Estimated Unjust Profits Exceed 500 Million KRW

"Caution Advised for Sharp Price Fluctuations in Specific Virtual Assets"

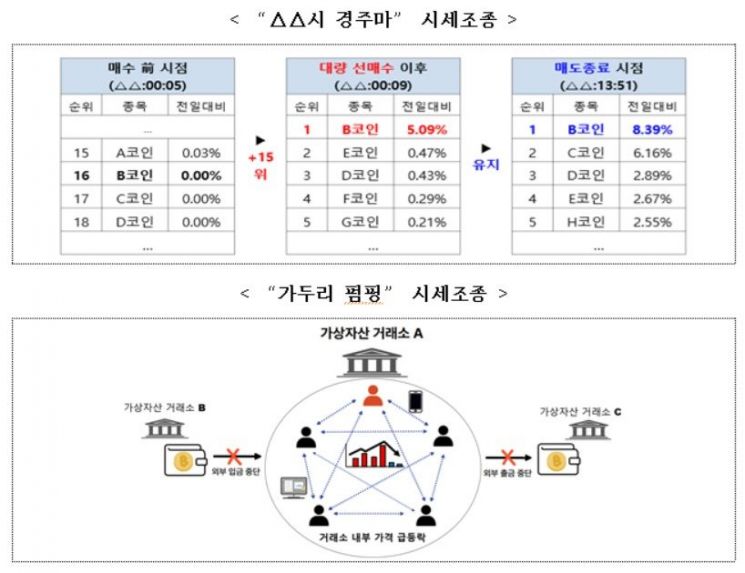

Financial authorities have reported suspects who manipulated virtual asset prices using methods such as '△△si Gyeongju Horse' and 'Gaduri Pumping' to the prosecution. It has been identified that they manipulated the prices of specific assets by exploiting characteristics of the virtual asset market, such as 24-hour trading and multiple listings of the same virtual asset on different exchanges.

On the 16th, the Financial Services Commission and the Financial Supervisory Service announced on the 17th that, following a resolution by the Financial Services Commission, they had reported suspects of virtual asset market price manipulation to the prosecution.

According to the investigation, the suspects used methods referred to as '△△si Gyeongju Horse' and 'Gaduri Pumping' around the fourth quarter of last year. At that time, the virtual asset market was active due to a Trump-driven favorable trend. Financial authorities have determined that the suspects gained illicit profits exceeding 500 million KRW.

The term △△si Gyeongju Horse was given because the rapid price increases of multiple virtual assets from the point when the daily price fluctuation rates reset resembled a horse race.

The suspects induced investor interest by pre-purchasing large volumes of virtual assets around the time when the price fluctuation rates of virtual assets on a specific exchange were collectively reset.

Then, by concentrating and repeatedly placing price manipulation orders within a short period (about 20 to 30 minutes) at a rate of 1 to 2 times per second, they created the appearance of continuous buying pressure, thereby manipulating the prices of some virtual assets.

'Gaduri Pumping' refers to artificially manipulating prices of virtual assets on specific exchanges where deposits and withdrawals have been suspended. Due to the designation of certain virtual assets as cautionary items by exchanges, deposits and withdrawals of these assets are temporarily halted, making arbitrage temporarily impossible. This makes artificial price manipulation easier, especially for small- and mid-cap assets with limited circulation.

The suspects exploited this by pre-accumulating cautionary assets and then submitting price manipulation orders over several hours, causing sharp increases in the prices and trading volumes of those virtual assets to attract buying interest. During the price surge periods, the prices of manipulated virtual assets rose up to 10 times higher than on other exchanges. However, after the manipulation ended, prices plummeted back to levels prior to the manipulation.

The financial authorities explained, "If prices surge sharply at specific times without reasonable cause, or during periods when deposit and withdrawal restrictions are in place, unexpected damages may occur," and added, "When prices of specific virtual assets fluctuate sharply, the exchanges designate and notify them as cautionary items, so it is important to carefully check whether such designations have been made."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)