Emart launches Beyond's second brand cosmetics line

"To strengthen customer attraction... Considering brand expansion"

Consumers flock to ultra-low-cost products under 5,000 won

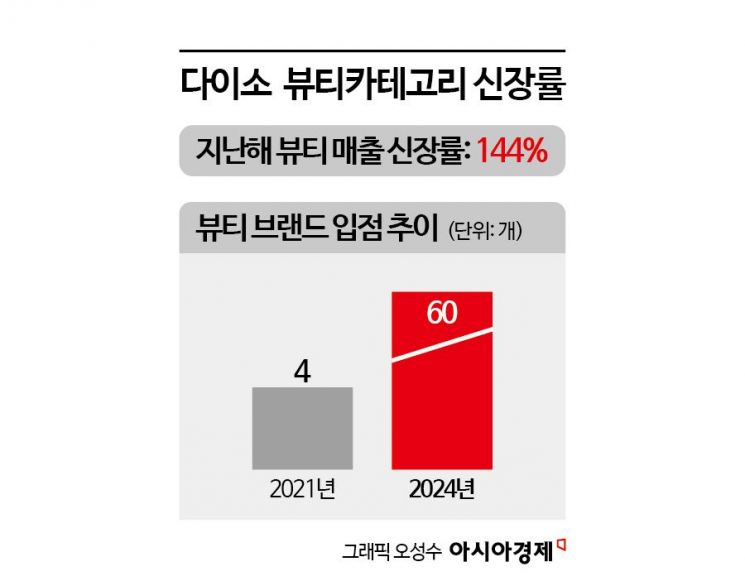

Daiso's beauty product sales grew 144% last year

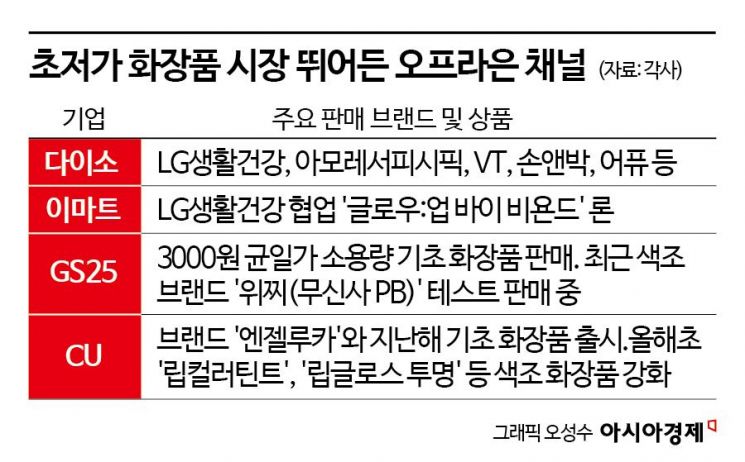

The "ultra-low-cost cosmetics" market has emerged as a new battleground in the offline retail industry. Following convenience stores, Emart, the leading hypermarket chain, has entered the ultra-low-cost cosmetics market previously led by Daiso. As consumer activity has shifted online, cosmetics priced under 5,000 won have become a key competitive advantage for attracting customers to offline stores.

According to the retail industry on April 21, Emart has partnered with LG Household & Health Care to launch an exclusive brand, "Glow Up by Beyond," introducing eight new products (five skincare items and three special care products). The new products contain skin elasticity ingredients such as collagen and bakuchiol, as well as brightening ingredients like glutathione, making them effective for "slow aging." All products are uniformly priced at 4,950 won. These items are also available on Emart's own online mall, SSG.com.

Emart launches 4,950-won skincare line in partnership with LG Household & Health Care

Glow Up by Beyond is the second brand (secondary line) of "Beyond," which LG Household & Health Care has operated since 2005. With a focus on naturalism, it has mainly sold products such as shampoo, body emulsion, and aqua cream. Considering that Beyond has had major retail locations in hypermarkets, the two companies reportedly chose Beyond as their collaboration brand. A Beyond representative stated, "We targeted customers seeking high cost-effectiveness slow-aging products," and added, "We plan to introduce additional new products, such as soothing and moisturizing lines, taking into account seasonal characteristics."

