commitment to faithfully executing their value-up plans for investors."

Meanwhile, the four major financial holding companies are scheduled to announce their first quarter earnings, starting with KB Financial Group on April 24, followed by Shinhan, Hana, and Woori Financial Group on April 25.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)