Beer K Struggles Amid Qingdao's 'Urine Terror'

Fading Strength Behind Past Glory... Heineken's Slow Decline

Lotte Asahi Beer... Rowing While the Tide is In

Last year, the fortunes of major imported beer brands diverged. China's 'Qingdao' struggled through a difficult year at the brink of survival due to hygiene issues, while 'Heineken' gradually weakened, reflecting the stagnant market atmosphere. In contrast, 'Asahi,' which led the revival of Japanese beer, enjoyed unprecedented prosperity, solidifying its position as the dominant player.

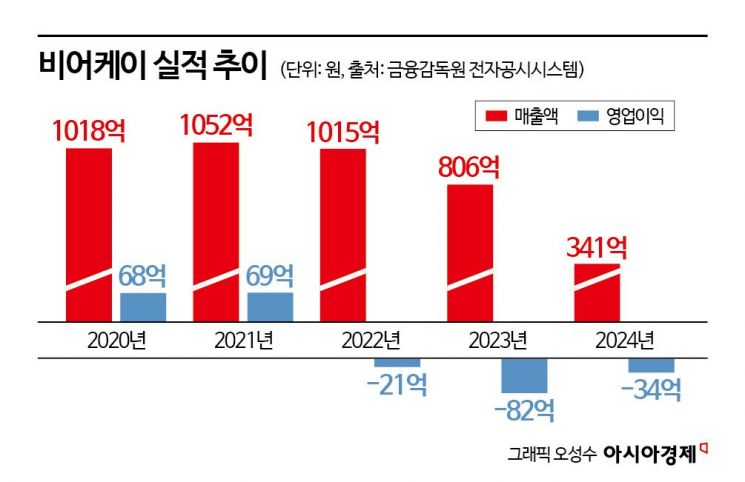

Beer K Struggles Amid Qingdao's 'Urine Terror'

According to the Financial Supervisory Service's electronic disclosure system on the 13th, Beer K, the importer of Qingdao beer, recorded sales of 34.1 billion KRW last year, a 57.7% decrease from 80.6 billion KRW the previous year. With sales dropping by more than half, the company could not avoid operating losses. Last year's operating loss was 3.4 billion KRW, continuing the deficit.

The sharp decline in Beer K's sales last year was decisively caused by hygiene controversies. Chinese beer, which ranked first in imported beer with 46,504 tons imported in 2022, maintained its top position and popularity until early 2023. However, in November 2023, a video surfaced showing a worker at Qingdao's Shandong factory allegedly urinating in the malt storage area, a key raw material for beer, known as the 'urine terror' incident, which led domestic consumers to shun the brand overnight.

This directly impacted Beer K as well. Until the incident, the company had been sailing smoothly with sales exceeding 100 billion KRW for six consecutive years since 2017, but despite clarifications that the incident was unrelated to the Korean-imported products, the situation rapidly deteriorated, and sales hit rock bottom for a while. Subsequently, the company sought normalization through cost reductions such as voluntary retirements and cuts in advertising and promotional expenses, but could not avoid poor performance last year.

Despite Beer K's efforts to recover, it is expected to be difficult to continue previous growth trends as the company's portfolio is practically dependent on the single Qingdao brand. An industry insider commented, "Consumers are sensitive to hygiene issues not only in alcoholic beverages but also in Chinese products in general," adding, "Given the poor market conditions and many alternatives available, it will not be easy to restore the damaged image once tarnished."

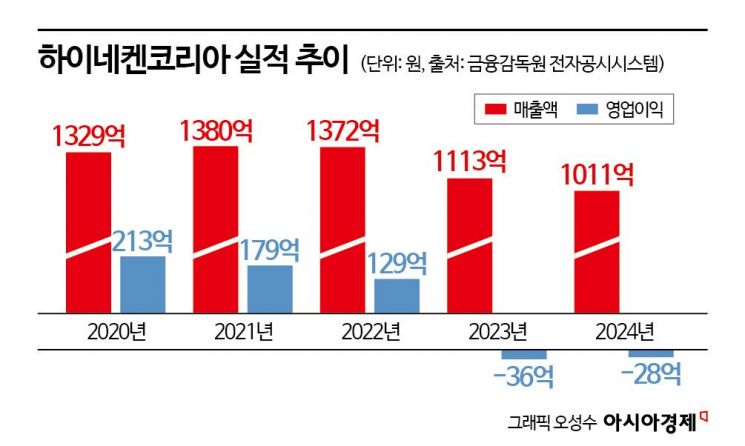

Fading Strength Behind Past Glory... Heineken's Slow Decline

Heineken, the world's second-largest beer company headquartered in the Netherlands, also could not avoid sluggishness. According to Heineken Korea's audit report, the company's sales last year were 101.1 billion KRW, a 9.1% decrease from 111.3 billion KRW the previous year. Operating losses continued for the second consecutive year at 2.8 billion KRW, following a loss of 3.6 billion KRW the year before.

