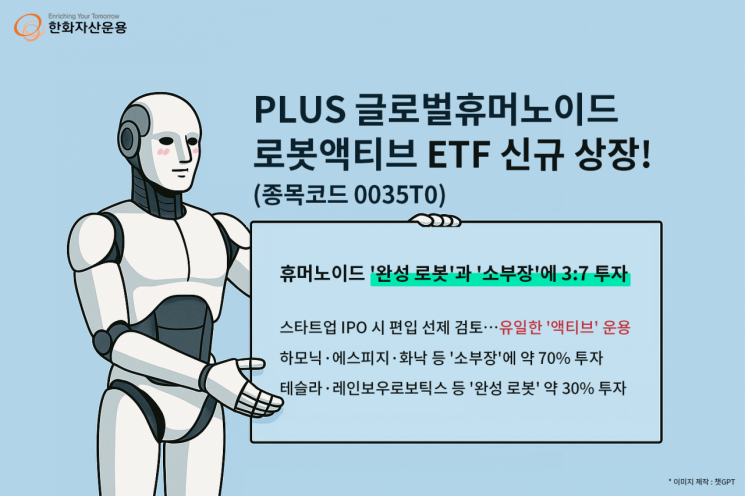

Hanwha Asset Management announced on the 15th that it will list the 'PLUS Global Humanoid Robot Active' exchange-traded fund (ETF), which allows investment in the growth potential of the humanoid robot industry.

PLUS Global Humanoid Robot Active is an ETF that invests in companies related to 'humanoid robots' that move like humans and autonomously perceive and act in the real world. Humanoid robots are expected to replace a significant portion of human labor and maximize productivity and efficiency through 24-hour operation, projecting substantial market growth in the future. They are also gaining attention as a key solution for restoring the competitiveness of U.S. manufacturing, promoted by former U.S. President Donald Trump.

The PLUS Global Humanoid Robot Active ETF invests about 30% in Tesla and Rainbow Robotics, leading humanoid robot companies representing the U.S. and Korea. Tesla is deploying its humanoid robot Optimus in electric vehicle production processes. Rainbow Robotics is expected to develop humanoid robots integrated with Samsung Electronics' AI technology.

The PLUS Global Humanoid Robot Active ETF invests approximately 70% in core 'SoBuJang (materials, parts, and equipment)' companies, which account for a significant portion of the cost of humanoid robots. Assuming the production cost of a humanoid robot is about $50,000, the cost of key components such as actuators and sensors is approximately $33,000, accounting for 66% of the cost. Therefore, as the humanoid robot industry grows, the scale of related 'SoBuJang' industries such as actuators and sensors is also expected to expand simultaneously.

An actuator is a driving device composed of reducers, servomotors, sensors, etc., and is a component that enables the movement of humanoid robot arms and legs. The more actuators there are, the greater the degrees of freedom, allowing humanoid robots to move more like humans.

The ETF invests in Japanese companies such as Harmonic Drive Systems, the global leader in the small precision reducer sector that constitutes actuators; Fanuc, the top industrial robot company with robot parts and AI machine vision technology; Yaskawa Electric, the global market leader in servomotors; and Nabtesco, the world market leader in RV precision reducers. It also includes Teradyne (U.S.), the world's number one collaborative robot company and parent company of Universal Robots; LG Innotek (Korea), a leader in vision sensors that serve as the robot's sensory organs; Robotis (Korea), a specialized manufacturer of actuators used in robot joints; and SPG (Korea), the domestic precision reducer company with the highest sales and mass production capabilities.

PLUS Global Humanoid Robot Active ETF is managed as an active ETF to enhance investment efficiency, reflecting the rapid development of the humanoid robot industry. This allows proactive capture of investment opportunities, such as directly considering the inclusion of core humanoid robot startups when they conduct IPOs (initial public offerings) without waiting for them to be included in the underlying index.

Humanoid robots are an emerging industry where unlisted startup companies are showing meaningful results. Examples include Boston Dynamics' 'Atlas,' scheduled to be introduced in Hyundai Motor's production process; Agility Robotics' 'Digit,' which will participate in Amazon's warehouses and logistics centers; and Figure AI's 'Figure 01,' which is expected to supply about 100,000 units to BMW and others over the next four years.

Geum Jeong-seop, head of the ETF business division at Hanwha Asset Management, explained, "The full-scale leap into the humanoid robot era does not simply mean the growth of companies making complete robots. Companies possessing materials, parts, and equipment technologies such as actuators and sensors that enable robot movement and perception will be the real beneficiaries and stand at the center of the industry."

He added, "The advantage of the active management strategy is its flexibility to respond swiftly to rapid market changes. When robot startups go public or global big tech companies begin to achieve results in the robot business, investors can proactively invest without waiting for index inclusion, providing optimal growth opportunities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)