KOSDAQ-Listed Pino Accelerates Entry into Korea

CNGR of China Becomes Major Shareholder

Acquired in June Last Year, Rapid Supply Contracts

Aiming to Bypass Tariff Barriers and Expand Exports via Korea

Chinese companies are seeing results in the Korean market with their strategies to circumvent US-imposed tariff barriers. By increasing transactions with both domestic and international companies and focusing on opening new sales channels, they are also signaling intentions to expand their businesses by establishing their own production lines. However, as the US has put measures to block "circumvented production by Chinese companies" on the agenda in ongoing reciprocal tariff negotiations with other countries, there are concerns that such attempts may face limitations.

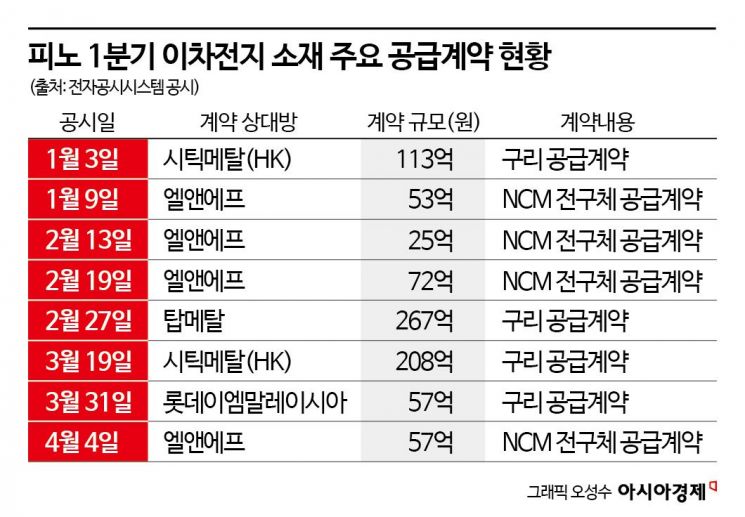

According to industry sources on April 23, the Korean subsidiary of CNGR, the world’s leading precursor manufacturer from China, recorded 78.4 billion KRW in revenue from secondary battery material supply contracts in the first quarter. This represents a nearly 18-fold surge compared to the total revenue of approximately 4.3 billion KRW in the first quarter of last year.

What stands out is that the company’s name, largest shareholder, and business area all changed before and after this performance improvement. Until the first half of last year, the company operated under the name Skymoons Technology, producing telecommunications equipment. In June last year, it was acquired by CNGR from China, which reorganized its main business into the new energy sector. As of the end of March, CNGR holds a 44.3% stake as the largest shareholder.

After the acquisition, the company transitioned into a secondary battery material company and has already signed 14 supply contracts this year alone, entering a full-fledged order-taking phase. It has mainly supplied nickel, cobalt, and manganese (NCM) ternary precursors or copper to Korean company L&F, Chinese company Citic Metal (Zhongxin Jinshu), and Lotte EM Malaysia, a subsidiary of Lotte EM Global based in Malaysia. Precursors are the main raw material for cathode materials in secondary batteries and are a key material that determines battery performance and price, but most domestic companies rely heavily on imports for these materials.

The company openly emphasizes that Pino can benefit indirectly from the US-China tariff conflict, highlighting its identity as a "circumvented base." The largest shareholder, CNGR, procures raw materials from its global production bases in Finland, Morocco, Argentina, and Indonesia, and strategically increases exports to the US by utilizing global trading centers in Hong Kong and Singapore. NCM precursors are a core business area in which CNGR has maintained the number one global market share for five consecutive years. In practice, when a customer places an order for precursors, Pino commissions CNGR to procure and process the raw materials. CNGR sources the raw materials from mines it owns overseas, such as in Indonesia, produces the precursors, and then Pino delivers them to the customer, according to the company.

A company representative stated, "We are not just a simple export intermediary, but will secure production facilities that meet the US's requirements for non-Chinese materials," adding, "We will minimize Chinese capital through various collaborations with Korean partners." The representative further explained, "Pino in Korea can become a key base for exporting secondary battery materials to the US."

The company also plans to expand cooperation with the POSCO Group. In December last year, CNGR acquired a 29% stake in C&P New Materials, a joint venture established by CNGR and POSCO Future M for domestic precursor production, with 80% and 20% stakes, respectively. The company stated, "If we expand the ternary precursor business and secure additional customers, sales could improve rapidly, and we could expect annual revenue of 1 trillion KRW by 2027." They added, "In particular, we will activate the operation of the joint venture with POSCO Group in 2027, establish production lines in stages, and from 2029, expand the value chain by building recycling plants and launching new product lines such as LFP (lithium iron phosphate)."

However, the fact that the US is currently considering measures to block "circumvented production by Chinese companies" in ongoing reciprocal tariff negotiations with various countries is seen as a risk. Depending on the details of origin rules negotiations for specific items, the impact could be unavoidable. Kang Insu, professor of economics at Sookmyung Women's University, explained, "The standard for sanctions on circumvented exports will depend on the origin rules negotiations, which are based on the value added." The US previously strengthened origin rules when it revised the North American Free Trade Agreement (NAFTA) to the United States-Mexico-Canada Agreement (USMCA) during the first Trump administration. Under NAFTA, 62.5% of auto parts had to be made in North America to receive tariff-free benefits, but the new agreement raised this requirement to 75%.

However, experts generally agree that it is difficult to predict the outcome in the battery sector, where China holds a dominant position. Professor Kang stated, "In the case of batteries, China's market share in core materials is so overwhelming that it is difficult to achieve a complete separation," adding, "During the tariff negotiation process, not only China but also major countries such as Europe and Japan are likely to intensify efforts for domestic production. Therefore, it will not be possible to completely sever the battery ecosystem dominated by China, including the preemption of mining rights in various countries."

Previously, CATL, the world’s largest battery seller from China, also established a subsidiary in Korea in January and began full-scale talent recruitment. The company is expected to target the domestic market with its main products, such as prismatic LFP batteries. In particular, with the passage of the 11th Basic Plan for Electricity Supply and Demand (the "Electricity Plan") in February, the company is expected to actively enter the energy storage system (ESS) sector, which is on the verge of market expansion. Industry insiders assess that CATL's entry into Korea is aimed at circumventing US tariff barriers against China and securing talent and industrial technology.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)