Unlike Qingdao, which faced a prominent adverse event with the urine scandal, Heineken Korea's poor performance was attributed to the contraction of the home alcohol market and the increased sales of Japanese beers led by Asahi. During the COVID-19 pandemic, Heineken Korea was at the center of the home drinking and solo drinking trend, boosting sales to 138 billion KRW in 2021. Thanks to Heineken's strong performance, the Netherlands exported beer worth 43.43 million USD (approximately 63 billion KRW) to the Korean market in 2021, becoming the largest beer importer to Korea.

However, from the following year, the beer bubble began to deflate gradually, and Heineken Korea's performance started to decline, with sales dropping 20% year-on-year in 2023, turning to a loss. Last year, most accounts in the financial statements recorded figures similar to the previous year, reflecting a stagnant trend and a year spent treading water. Although operating losses slightly decreased compared to the previous year, this was interpreted as a result of reduced product purchases due to decreased demand. Heineken Korea's product purchase amount last year was 47.2 billion KRW, a 15.0% decrease from 55.5 billion KRW in 2023.

Heineken Korea plans to recover the sales volume that has declined for three consecutive years by expanding its portfolio. Starting this month, Heineken Korea will exclusively distribute 'Snow Beer,' the flagship lager of China's 'China Resources Brewery,' in Korea. Snow Beer, along with Qingdao, is one of the best-selling beers in China and boasts the largest single-brand sales volume worldwide. A Heineken Korea official stated, "We plan to expand our product lineup through the distribution of cost-effective Snow Beer and further strengthen our position in the domestic beer market."

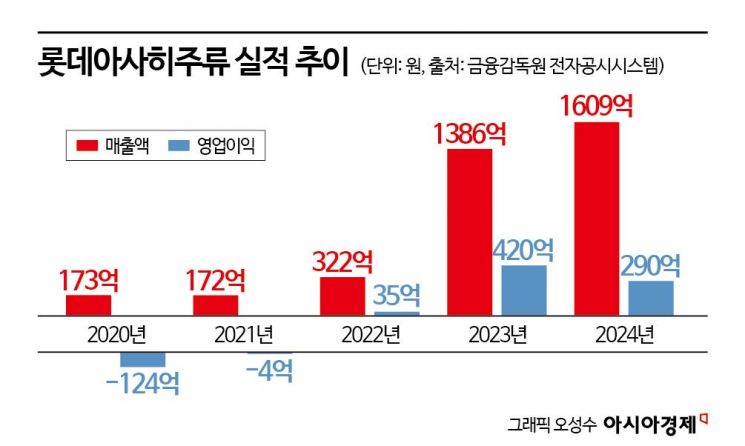

Lotte Asahi Beer... Rowing While the Tide is In

While most imported beers showed a gloomy face amid the sluggish beer market, only Lotte Asahi Beer continued its growth. Lotte Asahi Liquor's sales last year were 160.9 billion KRW, a 16% increase from the previous year. However, operating profit decreased by 12.8% to 36.6 billion KRW, and net income also fell 25.1% to 29 billion KRW compared to the previous year.

The decline in Lotte Asahi Liquor's profitability compared to the previous year is attributed to aggressive sales strategies. Previously struggling with deficits due to the boycott of Japanese products, Lotte Asahi Liquor turned profitable in 2022 and succeeded in reclaiming the throne of the imported beer market in 2023 with the 'Asahi Super Dry Draft Can.' Last year, the company made every effort to strengthen the regained leadership. In fact, Lotte Asahi Liquor increased advertising and promotional expenses by 50% compared to the previous year and succeeded in placing Asahi beer as well as Okinawa's local 'Orion' beer in most major channels such as convenience stores.

Having focused on brand awareness enhancement and securing sales channels last year, Lotte Asahi Liquor is expected to improve profitability this year based on these efforts. As the first step toward profitability improvement, the company raised prices of Asahi products by 8-20% on the 1st of last month. The 350ml Asahi Super Dry canned beer price increased from 3,500 KRW to 4,000 KRW, a 14.3% rise, and the 500ml can rose from 4,500 KRW to 4,900 KRW, an 8.9% increase. The company also plans to strengthen its product lineup centered on Asahi Group products this year to respond to diversification of consumption and low-alcohol trends.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)