Kim Byunghwan, Chairman of the Financial Services Commission, Visits the United States

Seeking to Boost Bio Investment through the Advanced Strategic Industry Fund

Discussions on Establishing the Advanced Strategic Industry Fund Suspended

Promoting Investment in the Korean Stock Market to Overseas Investors

Kim Byunghwan, Chairman of the Financial Services Commission, is attending a regular press briefing held at the Government Complex Seoul in Jongno, Seoul on the 26th, responding to questions from the press. 2025.3.26 Photo by Jo Yongjun

Kim Byunghwan, Chairman of the Financial Services Commission, is attending a regular press briefing held at the Government Complex Seoul in Jongno, Seoul on the 26th, responding to questions from the press. 2025.3.26 Photo by Jo Yongjun

Kim Byunghwan, Chairman of the Financial Services Commission, visited the biocluster in Boston, United States, to examine the investment capabilities of private companies and explore ways to vitalize bio investment through measures such as the 'Advanced Strategic Industry Fund' in the future. This initiative stems from the assessment that policy-based financial support is essential for the bio industry, which requires long-term investment.

On the 23rd, the Financial Services Commission announced that Chairman Kim visited the U.S. branch of the Korea Health Industry Development Institute in Boston and held a roundtable with local investment firms and Korean bio companies operating in the region.

The reason Chairman Kim visited the Boston biocluster was to benchmark strategies for expanding investment in the domestic bio industry. According to the Ministry of SMEs and Startups, the size of domestic venture investment dropped sharply from 15.9 trillion won in 2021 to 12.5 trillion won in 2022, 10.9 trillion won in 2023, and 11.9 trillion won in 2024. During the same period, investment in the bio industry also shrank from 3.4 trillion won to 1.9 trillion won, 1.7 trillion won, and 1.8 trillion won, respectively.

The Boston biocluster began to take shape in 1977 when the Cambridge City Council legalized DNA recombination experiments. This event marked the beginning of the biotechnology industry in the United States, and today, the area has grown into the world’s largest bio venture ecosystem, comprising more than 1,000 biotech companies, research institutes, hospitals, and universities.

In the case of the Boston biocluster, global pharmaceutical giants with a deep understanding of the industry directly participate and actively supply long-term venture capital, which plays a crucial role in sustaining the ecosystem. Such venture capital is invested not only for the pharmaceutical companies’ own research and development purposes but also for mergers and acquisitions (M&A) of bio venture companies.

Chairman Kim pointed out, "While Korea’s venture investment peaked in 2021 and 2022, it has since contracted due to the impact of global high interest rates. In particular, the bio sector, which requires sustained long-term investment, has experienced significant volatility." He added, "Investment in the bio sector faces difficulties in capital recovery, which raises concerns about the contraction of the bio venture ecosystem."

Following the roundtable, Chairman Kim visited AVEO Oncology, a U.S. company acquired by LG Chem. The purpose was to learn about cases of domestic companies entering the Boston market and to exchange views on policy tasks to support the domestic bio venture ecosystem.

At the meeting, participants noted that in the bio industry, not only is there significant uncertainty regarding the commercial viability from the early development stage, but it also takes a long time from initial investment to capital recovery, making continuous long-term venture capital investment necessary. In particular, participants stated that if public sector funds could play a more active priming role, private capital would be more actively attracted.

Chairman Kim stated, "Going forward, we will expand public sector capital capable of long-term patience in advanced strategic industries through vehicles such as the Advanced Strategic Industry Fund, and we will promote policies to vitalize venture investment by strengthening investment information infrastructure to support private investment capabilities."

He continued, "Since the bio industry is highly uncertain and capital recovery takes a long time, it is necessary for investors to participate based on their expertise, investing according to the nature of the funds and the stage of growth. We will support the formation of close networks among experts so that they can complement each other's strengths and create a synergistic investment environment."

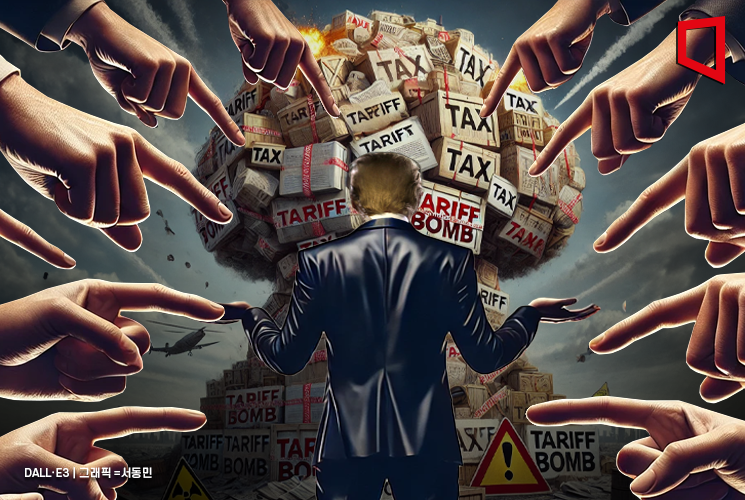

Previously, the Financial Services Commission announced plans to establish the Advanced Strategic Industry Fund to strengthen support for domestic companies as global competition intensifies in advanced strategic industries such as semiconductors, bio, batteries, and robotics following the launch of Donald Trump's second administration. As a result, the National Assembly's Political Affairs Committee also proposed a bill to establish the Advanced Strategic Industry Fund. However, discussions for passing the bill have been suspended ahead of the presidential election.

Meanwhile, after visiting the Boston biocluster, Chairman Kim traveled to New York, where he met with Stephen Schwarzman, Chairman of Blackstone. He also held a roundtable with Korean financial companies based in New York and had a private meeting with senior executives at Morgan Stanley Capital International (MSCI).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)