Last Month, Domestic Stock ETFs Saw Net Inflows of 540 Billion KRW

Rising Demand for Cash Flow Amid Volatile Market

Covered Call Investments Effective in Sideways Market Scenarios

As the market volatility caused by the US tariff shock gradually subsides, the covered call strategy is regaining market attention. In a sideways market where the stock market direction is unclear, covered call products that guarantee steady cash flow are being analyzed as a potentially effective investment option.

According to FnGuide on the 16th, the inflow of funds into domestic stock ETFs (Exchange-Traded Funds) last month was about 541.8 billion KRW, surpassing the 500 billion KRW monthly inflow barrier again following February. This contrasts with the approximately 100 billion KRW decrease in fund inflows into overseas stock funds during the same period. While domestic active and index stock funds each posted returns exceeding 2% since the beginning of the year, US stock funds recorded a loss of -15% amid tariff concerns and recession fears.

Researcher Kim Hoo-jung of Yuanta Securities explained, "Domestic stock funds have seen three consecutive months of inflows centered on ETFs," adding, "Fund inflows into secondary battery ETFs continue steadily, and inflows into semiconductor ETFs have also significantly increased due to expectations of semiconductor industry improvement."

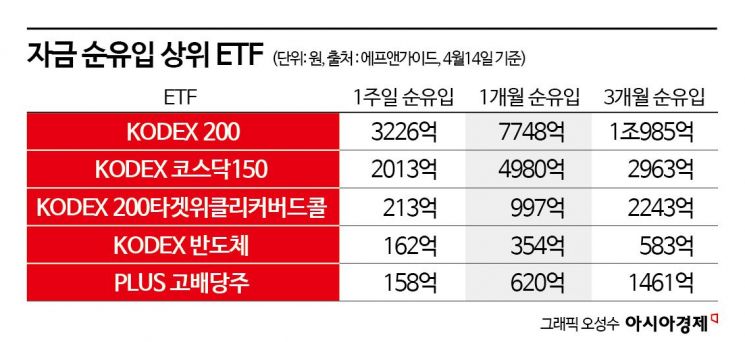

In particular, among the top ETFs by net fund inflow, covered call products showed remarkable progress. The KODEX 200 Target Weekly Covered Call attracted 224.3 billion KRW over three months until the 14th, ranking just behind industry leaders KODEX 200 (1.0985 trillion KRW) and KODEX KOSDAQ150 (296.3 billion KRW). This rookie ETF, listed less than six months ago, secured the third place in net fund inflow, surpassing large ETFs with assets under management (AUM) in the 600 billion KRW range such as KODEX Semiconductor, PLUS High Dividend, and PLUS K-Defense.

The KODEX 200 Target Weekly Covered Call is Korea’s first target covered call ETF using KOSPI 200 and on-exchange derivatives, with individual investors purchasing over 230 billion KRW worth this year alone. This is the largest scale among the nine covered call ETFs in the domestic asset market.

A covered call is a strategy that involves buying the underlying asset while selling call options to generate a steady cash flow. Recently, as the volatility of the global stock market, which had widened due to tariffs, gradually eased with the reduction of tariff pressure, demand for steady cash flow has increased. The expected premium income generated from selling call options is also non-taxable, unlike dividends from ETF constituent stocks, which enhances its investment appeal.

Researcher Park Hyun-jung of Daishin Securities evaluated, "In the current phase where it is difficult to gauge the exact direction of the stock market, securing cash flow can be a favorable strategy," adding, "Covered call ETFs are also a good alternative for investors such as retirees who need steady monthly cash flow." For investors expecting the stock market to remain sideways or decline slightly for a while, covered call investments that guarantee periodic cash flow may be suitable.

However, for investors with a long investment horizon who want to actively participate in the market, jumping into covered calls solely based on high distribution rates can lead to disappointment. Since selling call options?which are rights to buy a specific asset at a predetermined price?fundamentally limits the upside potential of returns, there is a limitation in that in a market where the underlying index steadily rises significantly, covered call ETFs cannot keep up with the returns of investors who simply buy index-tracking ETFs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)