Continued Employment of the Elderly in Super-Aged Korea Is Unavoidable

Retirement Age Extension Concentrated in Unionized and Large Companies... Deepened Dual Labor Market Structure

If Employment Continues Until Age 65, Annual Growth Rate Rises by 0.1 Percentage Points

Monthly Income Increases by 1.79 Million KRW Compared to Senior Jobs

"What is needed is 'reemployment after retirement,' not 'extension of retirement age.'" As Korea enters a super-aged society where continued employment of the elderly is inevitable, what is the most desirable way for them to work?

On the 8th, the Bank of Korea released research results stating that for continued employment of the elderly, a reemployment system after retirement, rather than a statutory extension of the retirement age, should be established. This is because extending the retirement age causes side effects such as contraction of youth employment, increase in early retirement, and deepening of the dual labor market structure. The proposed approach is a 'gradual approach.' It suggests giving segmented incentives to companies to first encourage the spread of 'voluntary reemployment,' and then gradually impose 'reemployment obligations.' If continued employment is successfully established, workers can earn a monthly income 1.79 million KRW higher than the current government-provided senior jobs. The Korean economic growth rate would also increase by 0.1 percentage points annually, which compensates for about one-third of the decline caused by population decrease.

Continued Employment of the Elderly "Unavoidable"... Urgent Need for 'Productive Jobs'

The Bank of Korea's Employment Research Team and Professor Kim Dae-il of Seoul National University's Department of Economics jointly released the report titled 'BOK Issue Note - Super-aged Society and Measures for Continued Employment of the Elderly' on the same day, presenting these findings.

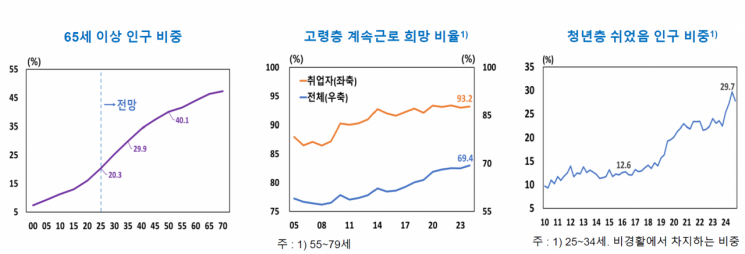

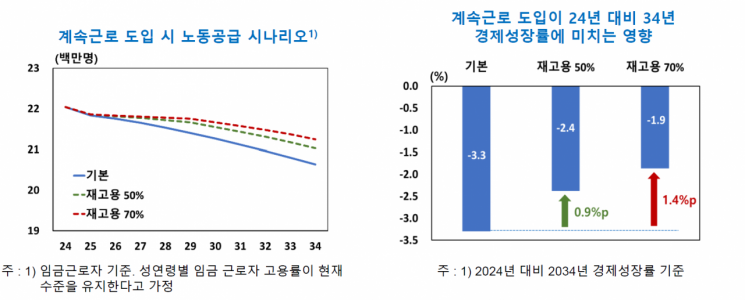

Continued employment of the elderly is inevitable. Korea, having entered a super-aged society, must actively utilize elderly labor to mitigate labor supply decline and reduced growth potential. Oh Sam-il, head of the Employment Research Team at the Bank of Korea's Research Bureau, explained, "Assuming employment rates by gender and age remain at current levels, the labor supply (based on wage workers) is expected to decrease by 1.41 million over the next 10 years." This corresponds to 6.4% of the current labor supply. This decline will reduce the gross domestic product (GDP) by 3.3% (0.33% annually) over the next decade. This decrease is about one-fifth of the average potential growth rate (1.6% annually) over the next 10 years.

Oh emphasized that "creating a labor market where the elderly can work productively for longer" is an urgent task for Korea. This conclusion is based on the elderly's strong willingness to continue working, income gaps after retirement, and the low satisfaction with government senior job programs. As the pension eligibility age is gradually raised, elderly workers retiring at 60 after 2028 will face a five-year income gap (ages 60-64) before pension benefits begin. Oh said, "Despite the strong willingness to continue working, many elderly workers are unable to remain in their main jobs and are pushed into simple labor positions. To prevent this, opportunities to utilize existing careers while maintaining productivity must be increased." He noted that current government senior jobs are mostly public service types based on volunteer activities, which are not considered quality jobs in terms of career development and income compensation.

2016 Retirement Age Extension Focused on Unionized and Large Companies... "Deepened Dual Labor Market Structure"

The retirement age extension implemented in 2016 without adjusting the wage system benefited mainly unionized and large company jobs. It also caused side effects such as increased early retirement. According to the report, the employment rate of wage workers aged 55-59 increased by 1.8 percentage points (about 80,000 people), and the employment rate of regular workers increased by 2.3 percentage points (about 100,000 people) from 2016 to 2024 due to the retirement age extension. However, over time, the effect of increased elderly employment gradually decreased. Oh explained, "This shows that companies tried to offset the additional burden from the legal retirement age extension through personnel and labor policies such as encouraging early retirement."

