Conversion of CB and BW Holders to Common Shares and Exercise of New Share Subscription Rights

Early Redemption Demands Disappear, Improving Financial Structure

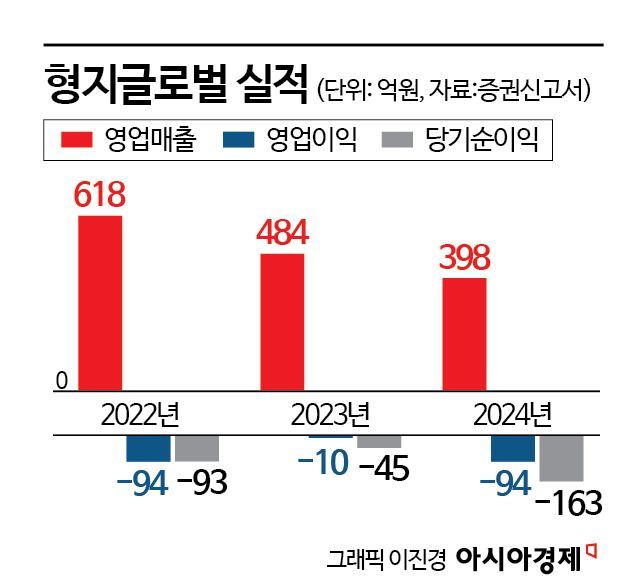

Profitability Improvement Remains a Challenge

Hyeongji Global, which is currently pursuing a paid-in capital increase to improve its financial structure, has greatly benefited from former Democratic Party leader Lee Jae-myung. Thanks to the stock price surge linked to political theme stocks, the company has eased the early repayment burden on previously issued convertible bonds (CB) and bonds with warrants (BW).

According to the Financial Supervisory Service's electronic disclosure system on the 17th, Hyeongji Global will raise 20.5 billion KRW through a paid-in capital increase allocating 0.703 new shares per existing share. The planned issue price for the new shares is 3,420 KRW, and the final issue price will be confirmed on June 11.

Hyeongji Global resolved to conduct the paid-in capital increase to enhance financial stability and raise facility funds to expand distribution networks in major commercial districts. The company's sales recorded 61.8 billion KRW in 2022, 48.4 billion KRW in 2023, and 39.8 billion KRW in 2024. The company explained that this was due to intensified competition in the golf apparel market and a preference for premium brands, which weakened the competitiveness of 'Castelbajac'.

During the capital increase process, Hyeongji Global corrected the securities registration statement, stating that the number of issued shares increased due to the exercise of conversion rights the previous day. The capital usage plan was also revised. The allocation for debt repayment was reduced from 12.2 billion KRW to 5 billion KRW. As the important disclosure contents of the securities registration statement were corrected, the effective date changed from April 17 to May 1. The subscription start date for existing shareholders was postponed from June 13 to June 16.

Earlier, Hyeongji Global announced on the 9th that rights for the 4th and 5th series convertible bonds and the 6th series bonds with warrants had been exercised. The conversion prices were 3,925 KRW and 3,346 KRW respectively, and the warrant exercise price was 3,172 KRW. The scheduled listing date is the 18th. Considering the closing price of 8,390 KRW the previous day, it appears to have recorded a return exceeding 100%. The number of issued shares increased from 12.62 million to 14.7 million.

The company explained that as of June 2, the initial early repayment date for outstanding bonds had arrived, and bondholders expressed their intention to exercise early redemption rights. Hyeongji Global faced a situation where it lacked funds to repay. Through negotiations with bondholders, it was agreed to defer the exercise of early redemption rights. Subsequently, the stock price surged, surpassing the conversion and exercise prices. As of the previous day, the outstanding bonds consisted only of the call option portion held by Hyeongji Global: 3.5 billion KRW of the 5th series convertible bonds and 1.5 billion KRW of the 6th series bonds with warrants. The call option can be exercised until July next year.

Having eased the debt repayment burden, Hyeongji Global increased its operating fund budget from 7.1 billion KRW to 14.3 billion KRW. The company plans to expand its overseas license business and optimize its overseas supply chain. To secure production volume, 13.5 billion KRW of the raised funds will be used for domestic production costs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)