This collaboration was initiated when Emart first proposed low-priced products to LG Household & Health Care. An Emart representative explained, "We proceeded with this due to the rapidly growing consumer interest in ultra-low-cost cosmetics," and added, "We will consider collaborating with other brands after reviewing consumer responses and market conditions."

Emart has been working to enhance its core competitiveness since last year through "ultra-low-cost strategies" and "store renovations" in response to the ongoing sluggishness in the hypermarket sector. This cosmetics collaboration is also aimed at attracting more customers by offering affordable price points. Currently, cosmetics priced below 5,000 won are the most powerful category for drawing consumers to offline stores. They are also effective in targeting a wide range of female customers from teenagers to those in their 40s. Daiso, for example, has achieved rapid annual growth by offering cosmetics at low prices such as 1,000 won, 2,000 won, 3,000 won, and 5,000 won.

Last year, Daiso recorded sales of 3.9689 trillion won and operating profit of 377.1 billion won, representing year-on-year increases of 14.7% and 41.8%, respectively. This was driven by the explosive popularity of brand products such as "VT (Riddle Shot)," "Son&Park (Color Balm)," "Tag (Shading, Cushion, etc.)," and "Amorepacific (Mimo by Mamonde Skincare)," which frequently sold out. The sales growth rate of beauty products at Daiso approached 144%. The number of cosmetic brands at Daiso has reached 60, with around 500 different products.

Convenience stores emerge as Daiso rivals..."Consumer choices will expand"

Convenience stores are also launching ultra-low-cost cosmetics in succession. In the past, convenience store cosmetics were mainly purchased for urgent needs, such as when customers were short on time or traveling, with a focus on cleansing foam, deodorant, and lip balm. However, recently, they have been expanding their product lines by emphasizing affordable prices.

As a result, GS25's cosmetics sales growth rate last year approached 46%. This is a significant increase compared to 22% in 2022. The strong sales of basic cosmetics (such as Dewytree and Mediheal) launched last year at 3,000 won contributed to this growth. On April 10, GS25 also began test sales of color cosmetics (five Glow Up Tint products and three Lip & Cheek products) from Musinsa's private brand, Wechii, priced at 13,000 won and 14,000 won, respectively. Having found success with basic cosmetics, GS25 is now expanding its category to color cosmetics. A GS25 representative stated, "We have set up beauty-specialized displays featuring Wechii products at 20 key locations, including New Annyeong Insadong Deom and GS Gangnam," and added, "By expanding from basic to color cosmetics, we will strengthen our competitiveness in the beauty market and establish ourselves as a neighborhood beauty platform."

CU partnered with the cosmetics brand Angel Luca last September to launch three basic cosmetics (serum, water-glow pack, and moisturizing cream), and in January this year, it introduced color cosmetics as well. Products such as "Lip Color Tint" and "Lip Gloss" are packaged for convenience and are all priced at 3,000 won.

Industry experts expect that as competition intensifies among channels to dominate the ultra-low-cost cosmetics market, consumer choices will expand. While ultra-low-cost products were previously limited to small beauty brands, recently, large corporations such as LG Household & Health Care and Amorepacific have also become actively involved. Consumers can now select cosmetics that suit their skin type. Lee Eunhee, a professor of consumer studies at Inha University, stated, "As economic conditions worsen, more consumers are gravitating toward ultra-low-cost products," and explained, "If the ultra-low-cost cosmetics market continues to grow, polarization may occur between expensive premium cosmetics and ultra-low-cost cosmetics."

The model is looking at Wechii products in front of the GS25 beauty specialty display. Provided by GS25.

The model is looking at Wechii products in front of the GS25 beauty specialty display. Provided by GS25.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)