Paradise, GKL, Lotte Tour Development

Casino Sales Up 10-20% Year-on-Year in Q1

Operating Profits Also Expected to Rise

Increase in Visitors Drives Up Hold Rate

Positive Outlook for Q3 with Visa-Free Policy for Chinese Tour Groups

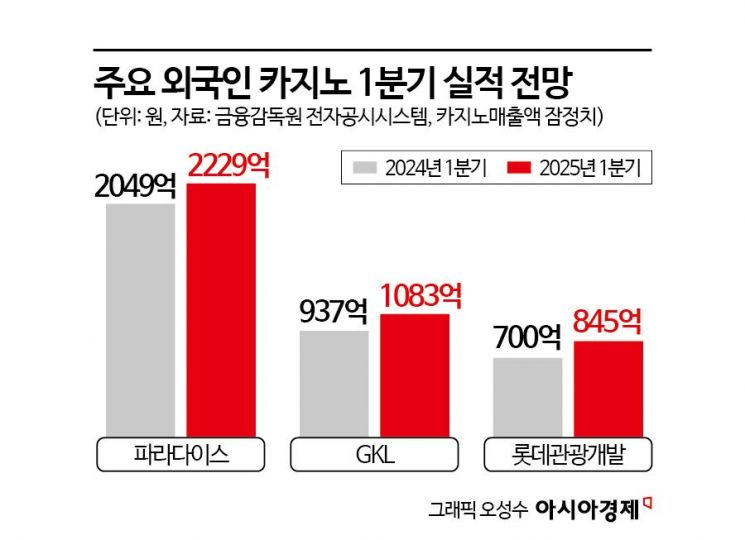

Major foreign casino operators in South Korea are expected to see their sales increase by about 10-20% in the first quarter of this year. As the number of foreign tourists visiting Korea has recovered to pre-COVID-19 levels, visitors from Japan, China, and other countries have increased, along with a rise in VIP demand with large betting amounts from these countries. The hold rate, which represents the casino's revenue share from the amount wagered by customers, also rose to double digits, leading to expectations of improved profitability compared to last year. Attention is also focused on whether the South Korean government's temporary visa-free policy for Chinese group tourists in the third quarter of this year will act as a positive factor.

According to the Financial Supervisory Service's electronic disclosure system on the 15th, Paradise, which operates casinos in four locations including Seoul, Incheon, Busan, and Jeju, reported a provisional cumulative casino revenue of 222.9 billion KRW for January to March this year. This is an 8.8% increase compared to the same period last year. Although sales declined in January and February compared to the previous year, casino revenue rebounded in March, recording 81 billion KRW, a 51.6% increase from the same period last year.

A Paradise representative explained, "March casino revenue significantly increased compared to the previous year due to the continuous rise in Japanese VIPs and the increase in the hold rate." In fact, Paradise Casino's hold rate was 8.3% in March last year but rose to 13.1% in March this year, marking the highest level since February last year (13.2%).

Grand Korea Leisure (GKL), which operates three Seven Luck casinos in Seoul and Busan, also reported provisional first-quarter sales of 108.3 billion KRW, a 15.6% increase compared to the same period last year. This was due to an increase in visitors from Japan and China and a rise in the hold rate. The number of visitors to Seven Luck casinos in the first quarter was 227,591, up 7.2% from the same period last year. Among them, Japanese visitors increased by 18.7% to 74,797, and Chinese visitors rose by 2.2% to 103,664. The overall hold rate also increased by about 3 percentage points from 10.2% in the same period last year to 13.1%, the best performance since 2022's 13.3%.

Additionally, Lotte Tour Development, which operates a casino within the Jeju Dream Tower complex resort, reported provisional first-quarter casino revenue of 84.5 billion KRW, a 20.8% increase compared to the same period last year. During this period, casino visitors numbered 109,631, up 38.3% from the same period last year, and the three-month average hold rate for table games rose by 1 percentage point to 19.2%. A Lotte Tour Development representative explained, "Not only the Chinese-speaking market, which had a high proportion of existing visitors, but also Japanese VIPs and high-rollers (customers who enjoy large bets) residing in Korea are increasingly visiting."

In the securities industry, it is expected that the operating profits of these three companies will also improve compared to the same period last year due to the increase in casino visitors and the rise in hold rates. Paradise's operating profit is expected to rise 8% from the same period last year to 52.3 billion KRW. GKL and Lotte Tour Development's operating profits are estimated to increase by 37% and 47%, respectively, to 18.9 billion KRW and 12.9 billion KRW. Lee Ki-hoon, a researcher at Hana Securities, evaluated, "The hold rate, which had been continuously sluggish, has steadily rebounded since the end of last year, and leverage from sales recovery is expected."

Foreign casinos are an industry expected to benefit from the increase in the number of foreign visitors to Korea. According to the Korea Tourism Organization, despite political instability due to the December 3 emergency martial law situation, about 1.12 million foreigners visited Korea in January this year, a 26.8% increase compared to the same period last year. This has recovered to 101% of the level in January 2019, before the COVID-19 outbreak. In February, about 1.14 million visitors came to Korea, a 10.5% increase from the same period last year, reaching 94.7% of the level in February 2019.

The tourism industry and securities firms expect that if the temporary visa-free policy for Chinese group tourists, who are the largest market for visits to Korea, is implemented, casino demand will increase further. There is also a forecast that if U.S. President Donald Trump's reciprocal tariff policy expands, Chinese tourists may expand their travel to Asian regions such as Korea, Japan, and Southeast Asia instead of the United States.

Lee Nam-soo, a researcher at Kiwoom Securities, pointed out, "If the Chinese visa-free system, currently limited to Jeju Island, is expanded to the entire country, interest in traveling to Korea will increase, and casino performance in Jeju, Seoul, Busan, and other areas is expected to improve simultaneously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)