Dongwon F&B to Be Delisted, Resolving Dual Listing and Boosting Corporate Value

Global Food Sales Ratio Targeted to Reach 40% by 2030

Dongwon Group is undertaking an organizational restructuring to target the global food market. The holding company Dongwon Industries will fully incorporate its affiliate Dongwon F&B as a 100% subsidiary, and Dongwon F&B will be delisted from the stock market. This is the first strategic restructuring measure led by Dongwon Group Chairman Kim Nam-jung to strengthen global competitiveness and resolve the complex governance structure.

Dongwon Industries and Dongwon F&B announced on the 15th that they held board meetings on the 14th and approved a comprehensive stock swap agreement. The comprehensive stock swap will be conducted by Dongwon Industries issuing new common shares to be given to Dongwon F&B shareholders. The exchange ratio is 0.9150232 shares of Dongwon F&B per one share of Dongwon Industries. Once this agreement is finalized, Dongwon F&B will become a non-listed company, with Dongwon Industries owning 100% of its shares.

Chairman Kim Nam-jung: "Innovation like the Bronze Age is Needed"

This organizational restructuring reflects Chairman Kim’s strong will. Earlier this year, he told employees, "The Stone Age did not end because of a shortage of stones, but because a new paradigm called bronze emerged," urging innovation beyond traditional business methods. He particularly emphasized, "Dongwon must move toward changing the rules of the game," and "We must abandon inertial thinking and break through with disruptive innovation."

Dongwon Group has so far focused on the domestic food business, but with stagnation in the domestic market and intensified competition, the need to expand into the global market has increased. Since last year, Dongwon Group formed a dedicated task force (TF) to review the food business strategy restructuring. As a result, they decided to establish a 'Global Food Division' centered on Dongwon Industries, grouping Dongwon F&B, Dongwon Home Food, the U.S. StarKist, Senegal’s S.C.A SA, and others.

The plan is to unify the production, distribution, marketing, and research and development (R&D) functions that each affiliate operated individually to increase efficiency in entering the global market. Dongwon Industries will integrate and reorganize its business departments into marine fisheries, global logistics, global food, and packaging to enhance synergy across various business areas such as deep-sea fishing, processing, logistics, packaging, feed, and food ingredients. Dongwon announced plans to increase the overseas food business sales ratio from 22% last year to 40% by 2030.

Establishment of Global R&D Center... Tripling Research and Development Capabilities

Dongwon Group plans to consolidate the scattered R&D organizations across its affiliates into a 'Global R&D Center' and accelerate the development of new products targeting the global market. The ratio of R&D investment to sales will be expanded from the current 0.3% level to over 1% by 2030.

In particular, they will leverage the local distribution network of the U.S. subsidiary StarKist to actively target the North and Latin American markets. Joint package products combining Dongwon F&B’s flagship products and StarKist’s hit items will be launched, and new products jointly developed at the integrated R&D center will also be introduced.

Senegal’s S.C.A SA and Capsen, tuna fishing and canning subsidiaries under Dongwon Industries, will serve as footholds for the Middle Eastern and European markets. Large-scale global mergers and acquisitions (M&A), which were difficult for Dongwon F&B alone due to financial constraints, will now be actively pursued under Dongwon Industries’ leadership.

Resolving Dual Listing... Investor-Friendly Governance Structure

This restructuring also resolves the issue of 'dual listing,' where both the holding company and its subsidiary are listed simultaneously. Dual listing has long been cited as a major cause of the 'Korea discount,' which lowers corporate value due to opaque governance structures.

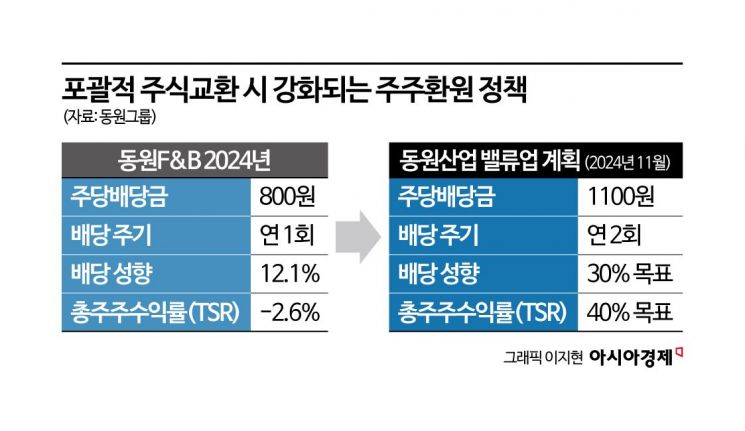

Through this comprehensive stock swap, Dongwon F&B shareholders will convert their shares into Dongwon Industries stock. Dividends are expected to increase from the current 800 KRW per F&B share to about 1,100 KRW per Dongwon Industries share, creating a more shareholder-friendly structure.

Chairman Kim and related parties, who are the largest shareholders of Dongwon Industries, will see their stake decrease from 87.9% to 78.9%, but this is regarded as a strategic decision for the group’s overall expansion and long-term competitiveness. Currently, Kim holds 60% of Dongwon Industries shares, Honorary Chairman Kim Jae-chul holds 21.5%, and the Dongwon Yukyoung Foundation holds 4.4%.

A Dongwon Group official said, "This is a structural innovation effort that simultaneously expands global business and resolves the dual listing issue through the reorganization of food affiliates. We will actively pursue discovering a second engine of growth at the group level, enhancing corporate value, and promoting shareholder returns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)