The increase in elderly employment due to retirement age extension was more pronounced in jobs with a high unionization rate. This trend was even more evident in large companies. Oh pointed out, "The benefits of retirement age extension concentrated on unionized and large company jobs with relatively strong employment protection, likely deepening the dual labor market structure."

Notably, for every additional elderly worker, about one youth worker (0.4 to 1.5) decreased. This phenomenon was more pronounced in jobs preferred by young people, such as in large companies. From 2016 to 2024, the employment rate of wage workers aged 23-27 decreased by 6.9% (about 110,000 people), and the employment rate of regular workers decreased by 3.3% (about 40,000 people). In other words, for every elderly worker added, 0.4 to 1.5 youth workers were reduced. Oh said, "As the retirement age was suddenly extended without changes to the wage system, companies likely reduced new hires, which are relatively easier to adjust, to reduce costs, leading to a decrease in youth employment. This aligns with the result that the increase in elderly employment due to retirement age extension was greatest in unionized and large companies, where youth employment decreased significantly."

Regarding wages, the report states that wages decreased mainly for youth and middle-aged workers rather than the elderly due to retirement age extension. Looking at wage changes from 2013 to 2019, the largest wage decreases occurred among middle-aged workers who have a high substitution relationship with the elderly. In contrast, elderly workers showed no significant wage changes. This is analyzed as not only because wages of elderly workers who maintained employment due to retirement age extension were rarely adjusted, but also because their wage levels were relatively higher than other workers of the same age group. Looking at the long-term effect on wages (changes from 2013 to 2023), the decline narrowed. This also suggests that over time, companies introduced various personnel and labor policies to alleviate labor cost burdens caused by the increase in elderly workers.

'Reemployment after Retirement' Should Be Introduced... Japan Cut Wages by 40%, Reemployment Established

The report views that the policy direction for continued employment of the elderly should favor reemployment after retirement rather than extending the retirement age. In the current situation where seniority-based wage systems, employment rigidity, and the 60-year retirement age are intertwined, trying to solve the continued employment issue solely by extending the retirement age risks repeating unintended side effects such as contraction of youth employment. Oh emphasized, "Strengthening and improving the system where workers who reach retirement age terminate their employment relationship and then sign a new employment contract to be rehired has the advantage of encouraging continued employment of the elderly by reforming the wage system and flexibly adjusting working conditions."

Looking at Japan, which entered a super-aged society earlier than Korea, they introduced continued employment systems gradually and stepwise. From 1998 to 2025, over about 30 years, Japan gradually implemented a continued employment roadmap: '60-year retirement age → securing employment until 65 → securing employment opportunities until 70.' They allowed labor and management to flexibly adopt continued employment forms suitable for each company, such as retirement age extension, abolition, or reemployment after retirement. Wages were cut by about 40%. There were also many cases of job adjustments.

Korea has already partially institutionalized this system, and companies adopting it have been increasing recently. As of last year, 37.9% of companies had adopted it. Companies with lower seniority-based wages and operating job-based or competency-based pay systems actively utilized reemployment. About 83% of reemployment occurred within companies.

The report proposed changing the current elderly employment law's obligation to make efforts for reemployment into an obligation to implement reemployment, mandating re-contracting with workers who wish to continue working after retirement. However, it explained that a minimum employment flexibility should be secured by recognizing exceptions such as low performers based on reasonable criteria agreed upon by labor and management. Oh said, "The current elderly continued employment subsidy (900,000 KRW per quarter for reemployed elderly workers) should be enhanced, and support criteria should be relaxed beyond uniform reemployment to promote reemployment activation."

However, the approach should be gradual. Rather than legally mandating reemployment in a short period, it is necessary to first encourage voluntary spread of the reemployment system through incentive schemes and then impose reemployment obligations on companies in a stepwise manner. Oh pointed out, "If reemployment is mandated in a short period, workers' bargaining power will strengthen, making it difficult to resolve the rigidity of the current wage system, and unintended side effects may be repeated."

Continued Employment until 65 Increases Growth Rate by 0.1%p Annually... Offsets One-third of Population Decline Impact

If continued employment is successfully established, elderly workers will have expanded opportunities to work longer while maintaining productivity in their main lifetime jobs. This can mitigate growth slowdown caused by labor supply decline and contribute to securing individual income stability. According to the report's simulation, if continued employment until 65 is possible, the growth rate is estimated to increase by 0.9 to 1.4 percentage points (0.1 percentage points annually) over the next 10 years. This means about one-third of the economic growth rate decline due to population decrease can be prevented.

Assuming a 40% wage cut during the reemployment process, the simulation showed that monthly income would increase by 1.79 million KRW compared to working in government-provided senior jobs during the income gap period (ages 60-64). Pension receipts after age 65 are also estimated to increase by 140,000 KRW per month. Oh said, "No significant negative impact on youth employment was observed. When additional earned income and pension income are discounted to present value at age 60, it amounts to an increase of 110 million KRW."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)